The federal committee’s decision that «the central component of a modern and efficient infrastructure is the expansion and modernisation of the rail network» comes as a swift response to recent reports claiming insufficient rail investments in Europe but also to Wissing’s discourse on the importance of road infrastructure investments due to the forecasted ‘disproportionate’ growth of road transport in Germany by 2051.

The coalition committee decided to fund railways while increasing truck tolls, specifically via a CO2 surcharge of 200 euros per tonne. On top of that, 80 per cent of the revenues generated by the CO2 surcharge will be used to fund rail projects. According to the truck transport association BGL, the 200 euros surcharge corresponds to a doubled toll price.

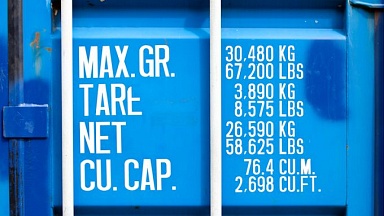

Combined transport and single wagonload

The decision concerning truck tolls meets the demands that rail transport associations voiced for years to achieve a level playing field between the two modalities. The cake’s frosting was the estimated 45 billion euros railway investment package, implemented via the state-owned Deutsche Bahn (DB) and its subsidiaries by 2027.

The amount reflects DB’s financial needs to carry out infrastructure projects, but it is not officially budgeted by the state. DB itself hailed the decision as a «resolution to the investment backlog in the German rail network» and claimed that it sets the course for the «rail network of the future».

Investments will target, among other things, the expansion of the combined transport terminals network, rail infrastructure modernisation, and digitalisation projects. At the same time, the funding of single-wagonload transport is also part of the agenda. The total number of projects still needs to be specified.

Praise, but also criticism

Several rail transport associations unanimously praised the committee’s decisions and plans, with the general feeling that the measures are a very positive and promising development. Nevertheless, many, including Allianz pro-Schiene and Die Güterbahnen, criticised parts of the government plans concerning climate protection goals and road investment projects.

Specifically, the main point of critique was that state-budget flows in road transport investments, like the accelerated construction of motorways, are still going strong. Peter Westenberger, Managing Director of Die Güterbahnen, said, for instance, that using toll revenues to fund rail projects could also be a way for the government to save its budget for road investments.

The plans were also criticised by the truck transport association BGL, which spoke of a political ‘hara-kiri’ and ironically said that the committee in charge of the decisions expects to «have their rhubarb spritzer (flavoured beverage) delivered to their front door by train in the future».

Closure of a long debate

The discussion about where infrastructure investments should target has been taking place in Germany since late January. After two months of intense debates and parliamentary sessions, the federal committee’s ‘modernisation package for climate protection and planning acceleration’ seems to be on the right track.

The interesting remaining point is how these 45 billion euros will be allocated and what projects they will facilitate. Will the full amount be invested, and what will be the funding share between toll revenues and state money? Moreover, will the share of rail freight investments be sufficient, or will passenger rail get the largest share of the pie? 2027 is close, so rail investments in Germany in the coming four years should flourish and present at least some initial results to assess.