Ports in Shanghai and Ningbo, the world’s largest and third-largest container hubs, have closed for the second time due to the impact of a typhoon this summer.

China’s National Meteorological Centre has issued an orange alert, the second-most serious level, for the Typhoon Chanthu, which is expected to make landfall in the Zhoushan Archipelago, Zhejiang province on Monday with strong gales and heavy rainfall.

Terminal operators at the nearby Yangshan Deepwater Port, which accounts for about 45% of Shanghai’s throughput, have suspended all box pickup and delivery operations from September 13.

The two main port areas, Waigaoqiao and Wusong, will halt the entry and exit of containers at the same time.

Storage yards were also closed.

At the major terminals in Ningbo — including Ningbo Beilun Container Terminals, Daxie China Merchants International Terminal and Meishan Container Terminal — closer to the landfall point, operations are being phased out at an earlier time from September 12.

The suspension is similar to the measures taken when Typhoon In-fa hit the two Chinese gateway ports in July.

Shanghai and Ningbo are no stranger to the visits of typhoons each year, which normally leads to some delays to vessel schedules.

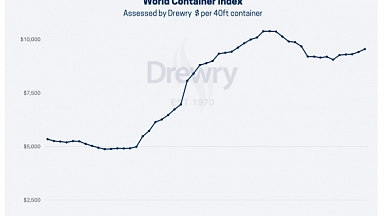

The disruption this year, however, has rubbed salt into the wound of an already badly stretched global supply chain, with unprecedented port congestion and logistics bottlenecks triggered by the coronavirus pandemic.

The Meishan container hub, for example, had been shut down fore more than two weeks after a dock worker tested positive for coronavirus in the past month.

According to Lloyd’s List Intelligence data, there were already 86 containerships at anchor off Shanghai and Ningbo as of Friday before the closure and a further 55 off the US ports of Long Beach and Los Angeles.

The boxships waiting to load in waters off the two Chinese gateway ports total nearly 385,700 teu, with similar capacities waiting to discharge off the two ports on the US west coast — suggesting more than 3% of the fleet capacity is tied up at these two destinations.