The current «extraordinarily volatile» state of freight markets is likely to be prolonged throughout most, if not all of next year, a senior industry executive has warned.

Jens Lund, until recently, DSV’s long-standing CFO, now appointed to the newly-created post of chief operating officer (COO) at the Danish freight forwarding and logistics group, told Lloyd’s Loading List in an interview that he saw no let-up in the «distressed» conditions the sector has been working under for the past 18 months or so.

«Looking at the problems supply chains are facing right now on the ocean freight side; there are too few ship calls because the ports are already flooded with cargo, there is a desperate lack of available empty containers and also a need for truck drivers. And on top, there are all of the COVID-related restrictions with ports shutting down here and there, such as in China.

«There are just too many (negative) factors and nothing tells us that this will change in the foreseeable future. If it had been one vessel stuck in the Suez Canal, it would be different as at a certain point in time things would normalise. But that’s not the case. There are no signs of the situation normalising and we expect that in 2022 we will continue to be confronted by what are extraordinarily volatile market conditions — probably all the way through next year,» he noted.

«As for the immediate future, it perhaps goes without saying that we’re headed for a very busy Q4 — a peak on top of a peak one could say and on a consumer level, people are probably going to have find alternative Christmas presents to those they’d initially planned as a lot of goods will not arrive in time to be made available for the holiday season.»

While the difficulties in ocean freight logistics — capacity constraints, port congestion and containers in short supply — are set to persist, the picture on the air freight side is hardly more positive, Lund underlined.

«There are bottlenecks here too and spot prices in air freight right now compare with those we were seeing during the peak period for Covid-related PPE shipments. The cost of chartering aircraft is at a similar level to what it was then too.»

’Slow’ fix

Asked to comment on the criticism being levelled at ocean carriers by shippers over the elevated levels of rates on headhaul routes and in addressing the capacity situation, Lund replied:

«The shipping lines have for years and years been operating fleets without generating an appropriate return. Now, of course, they are experiencing an extraordinarily high return. So the coin has really flipped. They are clearly in a strong position at present and while I think they are trying to fix the capacity issues affecting the market, one could perhaps argue they have been slow in going about the task.

«If you’re a shipper paying $20,000 for a container when you used to pay, let’s say $4,000 it’s a bitter pill to swallow and yes, we are concerned about the solidity of some of our clients under present market conditions.»

Value-added services

As for DSV’s own fortunes, its Q3 results released earlier this week revealed an increase in operating profit (EBIT) of well over 50% on the same period the previous year, buoyed by the high level of ocean and air freight rates which spurred yields to fresh heights and also by strong demand for the group’s value-added services, driven by the disruption and chaos brought to supply chains and global trade by the Covid pandemic and also Brexit.

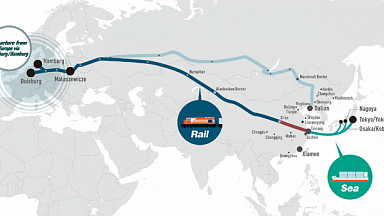

Elaborating on DSV’s value-added services offering, Lund said: «We might do many different things in order to ensure that shippers get their cargo. If we take Brexit, for example, everything now has to be customs-cleared and we are paid a fee to carry out such services. Another example could be in the ocean shipping market where say, congestion at Felixstowe may mean some lines aren’t serving the port directly. We would work on finding another solution for shippers in order to maintain their supply chains, such as an alternative routing to the UK.

«These value-added services enable us to make more money per transaction and we’ve managed to deliver them while keeping our own costs under control and achieving solid productivity throughout Q3.»

M&A

Turning to M&A, the integration of Agility’s Global Integrated Logistics (GIL))business, acquired in August this year, is progressing «according to plan» — with raised expectations in terms of EBIT contribution — and is expected to be completed by the end of Q3 2022.

As for the next stage in DSV’s journey of external growth, shortly after the purchase of Agility GIL was completed this summer, Lund caused a bit of stir when he was reported to have disclosed in a media interview that Deutsche Bahn-owned German counterpart DB Schenker was a potential acquisition candidate for DSV.

Clarifying his comments, he said: «I was asked a question by a journalist along the lines of, ’Is DSV continuing to pursue its M&A strategy ?’ ’Yes, we are,’ I replied. And then he said, ’So would that mean that you would be potentially interested in DB Schenker if it was put up for sale ?’ Given that our strategy is to consider all of the opportunities that present themselves, my response was that if such an eventuality came about we would take a look. That was all. We’ve never spoken to Deutsche Bahn’s nor to DB Schenker’s management.»

He continued: «Our M&A strategy has not changed. The aim has always been to try and grow as fast as we can by looking at available targets, large and small, to see if there’s something that works well, in combination (with us). The acquisitions we’ve done over the years have led to significant changes at DSV and the team we have now and the capacity available within the group means we are ready to carry out other potentially transformative deals should these come along in the future.»

Lund went on to highlight that the current bullish market conditions are driving potential M&A activity and higher-priced deals in the freight forwarding and logistics space.

«Let’s say you’re running a company and in these extraordinary times you’ve managed to double your profitability and are tempted to try and sell the business on a high multiple which one can understand. You hire a consultant and say, ’Listen, we’ve done wonderful things etc.....but in reality it’s just the market dynamic that’s changed.»

He concluded: «However, that’s not to say there are no attractive assets coming on to the market. But you have to be very careful what you pay. The price we paid for Agility GIL was actually three times the price we paid for UTi (whose purchase DSV completed early-2016) which was more or less the same size. Of course, all the share prices had come up so we had to pay the harder currency. Agility GIL still is and will be a good business case for us. But being certain of your business case is paramount.»