Freight rates may have peaked for now and be coming down from their all-time highs. But any resetting to prior levels could take another two years, according to analysis by Sea-Intelligence.

Although the Shanghai Containerised Freight Index added 0.4% in the past week, other indices show a downturn in the rates paid, including Freightos’ Baltic Index, which recorded an 11% decline on its global index and a sharp 21% fall on the transpacific, and Xeneta, which also recorded a smaller decline on the Asia-US west coast routing.

While each index uses its own methodology, the direction of travel indicates that some of the froth is coming out of the overheated spot market. One likely reason for this is that those shippers desperate to ship goods in time to meet the US holiday shopping season, and willing to pay any amount to do so, have now missed their window of opportunity.

Nevertheless, inventory restocking and the rush to get goods out of Asia ahead of the Chinese New Year holiday in February are likely to mean that freight rates remain firm for some time yet.

Moreover, the historical progress from peak rates to normalised rates is often a long and drawn-out process.

An analysis of five periods of sustained rate declines since 1998, conducted by Sea-Intelligence, indicates that it could take between 18 and 30 months before rates stabilise anywhere near their prior levels.

Tug-of-war between shippers and carriers

«The current situation is highly unusual and among many pertinent questions is the one about how quickly freight rates will normalise,» said Sea-Intelligence chief executive Alan Murphy. «This depends on a myriad of operational issues linked to the bottlenecks, as well as the commercial outcome of the impending tug-of-war between shippers and carriers on the rate levels themselves.»

Previous periods of declining rates had seen falls of as much as 40% from their high points. Each decline had taken different periods of time between the peak and trough, but it was still possible to assess the weekly rate of decline across the period.

«The rate of decline ranges between 0.4% and 0.9% per week, from top to bottom,» he said. «This therefore indicates the speed of rate collapse seen in the five previous cases of prolonged declines. If these five periods are to reflect the inherent pricing mechanisms in the industry — and if these mechanisms remain in force — then we can use this to calculate a reversal back to normality.»

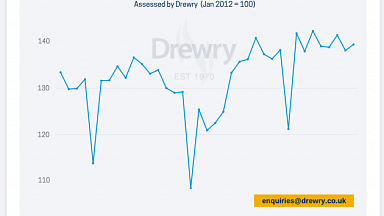

A long-term view of freight rates showed that carriers had been able to maintain a level of control during the first decade of this century, despite periods of decline. But from 2015-2019, this power had weakened, and freight rates had reset at a lower level before bouncing back sharply following the pandemic.

A 69% fall is required

A stronger, more consolidated carrier sector was likely to be able to prevent rates falling to that level again, but even to get back to the rate levels seen between 1998-2014 would require a 69% fall from where they are now, said Mr Murphy.

«With a rate decline ranging from −0.4% to −0.9% in percentage points per week, this implies the rate decline would take 18 months.»

But this would require that rates fell as quickly as they had during the global financial crisis in 2008.

«If, however, the rate decline only matches the average seen over the past five periods, then a normalisation would take as much as 26 months,» he said.

Should rates only decline at their slowest recorded rate, it could take as long as 30 months to return to the earlier base level. «Overall, the conclusion is very positive for carriers and less so for the shippers.»