The latest ocean freight backlogs and challenges following many months of supply chain disruptions have highlighted the fragility of just-in-time (JIT) supply chain models and require cargo owners to rethink their approaches to supply management, according to several freight and logistics industry insiders and advisors.

With more than 300 container ships vessels currently reported to be waiting at or outside various ports around the world — for example, at south China’s Yantian and Nansha, or US west-coast ports — LA/LGB, due to disruptions, the executive vice president (EVP) for sea logistics at one major global ocean freight forwarder warned cargo owners last week that just-in-time supply chains do not work in the current disrupted ocean freight environment. Urging shippers to «increase inventories», he noted: «Supply chains are too tight: just in time does not work in these times» — in which ocean supply chains are severely disrupted and consumer demand is set to remain strong.

He expects that the current situation in south China «will get worse in the coming weeks», but «eventually it will get better», because Chinese authorities and terminal operators are working on solutions.

More ‘wriggle room’ needed

One Middle East-based logistics coordinator highlighted that «JIT in the supply chain suits the balance sheet only until there’s a problem — then production stops and companies wonder why they left themselves so vulnerable. Surely they should build in more ‘wriggle room’ — even at a little short-term cost.»

This was echoed by another supply chain specialist, who noted there was currently a need for «buffer stock» and «buffer transit time».

And another supply chain specialist said he has been advising international customers «to approve smaller shipment lots, reduce factory stuffing FCLs, and improve LCL consolidation», as well as using «innovative air-sea and sea-air solutions built to suit key customers — which allows them small lots faster deliveries». He also said more innovation was required «to reduce American and European destination clearance and delivery costs» — in order to sustain the model.

Container shipping industry consultant Lars Jensen, CEO of Vespucci Maritime, today highlighted that according to the vesselfinder.com ship-tracking tool, «Monday morning shows 67 container vessels at anchor off the south China coast due to the disruptions experienced in Yantian, Shekou and Nansha. This is in addition to an armada of other bulk and cargo vessels also waiting in the area. Presently the count as per AIS data off the California coastline is eight vessels outside Los Angeles/Long Beach and 20 vessels outside Oakland.»

Despite warning last week that the situation could get even worse, if the current incidents of Covid-19 at ports in south China become replicated at other Chinese container hubs, and acknowledging «the almost chaotic state of the market presently, where the Covid outbreak in south China is wreaking havoc on planned sailings — on top of a market already in partial disarray», he rejected the suggestion that the global maritime supply chain as a whole was fragile.

Jensen noted: «I actually do not see the global maritime supply chain as fragile. Despite a pandemic and the blockage of the Suez Canal, something like 99% of all cargo still gets moved. It might be delayed, as well as quite costly, but it does get moved.

Importance of resilience

«What I instead see as failing has been many shippers’ drive over several decades to constantly make their own supply chains as ‘efficient’ as possible — where efficiency was all about lower cost, lower inventory, just-in-time, faster lead times etc., but in the process removing resiliency. This makes some — not all — shippers extremely vulnerable to disruptions to the system.»

Jensen highlighted last week that, based on reports that 300 vessels were now waiting due to disruptions at various ports, «this means some 5.5% of all vessels». And in terms of capacity, «this is highly likely to be severely skewed towards larger vessels waiting in line, and therefore even more in capacity terms».

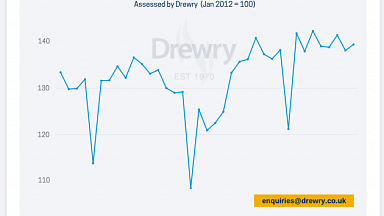

As reported last week, Drewry’s ports and terminals analyst Eleanor Hadland said that the disruption in China would eventually spill over and disrupt European and North American markets again, commenting: «We’re seeing this contagion spread around the world and there is just a lack of resilience. There is no spare capacity in North America or China at the moment to handle this level of disruption.»

Maersk update

In its latest update last Friday, Maersk said that «with a steady inbound flow every day, the total queue of vessels waiting to berth at the Port of Yantian increases», although the container line noted that «the Port Authority has been successful with re-opening the west port yard for laden import pickup, and one more berth has been re-opened — allowing a maximum of 7 vessels alongside at the same time. This moves productivity towards 45% of normal levels.»

It continued: «While this has a positive impact on gate activity, which is soon expected to reach the same levels as before the incident, schedule reliability will continue to suffer with an average waiting time of 16 days and counting.»

Like other carriers, Maersk and its partners have responded to the disruptions at Yantian by omitting vessel calls at Yantian and fellow Shenzhen port Shekou, including switching to call in nearby Nansha or Hong Kong, with 19 of its mainline services being impacted for the remainder of this month.