The blockage of the Suez Canal by the ‘Ever Given’ Evergreen containership since 23 March will hasten the global shift away from just-in-time supply chains after further exposing their fragility, according to A.P. Møller-Maersk CEO Søren Skou.

The Danish shipping giant Maersk, sometimes seen as a bellwether of global trade given that it carries one fifth of the world’s ocean-going unitised freight, has a number of ships among the hundreds of vessels delayed by the blockage of the ‘Ever Given’ and has already rerouted 15 of its vessels around South Africa, adding about 10 days to journeys. It is also considering using air freight to get crucial components to customers.

Interviewed by The Financial Times, Skou said that companies had already been changing their supply chains because of the coronavirus pandemic, moving away from single suppliers and rethinking their dependence on just-in-time supply chains — where parts and components are delivered to manufacturing and assembly plants exactly when required. Instead, companies are increasingly embracing just-in-case supply chains, keeping much higher levels of inventory to avoid being caught short by disruptions.

Higher cost of losing sales

«We are moving towards a just-in-case supply chain, not just-in-time. This incident [in the Suez Canal] will make people think more about their supply chains,» Skou noted.

«How much just-in-time do you want to be? It’s great when it works but when it doesn’t, you lose sales. There’s no just-in-time cost savings that can outweigh the negative of losing sales.»

He added that companies were also moving away from being dependent on single suppliers, a decision that might have saved them «the last 5 cents on a component. We clearly see our customers saying we need to have multiple suppliers to make sure that one small sub-supplier can’t close us down.»

Elevated prices to continue

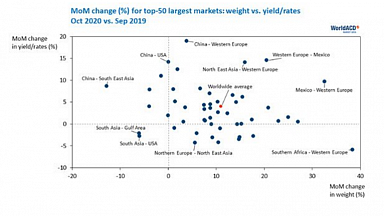

Freight rates have increased sharply in recent months as shippers worldwide seek to boost their inventories after being caught out by the strength of the recovery in demand for goods at the end of last year — a trend which Skou expects will continue in the coming months.

«Retailers stopped buying in the spring of 2020 and now they’re trying to restock at the same time as there’s very strong demand,» he noted. «The restocking cycle will run for a while.»

Freight rates were also likely to increase further because of container ships being left out of position by the Suez closure, Skou concluded.

Ever Given refloating

As reported today by Lloyd’s Loading List, the grounded 20,000 teu containership Ever Given, which has been blocking the Suez Canal since 23 March, has been partially refloated, the Suez Canal Authority said this morning. Traffic could resume today following the 80% refloating of the Evergreen containership blocking the key navigation channel since 23 March. But salvors caution there is work still to do and major container lines have already begun rerouting vessels, warning of short-term spikes in rates and months of disruption to supply chains.

After major container lines over the weekend announced large numbers of cancellations of services through the Suez Canal and vessels being re-routed via the Cape of Good Hope, MSC Mediterranean Shipping Company confirmed that the current Suez Canal blockage «is going to result in one of the biggest disruptions to global trade in recent years», with the company «working around the clock to manage our fleet and services so we can keep cargo moving and keep trade flowing as best we can under the circumstances». It said sailing around the Cape of Good Hope was an option on some routes, while in other cases it was «more about working closely with our customers to see what other solutions we can devise».

Huge backlog of ships

Caroline Becquart, MSC’s senior vice president and head of Asia & 2M service network, on Saturday commented: «Unfortunately, even when the canal re-opens for the huge backlog of ships waiting at anchorage this will lead to a surge in arrivals at certain ports and we may experience fresh congestion problems.»

She continued: «We envisage the second quarter of 2021 being more disrupted than the first three months, and perhaps even more challenging than it was at the end of last year. Companies should expect the Suez blockage to lead to a constriction in shipping capacity and equipment, and consequently, some deterioration in supply chain reliability issues over the coming months.

«MSC, as a container carrier and service provider, will exhaust all possible options to remedy the situation.»

Just-in-time reversal reports

Several reports have highlighted how the COVID-19 pandemic has been forcing shippers around the world to re-evaluate and resilience-test their supply chains to a much deeper level, along with the adoption of greater levels of supply chain diversification, innovation and long-term planning.

Following several such reports last year, two new reports published this month highlighted how diversifying sourcing is widely now seen as critical to alleviating supply chain volatility, with one survey finding almost 90% of shippers diversifying their supplier base or planning to diversify their suppliers. ‘The State of The Freight 2021’ report, based on a survey of over 300 supply chain professionals, identified what it describes as «massive visibility gaps and urgent needs for digitalisation in logistics» after finding «how unprepared many industry stakeholders were when trade wars and then COVID-19 shook global supply chains».