Amid tight supply of ships and equipment, the EC2408 contract closed at $4,192 yesterday, up from $3,933 the previous week, although the EC2406 contract price dipped to $3,976 from $4,009 the week before.

Linerlytica noted that attention is now shifting to the EC2408 contracts as the EC2406 contract expires on 24 June.

Average daily trading volume for the EC2408 contracts, which expire on 24 August, more than doubled to 80,300 last week, from 36,882 the previous week.

The EC2410 contracts that expire on 24 October closed slightly higher at $3,363, compared with $3,268 on 13 May, while daily trading volume averaged 23,877 last week, higher than 14,331 the previous week.

Linerlytica remarked: «Spot freight rates on the Shanghai to North Europe route could rise by a further 35% by August this year, if the CoFIF freight futures traded on the Shanghai Futures Exchange are accurate in their predictions.

«The next six months will provide a key test to usefulness of the freight futures in predicting future freight rate movements, with its current bullishness standing in sharp contrast to the carriers’ own bearish earnings forecast for the same period.»

The consultancy observed that initial concern that CMA CGM’s resumption of Suez transits on its BEX2 Asia-Mediterranean service could trigger a response by its rivals proved to be unfounded, while the Shanghai Futures Exchange’s restrictions on speculative activities did little to dampen trading volumes as average daily turnover reached $3.5bn.

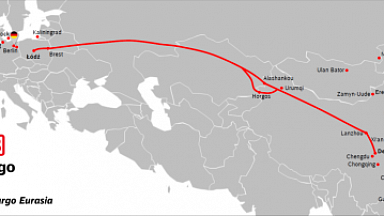

Linerlytica added: «Rates to Europe continue to strengthen with the shortage of vessel capacity and boxes pushing up rates, especially to North Europe where the space scarcity is most acute. The rate gap between Mediterranean and North Europe is set to narrow further and could reach parity within the next two months.»

Newbuilding deliveries are set to add 24% to weekly capacity in June, compared with May. However, schedules remain highly volatile due to persistent port congestion in the Persian Gulf and Southeast Asian hubs that could delay the arrivals of ships in China next month.