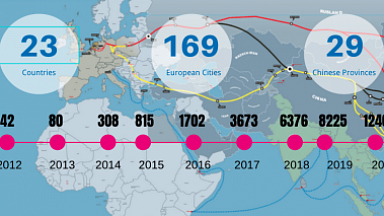

According to the information of the ERAI portal by the end of 2021, 618 thousand TEUs traveled along the Eurasian transit railway route, which turned out to be 28% more than the indicators of the revolutionary 2020. What helps to keep the momentum? In the past few years, we have seen the continuous growth of the volume of cross-border transport of CHINA RAILWAY Express (CR-express). In my view, the main reason is that the impact of the COVID-19, the port congestion, and the shortage of sea transport capacity caused by the high sea freight rates, led to the influx of goods into the CR-express market. Railway transportation ensures predictability and stable supply, which is also a key factor contributing to the growth of transportation volume. In addition to its advantages of safety, stability and high-speed transportation, the characteristics of low carbon, environmental protection and energy conservation are also the premise of the long lasted prosperous business. Rapid growth of Eurasian rail transit The COVID-19 crisis has ramped up the modal shift to rail transit services in Eurasia. What factors would you point out as key for Chinese consignors and logistics companies that opt for the Eurasian rail route? Affected by the COVID-19, many shippers began to flock to the Eurasian railway transportation market compared with the Sea transport with high freight and shortage of capacity. At the same time, more and more consignors and logistics companies believe that Eurasian railway transportation is full of prospects with its advantages in efficiency, stability, and freight. COVID-19’s impact on rail transit China’s principled stance on COVID-19 has already led to several logistics failures. Some argue that the Chinese requirements are excessive. How do we mitigate the impact of such restrictions on freight flow? Could the containerization be a remedy for the problem? The spread of the coronavirus has led to a worldwide, ongoing pandemic. China has taken timely, decisive, and effective measures in the fight against the virus, providing an important framework for moving forward as we combat COVID-19. The impact of the pandemic won’t last longer. During this period, the logistics business relying on railway transportation and container multimodal transport increased significantly and played a key role. In post-pandemic era some enterprises in this industry have become more determined and confident in developing container multimodal transport, which will become the main direction of port centralized transportation and strategic logistics in the future. I am confident that all levels of logistics activity will soon return to their pre-COVID levels. New points on the map for Eurasian rail transit Mainland cities of China are traditional origin and destination points for Eurasian rail transit. However, more and more containers are moving to and out of coastal provinces cities, e.g. Shanghai — Hamburg regular service. How would you assess the demand on such services and its sustainability? The epidemic has disrupted the international trade. In 2021, the product exports are curbed by the COVID-19-related reasons such as the shortage of shipping capacity and the rise of ocean freight. At this critical moment, as the third channel of logistics, CR-express is of great significance in promoting international logistics and international trade. It provides customers with more choices. The continuous market demand in turn renders the CR-express transport develops in an increasingly market-oriented way, and help it gradually realizes sustainable development. What does economic growth in Central China offer to Eurasian rail transit? The increasing volume of CR-express transport in recent years highlights its role as strategic channel. Locating in the hinterland of the vast country, central China, like a backbone connecting the east to the west and the south to the north, has achieved sustained economic growth. A lot of goods in central China need to go out of the country by means of CR-express. The number of CR-express trips has increased. The prosperity of CR-express market has also further promoted the development of the local economy. It’s a win-win game. China government subsidies for railway transportation On 10th December, the Chinese government postponed the abolition of subsidies for rail freight until the end of next year. How did Chinese companies react to this news? What are the freight market players doing to get prepared for the cancellation of state support? In the early days, subsidies fostered the growth of CR-express. It can be said that high subsidies built a greenhouse for some growing enterprises. However, the subsidy reduction and cancellation policy has raised concerns in the industry about the future development of CR-express. I don’t think subsidy reduction and cancellation is necessarily a bad thing, and it brings rationality and competitiveness to CR-express market. In the post-epidemic era, logistics companies like we Neptune who firmly practice the National «Belt and Road» initiative, must learn to survive, and develop without subsidies and support any more from the government, and raise their logistics service quality, improve the efficiency of freight transport, constantly develop new markets, and provide better products. Maritime shipment rates: new normality? Container shortages, the blockage of the Suez Canal and port closures in China have led to a spike in sea freight rates, especially those between China and Europe. If in April 2020 the WCI Drewry rate was $1,495, then by November 2021 this indicator reached $9,292, surpassing the psychological mark of $10,000 in September 2021. In your opinion,…

Thanks!

We will contact you.