The COVID-19 pandemic has delivered perhaps the greatest shocks to international trade since the Great Depression. Global trade in 2020 is projected to decline by 20% according to BCG baseline scenario for economic recovery, and it is not projected to regain its 2019 absolute level of $18 trillion until 2023. Only the most optimistic economic scenarios see trade returning to its previous level in 2021.

Regardless of when the top-line numbers fully recover, however, the global trade landscape will still look dramatically different as companies shift their focus from fighting the pandemic to winning the post-COVID-19 future. As it destabilizes economies, intensifies geopolitical frictions, and exposes the risks of current global manufacturing and supply networks, the pandemic is also likely to redraw the map of world trade.

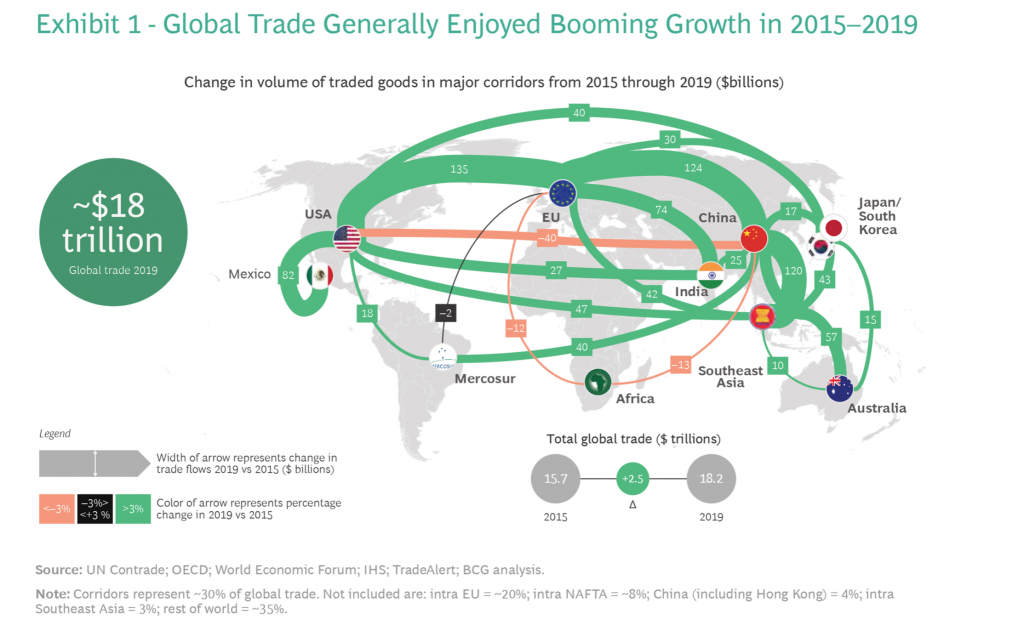

To visualize these shifts, BCG experts have prepared two maps depicting major trade corridors. One shows the actual change in trade volumes from 2015 through 2019:

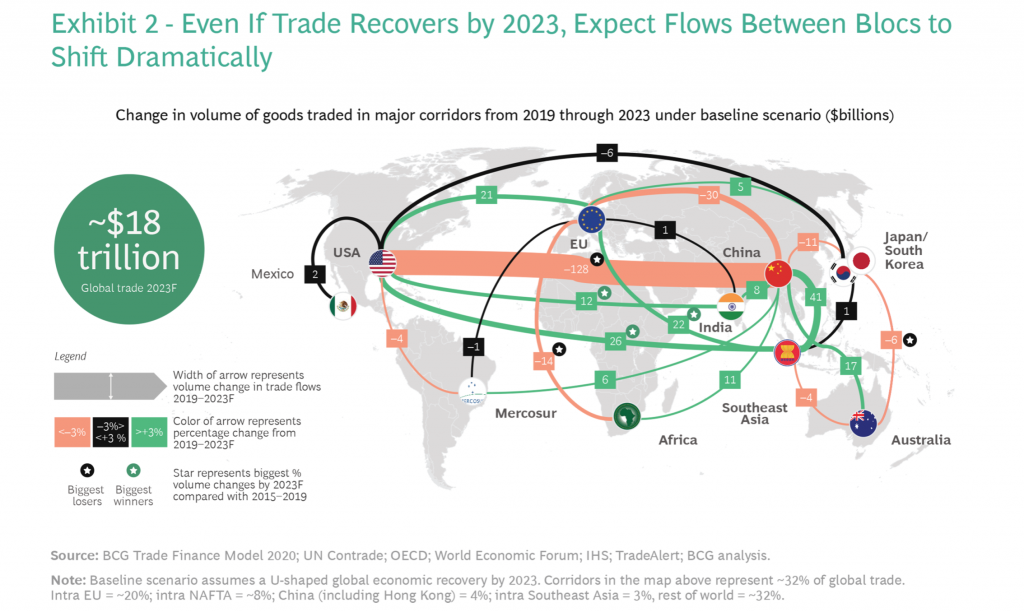

The other projects changes from 2019 through 2023 under BCG baseline economic scenario:

Among the sharpest shifts:

- Two-way trade between the US and China in 2023 will have shrunk by around 15%, or about $128 billion, from 2019 levels. Trade between the US and the EU will continue to grow, but at a sharply lower rate than the $135 billion surge from 2015 through 2019.

- EU trade with China will have declined by about $30 billion from 2019 through 2023, after growing by $124 billion in the previous four-year period. EU trade with India and South America will flatten.

- Southeast Asia will continue to be one of the strongest gainers, increasing two-way trade by around $22 billion with the EU, $26 billion with the US, and $41 billion with China by the end of 2023, but still at a slower pace than the earlier four-year period.

The pandemic is adding greater urgency to efforts to restructure global supply chains as companies seek to make their manufacturing and procurement networks more resilient to shock.

Companies should start acting now to adapt to the emerging new reality of the post-COVID-19 era, such as by reassessing their global manufacturing and supplier footprints and their approach to inventory, as many of the changes are structural and are likely to be long-lasting.

The COVID-19 crisis has already accelerated the trend toward nationalist policies and managed trade. In addition to worsening the US-China relationship, the pandemic is prompting some governments and customs unions to place further controls on trade in medical and agricultural goods. Rising tariffs, restrictions on market access, and other manifestations of geopolitical frictions will also require companies to alter their supply chains.

The paths of the COVID-19 pandemic and the recovery of the global economy remain impossible to predict. But it is becoming increasingly clear that, disruptive impact on international trade will leave a lasting mark. Companies should take a fresh, holistic view of the markets and trade relationships that are likely to drive growth and secure competitive advantage in the post-COVID-19 world.