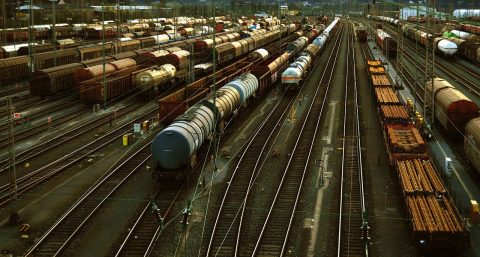

If the measure is to be applied, this will most likely have an impact on other traffic on the railway network, which is facing many other challenges at the moment. The German network is facing heavy construction works with limited capacity as a result. Even for normal traffic, disruptions are the norm in this period.

RailFreight.com contacted various companies involved in rail freight in Germany to hear what they have to say. Representatives from NEE, Transwaggon, ScandFibre, and Deutsche Bahn shared their concerns or lack thereof. Contrasting expectations have transpired from the different companies.

First things first: what does the measure entail?

The new measure is «intended to create the conditions for preferential train path allocation and dispatching of coal and mineral oil trains,» Wesseln said. «This means that the deadlines that were previously applied to train path allocation will be suspended for energy transport. Both processing and allocation will be prioritised.

In a second step, transports on a defined network section, the so-called EnKo network for ‘Energie-Korridore’, are to be prioritised on a dispositive basis in the event of a crisis. Trains in the EnKo network are then to have priority over all other trains, including long-distance passenger trains with the exception of the so-called Dringliche Hilfszüge», urgent relief trains.

What do companies expect?

NEE seems to be taking a cautiously pessimistic approach. «We are not yet in a position to say what the impact will be for our members, because at this point the shippers or politicians have still not provided any valid data on what the additional expected freight volumes will be,» Wesseln claimed.

However, NEE made rough estimates for the coal and mineral oil sectors. Wesseln said that «in the coal sector, considerable additional volumes could be expected in seaport-to-hinterland transport; in mineral oil transport, the issue is also possibly volumes, but above all possibly changed routes».

Transwaggon is more concerned when it comes to the activation of the measure. Carsten Schiering, Transwaggon Managing Director, highlighted that the rail prioritisation for energy products in Germany is expected to lead to a 30 per cent capacity decrease in the DB single wagonload network for Transwaggon.

On a more positive note, Mats Erkén, managing director of ScandFibre, told RailFreright.com that the company does not expect significant consequences if the measure is activated. When it comes to the rail prioritisation of energy supplies, Erkén pointed out that «no significant change in volume due to the new prioritisation of energy transports is expected».

ScandFibre is continuing to use rail for 90 per cent of its shipments in Germany while relying on road transport when restrictions and stops were announced. Erkén pointed out that «there could be some more congestions and delays, but I do not for the moment expect any dramatic changes.»

What do companies want?

Wesseln provided RailFreight.com with a list of demands that NEE has for the German government and all parties involved. The company is asking for «figures on the expected changed transport demand, bottleneck-related coordinated considerations on what can be done sensibly, arrangements with all parties involved, DB Netz, politicians, shippers, RUs, on how transports can be routed differently, and a thorough debate with all stakeholders, including the RUs that do not actively transport energy».

As Schiering pointed out, Transwaggon’s customers are currently forced to reduce their volumes and their production while searching for valid alternatives. «Current business suffers from huge backlogs in the network which results in daily traffic restrictions,» Schiering commented. The rail prioritisation of energy supplies will therefore amplify these problems.

On the other hand, DB is getting ready to increase the number of trains carrying energy supplies to run during fall and winter while waiting for politicians and the energy industry to provide more information. A DB spokesperson stated that «the legal ordinance on the prioritisation of supply-relevant trains is a practical precautionary measure by the federal government».