China-Europe logistics market

Demand outlook

- S&P Global’s China Business Outlook survey indicates a moderate improvement in company expectations. It is believed that the growth in business activity will be primarily driven by domestic factors. For trade with Europe, this means maintaining stable but limited export flows. External risks, competition, and current and potential trade barriers continue to constrain demand for Chinese products. Potential support for the flow of goods will remain targeted, relying on high-tech and capital-intensive product groups.

- Export conditions for German industry improved to a 17-month high (51.6) in October, but trends in external demand remain weak [S&P Global]. The inflow of new export orders declined, reflecting weakness in external markets, primarily the US and China. The most resilient segment of German exports remains machinery and equipment, while the chemicals and automotive industries are experiencing a downturn.

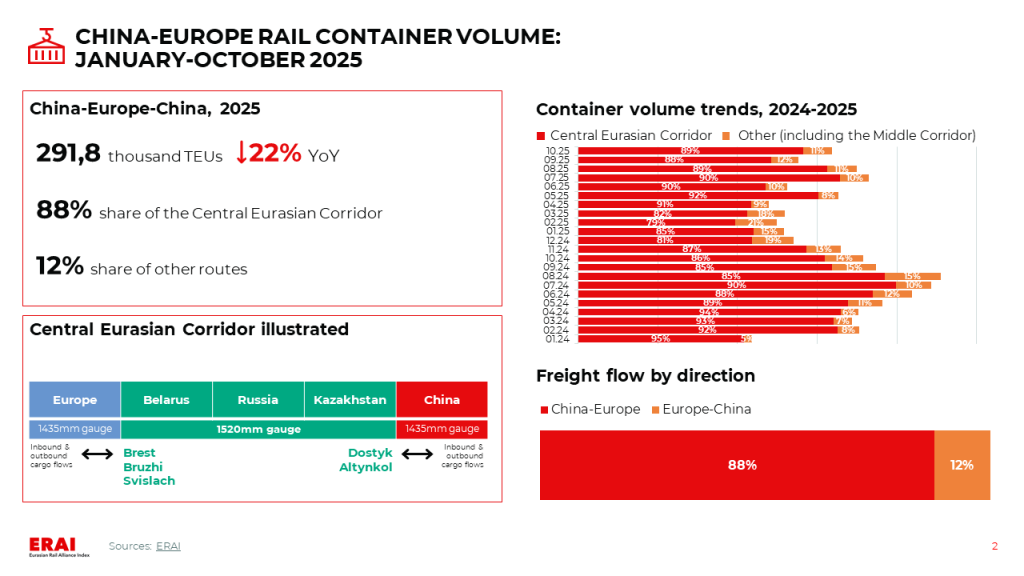

- In January-October, the volume of China-Europe-China rail container transportation decreased by 21% YoY. In October, the total shipment volume across all routes fell by 11% YoY but also increased by 11% MoM. Volume growth in October compared to September was recorded on both the Central Eurasian Corridor and the Middle corridor. Seasonal delays are observed on the Middle corridor in the Caspian Sea due to adverse weather conditions.

- Demand for Asia-Europe ocean freight remains stable. According to JOC, in 4Q2025 demand may receive additional support from inventory replenishment ahead of the late Chinese New Year (17.02.2026-03.03.2025). A new trend on the demand side is that shippers have begun reallocating bookings in favor of services with shorter transit times [Flexport].

Freight rate trends

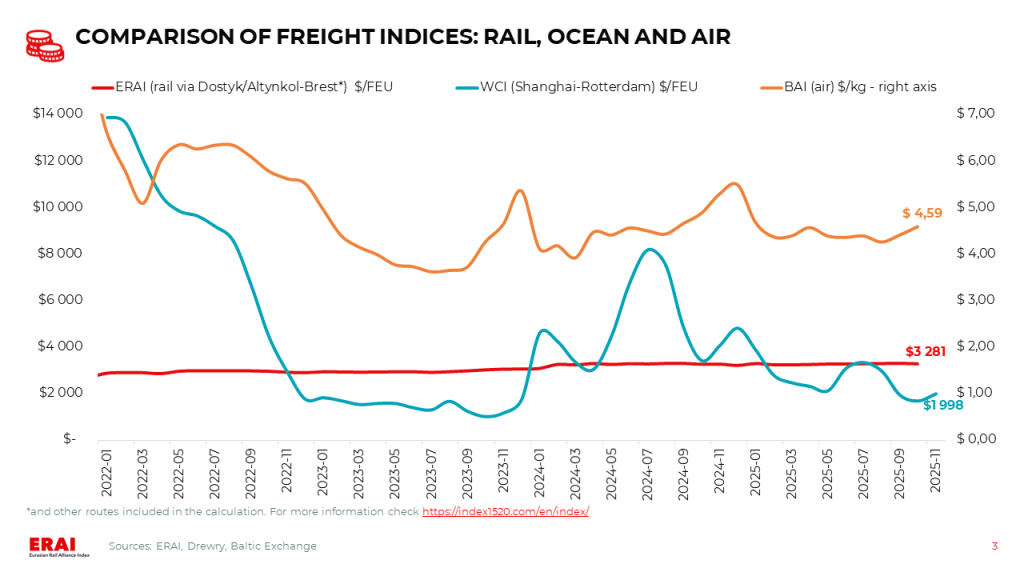

- The Shanghai-Rotterdam WCI increased by 3% last week to $2 028/FEU (22% MoM, −50% YoY) [Drewry]. According to Drewry, carriers have announced FAK rate increases effective November 15, targeting a range of $3 000-3 650/FEU in an effort to gain leverage ahead of the 2026 contract talks. GeekYum data shows the average spot rate from major carriers in the second half of November is around $2 500/FEU. Available December quotes average around $3 300/FEU (only some lines have published offers). The rate increases are supported by stable demand, blank sailings (at least 10% in November), and terminal congestion in Europe.

- Futures quotes indicate a moderate increase in ocean freight rates until the end of 2025. Specifically, Asia-Europe rates could gradually rise to approximately $2 300/FEU by year-end. Traders expect rates to remain in the $1 500-2 000/FEU corridor for most of 2026.

UPDATE: As of the evening of November 20, 2025, the latest WCI Shanghai-Rotterdam reading has risen by 8% WoW — up to $2 193/FEU.

Other trends

- China Development Bank will allocate a 30 billion yuan ($4.22 billion) loan to support the development of China-Europe Railway Express [China Daily]. The funds will be directed towards corridor development, infrastructure and hub construction, and enterprise support.

- The European Council has approved the abolition of the duty-free threshold for goods valued up to €150. The interim measure is scheduled for implementation in 2026, with full implementation following the launch of the EU Customs Data Hub in 2028. According to the European Commission, in 2024 91% of inbound small e-commerce parcels originated from China.

|

|

Ocean freight: short-term market improvement amid persistent medium- and long-term risks

Current Situation and Near-Term Outlook: the recovery trend continues.

- Demand for Asia-Europe ocean freight remains stable. According to JOC, in 4Q2025 demand may receive additional support from inventory replenishment ahead of the late Chinese New Year (17.02.2026-03.03.2026). A new trend on the demand side is that shippers have begun reallocating bookings in favor of services with shorter transit times [Flexport].

In January-September, Asia-Europe shipment volumes increased by 9,8% YoY [JOC].

- Significant operational disruptions persist in Northern European ports. The cause is sustained import volumes amid ongoing constraints on container handling and evacuation. As of 15.11.2025, port delays amounted to: 378 thousand TEU in Northern Europe (-27% MoM) and 1.1 million TEU in North Asia (39% MoM) [Linerlytica].

- The Shanghai-Rotterdam WCI increased by 3% last week to $2 028/FEU (22% MoM, −50% YoY) [Drewry]. According to Drewry, carriers have announced FAK rate increases effective November 15, targeting a range of $3 000-3 650/FEU in an effort to gain leverage ahead of the 2026 contract talks. GeekYum, data shows the average spot rate from major carriers in the second half of November is around $2 500/FEU. Available December quotes average around $3 300/FEU (only some lines have published offers).

- Rate increases are supported by stable demand, blank sailings (at least 10% in November), and terminal congestion in Europe. Delays in Northern European ports are currently artificially constraining available tonnage capacity. Should demand weaken, carriers may partially scale back their rate increase plans.

- However, maintaining profitability requires rate hikes. Estimates of rate levels at which carriers are able to break even:

UPDATE: As of the evening of November 20, 2025, the latest WCI Shanghai-Rotterdam reading has risen by 8% WoW — up to $2 193/FEU.

Asia-Northern Europe: ~$1 800/FEU for major carriers [JOC];

General level (not broken down by trade lane): ~$1 100/FEU [ShippingWatch].

- Medium- and Long-Term Outlook: the overall trend continues to point towards a growing supply-demand imbalance and intensifying competition.

China-EAEU logistics market

Import and export trends

- Russia’s GDP growth has been consistently slowing throughout 2025: from 1.4% in the first quarter to 1.1% in the second and 0.6% in the third quarter. Official forecasts for the annual result have been successively revised downward: the Ministry of Economic Development expects 1% growth, while the Bank of Russia forecasts 0.5-1%. In the manufacturing sector, over nine months, 17 out of 24 types of activities showed a decline in physical output, with even the defense industry showing signs of slowing down. The economy’s main driver — consumer demand — is also showing signs of weakening amid slowing real wage growth and declining employment [Kommersant].

- The Ministry of Finance’s campaign against «gray imports» is receiving mixed reactions from the market. Supply chain participants fear short-term consequences, including potential shortages of certain product categories and price increases of 10-40% due to higher fiscal pressure [Kommersant]. At the same time, a Bank of Russia study based on 2014-2022 data demonstrates a stable negative correlation between the size of the shadow sector and the profitability of legal businesses, justifying the need to continue market cleansing policies for long-term economic health.

- In October 2025, sales of new passenger cars in Russia amounted to 165.7 thousand units, a decrease of 3,2% YoY. Cumulative sales for January-October 2025 reached 1,062 thousand vehicles, down 19,9% YoY [AUTOSTAT].

- In January-October 2025, the volume of export rail transportation across Russian-Kazakh border crossings increased by 7,2% YoY, reaching 25.5 million tons [RZD]. In the container segment, 328.6 thousand TEU were shipped (+41%), which is an all-time high. The growth was made possible «through the development of railway infrastructure, border crossing points, and the establishment of effective technological cooperation between railways, border, and customs services».

- Import rates in the China-Moscow multimodal corridor continue to show active growth. Over the past month, the increase has been approximately 1 000$/FEU, with the average transportation cost via Far Eastern ports at ~$5 000/FEU (SOC). Meanwhile, rates for direct rail transportation remain stable, with the average cost in mid-November at ~$4 900/FEU (COC).

- The planned 10% increase in railway tariffs from December 1, 2025, with an additional 5% в 2026 indexation for container transportation in 2026, will create a new pricing environment for shippers. IPEM experts predict a decrease in the competitiveness of rail transportation for a number of product categories and their limited outflow from the network [PortNews].

Other trends

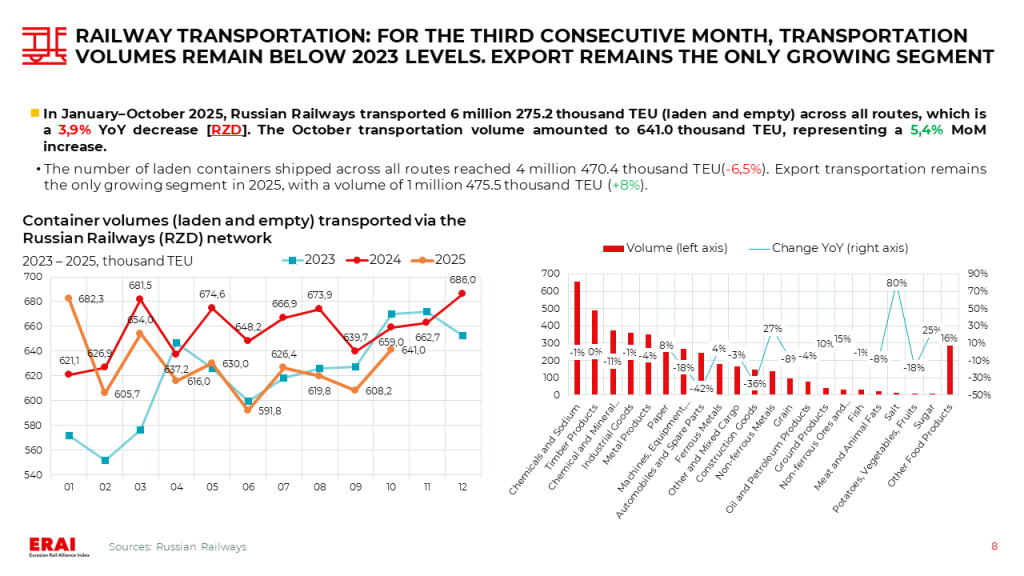

- In January—October 2025, Russian Railways transported 6 million 275.2 thousand TEU (laden and empty) across all routes, which is a 3,9% YoY decrease [RZD]. The October transportation volume amounted to 641.0 thousand TEU, representing a 5,4% MoM increase. Export transportation remains the only growing segment in 2025, with a volume of 1 million 475.5 thousand TEU (+8% YoY).

- In the first 10 months of 2025, export railway transportation of ferrous metals increased by 14.3% to 20.6 million tons. The main volume was shipped via ports in Southern Russia (9.4 million tons), driven by demand from Asian countries [1520international]. Containerised metal transportation showed a 1.5-fold increase, reaching 2.3 million tons. This dynamic is attributed to the development of tariff policies and the expansion of multimodal services. The growth in container shipments indicates the efficiency of containerised transport, the convenience of handling and loading, which increases delivery speed.

|