Difficulties experienced throughout much of the global ocean freight logistics chain for several months look set to continue well into the second quarter (Q2) of this year, according to freight forwarding and other sources, including high prices, poor vessel reliability, capacity issues and acute equipment shortages.

Kuehne + Nagel CEO Detlef Trefzger said last week that he did not expect an improvement in the immediate future to the issues related to the supply of containers, port congestion and dock labour shortages, noting: “Container supply is tight, because the demand is there, but we have congestion at the ports – which is driven by all the health and security measures the pandemic has caused.”

For the container situation to ease, handling at the port terminals needs to be speeded up, he added, noting: “We would not expect this to be solved before the summer (this year) and it depends on vaccination and on other health safety measures.”

Vessel capacity and equipment still very tight

In an update late last week, Grant Liddell, business development director at UK forwarder Metro Shipping, said as we look ahead to Q2, “the issues that we all expected to ease, are still there”, highlighting that “schedule reliability is at its lowest recorded level, rates remain very high, and vessel capacity and equipment continue to be very tight, with demand further escalating after the Asian holiday period”.

He continued: “Shipping lines and cargo owners are reporting strong order books well into the Q2, and with the expected loosening of lockdown measures throughout the UK, Europe and the rest of the world, as the vaccine roll out grows, we can expect demand to remain high until the summer and possibly beyond. The carriers are maintaining their peak season charges throughout Q2, and market rates remain very high for both contract renewals and in the spot market.”

He noted that some shipping lines “have actually announced increases to their peak season surcharges, at an unseasonal time”, such as Hapag Lloyd, from 1 March, with “confidence from the carriers very ‘bullish’ still”.

And he said operational challenges are also not unique to the Far East, highlighting “port congestion, equipment shortages and schedule reliability being experienced across the Indian Sub-continent, North America, Australia, Europe, and the Middle East” that were indications of “an inescapable global supply chain position and issue”.

Liddell noted that US west coast ports still have major congestion issues, with dozens of vessels still being held up for weeks, “creating more delays and further slowing down the evacuation of equipment back to the manufacturing regions”.

Liddell said “these global issues and challenges” meant that “the role of an expert freight forwarder has never been so important to keep supply chains moving”. His own company, for example, “continues to work as a partner and on a collaborative strategic approach with clients ensuring the best fit solution and all alternatives are offered in the current dynamic market, ensuring every option is available as part of the supply chain decision-making process”, with some such as Metro able to provide additional visibility via their own technology tools.

His views are also reflected by several other freight forwarding and other ocean freight industry sources, which also anticipate several months of further ocean freight challenges, with significant cargo and equipment positioning issues already baked into the system.

Space ex-China easing

However, a source at freight forwarding and logistics group DSV indicated that the ocean freight market from China had eased to some extent in recent weeks, although the disruptions to global supply chains were continuing.

“The ships sitting on the West Coast are a massive issue for us here in the United States,” he noted. “It’s not only a United States issue; it really trickles down to Latin America as well, Mexico, also from Europe, and also the outbound out of the US.”

“That said, space out of China, seems to have eased up a little bit,” since Chinese New Year, at least on the ocean export side from China to the US, although the cause of that easing remained unclear.

“We don’t really see any issues getting capacity,” he noted. “There are still some constraints on equipment, but from getting capacity, it is starting to balance out to some degree – and potentially as a result of what’s going on with the delays”.

He said it was unclear whether demand was now dropping on a longer-term basis, or whether, to a certain degree, ocean freight customers may have reduced demand after asking “does it even make sense to continue just to throw more freight into a big black hole”?

He added: “I think we don’t know the answers to that yet. But what we’re seeing at least is that it’s not as challenging getting space and capacity as it was just a few weeks ago, one month ago (on the ocean side, ex-China to the US).”

Containers out of position

As reported today, the problems of containers being out of position continues. Despite a shortage of empty containers in international export markets, empties are continuing to pile up in the UK, with the excess of containers at UK ports even higher now than last year, according to the latest data from Container xChange.

It said other European gateway ports have also suffered disruptions and delays due to pandemic driven container traffic surges. However, container availability at leading hubs is currently better balanced than in the UK.

At the port of Rotterdam, the CAx average reading for a 40 ft container this year is 0.51, compared to an average of 0.40 in 2020. At Antwerp, shortages have been a problem, with an average reading for a 40 ft container of 0.21 in 2020 improving to a more balanced 0.41 this year.

Similarly, at Hamburg, the average CAx reading for a 40 ft container in 2020 was 0.27 suggesting critical shortages. This year the average reading has improved to 0.49.

Spot rates close to record highs

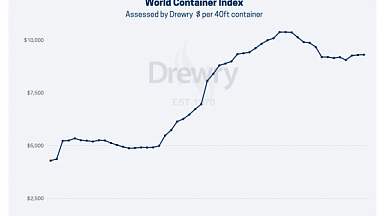

As reported last Friday, ocean freight spot rates have remained close to record highs on the main east-west trades, defying the normal annual pattern of falling in the weeks after Chinese New Year, with the cargo backlogs, port congestion, equipment shortages and sustained high volumes keeping prices high. In its latest freight rate assessments on eight major East-West trades, Drewry’s composite World Container index decreased this week by 2.2% or $117 to stand at $5,121 per 40ft container – still more than three times its level (+232.6%) a year ago, despite slight falls on most of the main lanes.

The average composite index of the WCI, assessed by Drewry for year-to-date, is $5,231 per 40ft container, which is $3,539 higher than the five-year average of $1,692 per 40ft container.

Freight rates on Shanghai-Rotterdam weakened this week by 3% or $286 to reach $8,188 for a 40ft box, but remain more than four times their level a year ago. Spot prices on Shanghai-Los Angeles also dropped 3% to $4,261 per feu, although rates from Shanghai to New York grew $23 to reach $6,651 per feu.

Drewry expects rates to stabilise in the next week.

The latest Shanghai Containerised Freight Index (SCFI) shows spot rates for China-Northern Europe at $3,966 per 20 ft unit, representing a 3.5% fall against its pre-Chinese New Year level, according to Lloyd’s List. The SCFI shows a 1% increase on the head-haul China-US west coast trade during this four-week period to $4,078 per feu, and a marginal uptick of 0.2% on the China-US east coast route to $4,808 per feu.

Late last month, the port of Los Angeles began encouraging diversion of containerships to other US west coast ports in an effort to reduce the backlog of cargo on vessels currently at anchor and awaiting berths. Port of Los Angeles executive director Gene Seroka estimated that it would take a month to clear just the tens of ships already anchored and waiting in the bay.

The port is forecasting 730,000 teu for February, a 34% jump over the same month last year, with Seroka attributing the overwhelming number of imports to American consumers who have continued on an “unprecedented buying surge” that started last summer and that “has not slowed yet”.

Lloyd’s Loading List reported late last month that exceptionally low US retail inventories seem set to fuel strong US container import demand for all of 2021 as long as retail sales are sustained at relatively normal levels this year, according to analysis by container shipping specialist Sea-Intelligence.

Sea-Intelligence analysed the developments in sales and inventories in the US using the latest data released by the US Census Bureau. With US inventory levels currently exceptionally low, Alan Murphy, CEO of Sea-Intelligence, said that “if retail sales in the US revert back to the normal trend growth in 2021 – i.e. they do not “collapse”, they simply go back to normal – then we will see import growth for the entirety of 2021 remain elevated compared to 2019, simply in order to rebuild inventories.”

Demand boom

He noted: “What this means is that a normal development in sales in the US, could – through inventory replenishment – sustain a strong US import container growth through all of 2021. By early 2022, we might then see year-on-year growth temporarily approach zero, but this is a short-term phenomenon, associated with the excess inventory build-up seen in 2021.”

As Lloyd’s Loading List reported last week, analysts at Maritime Strategies International (MSI) believe that “with carrier booking volumes reportedly still strong, several months of further port congestion to contend with, and uncertainty over the scale of pent-up demand post Lunar New Year, nothing is yet set in stone and strong freight and time charter markets by historical standards are expected to endure at least into H2 21”.