As of 2023, Kyrgyzstan’s bilateral trade within the EAEU space amounted to $4,357.3 million in monetary terms, of which Russia accounted for 67 percent and Belarus 2.4 percent. Russia remains one of Kyrgyzstan’s leading trade and economic partners and accounts for about 19 percent of the republic’s foreign trade in 2023.

Bilateral trade between Kyrgyzstan and Russia amounted to $2,930.7 million in 2023, down 15.7 percent compared to 2022.

Bilateral trade between Kyrgyzstan and Belarus has been mixed over the past six years, with particularly significant growth observed in 2022. In 2023, bilateral trade amounted to $103.4 million, down 18.3 percent compared to 2022.

Russia exports to Kyrgyzstan metal products, refined fuels, and agricultural products. Kyrgyzstan supplies Russia with fruits, vegetables, textiles, clothing, and agricultural products. Timber products, as well as plastic and other chemical products, prevail in the cargo flow from Belarus to Kyrgyzstan. Kyrgyzstan supplies Belarus with livestock and horticultural products.

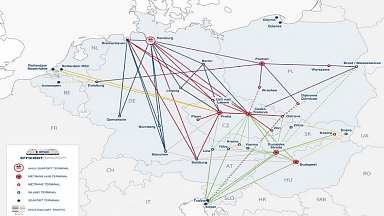

Kyrgyzstan has untapped capabilities in logistics. The country is located in the heart of Central Asia and borders on Kazakhstan, China, Tajikistan and Uzbekistan, which makes it a potential transit hub on routes connecting these countries and neighbouring regions.

Most of the commodity items are containerable, which makes railway operations between Kyrgyzstan, Russia and Belarus a promising area of business. Better transport connectivity can generate cumulative effects for the three countries, as it will boost trade and economic activity. The lack of a single rail link connecting the northern and southern Kyrgyzstan that is also integrated into the crossborder rail network holds back the development of the container rail transport between the EAEU partners.