The results of 2024 demonstrated a gradual slowdown in trade growth. Exports to China amounted to $129.1 billion (+ 0.47% compared to the previous year), and imports increased to $ 115.5 billion (+ 3.96%). On the Russian side, the factor driving the slowdown in growth was the end of the period when the economy was adapting to new realities and when companies were reorienting to cater to eastern markets, including China. On the Chinese side, this is partly explained by internal factors, including a decrease in production activity and signs of market overheating, which affects the demand for Russian exports.

The beginning of 2025 has shown signs of stabilization with regards to mutual trade at existing levels. In the first four months of 2025, trade turnover decreased 7.5% (to $71.12 billion): Russia’s exports fell 9% (to $ 40.31 billion), and imports fell 5.3% (to $ 30.81 billion). As for exports to China, the leaders in the decline were oil, oil products and gas (-29%), fertilizers (-16%), edible oils (-20%) and timber (-6%). At the same time, exports of copper (+ 91%), ores (+ 59%) and aluminum (+ 50%) increased significantly. Imports from China fell in the automobile and spare parts segment (-60%), but increased in industrial equipment (+9%), optics (+14%), ferrous metals (+26%) and organic chemicals (+15%). Deliveries from Chinese stores online increased 80%.

In 2025, the reduction in imports of passenger cars has had the main impact on the situation in the container market. Over the 2021–2024 period, it increased almost tenfold — from 1.5 to 15.2 billion USD. However, in the first five months of 2025, a decrease is observed: imports of cars and components fell from 8.8 billion to 4.2 billion USD (-52% compared to 2024).

Exports of aluminum and its alloys demonstrated growth, from $1.33 billion in 2022 to $3.54 billion in 2024: this is due to the strengthening role of the Shanghai Exchange in trading Russian metal.

At the same time, supplies of sawn timber and refined copper decreased, while exports of precious metal ores and concentrates, on the contrary, increased significantly (+43.75% y/y, to $1.84 billion).

In recent years, there has been a noticeable decrease in the value of frozen fish supplies from Russia after they peaked in 2022 at a value of $1.78 billion (886.1 thousand tons). In 2024, the decrease occurred both in value ($1.3 billion, −21.5% compared to 2023) and in physical volume (1 million tons, −16% compared to 2023).

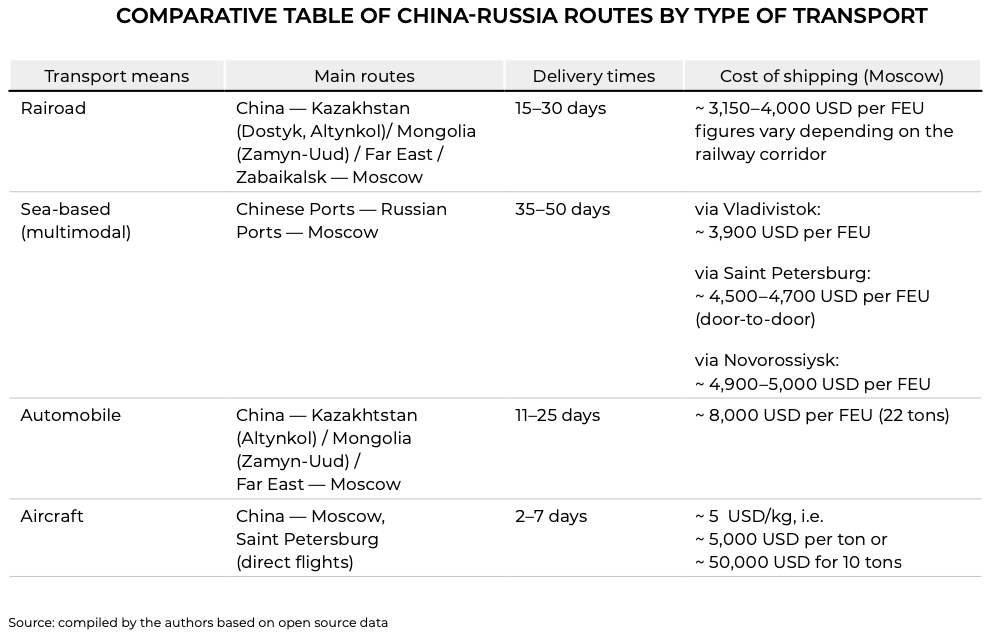

The delivery of cargo from China to Russia takes a variety of routes. Today, transportation is carried out by sea, rail, road and air transport. Each of these has its own characteristics, terms and cost.

According to some companies, at the beginning of 2025, there will be a decrease in container shipments from China to Russia by 8-9% compared to the same period last year. Such a decrease has been observed for shipments both through ports and through land border crossings.

The beginning of the year was also marked by a significant reduction in rates. The cost of delivery through the ports of the Far East varies within the range of about $3,800–4,400 per FEU (when providing a container by the carrier, COC), and when using shipper’s containers (SOC) it is approximately $3,600 per FEU (current as of the beginning of July 2025). Against the backdrop of weakening demand and cheaper container rentals, a reduction in rail freight rates was noted: in June, they decreased by $300, amounting to an average of $3,750 per FEU (COC), while during the peak periods of 2021-2022, they reached $13,000-15,000 per FEU. These changes reflect current economic trends and the adaptation of logistics infrastructure to external economic factors.