Several leading container shipping analysts have welcomed the Premium Surcharges indicator from leading freight rates specialist Xeneta, which appears as a pop-up on the company’s Xeneta Shipping Index (XSI) main page, which provides a free weekly analysis of market average short-term rates for shipping a 40’ container (FEU) on the main intercontinental trades.

Estimated premium surcharges

Its estimate of premium surcharges paid by customers indicates that to guarantee space and equipment, carriers are applying additional surcharges of up to US$500 to US$10,500 per container on Far East to US West Coast (USWC) corridors; up to US$1,500 to US$4,000 per container on Far East to North Europe; and up to US$1,500 to US$4,000 per container on Far East to Mediterranean.

Xeneta emphasises that these space-guarantee surcharges are not part of its rate aggregation figures, and that customers must add these premium surcharge estimates to the base rate shown in the XSI to calculate the full price.

Xeneta’s XSI index this week for the transpacific Far East – USWC gives a current average price of US$8,881 per feu – a week-on-week (WoW) rise of 1.68% and a month-on-month (MoM) increase of 8.64%. Including the space-guarantee premium surcharges, that price rises to between $9,381 and $19,381 per feu.

Its Asia-Europe index reading this week for Far East to N. Europe is $14,056 per feu, virtually flat WoW (+0.06%) and up MoM by 2.83%. Including the space-guarantee premium surcharges, that price rises to between $15,556 and $18,056 per feu.

Comparing freight rates indices

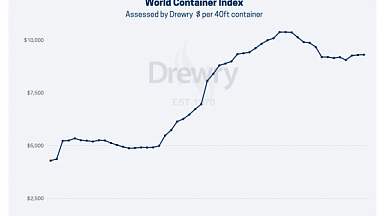

Container shipping analyst Lars Jensen, CEO of Vespucci Maritime, observed that container shipping freight rates are typically seen through the lens of the rate index measurements from providers such as Xeneta (XSI), Shanghai Shipping Exchange (SCFI, CCFI), Freightos Baltic Index (FBX), Drewry (WCI), Container Trade Statistics (CTS) and similar. But he said it is also important to note that “there is not any individual index which shows the ‘correct’ price. They show an element of the price, but individual shippers pay different rates depending on their size, carrier relationship, specific corridor, etc. Hence the index is only one part of the picture where the change is often more important than the specific level.”

He also highlights that different index providers use slightly different methodologies in terms of what is, and isn’t, included – noting that the XSI rate does not include premium surcharges applied by the carriers to guarantee space and equipment.

Welcoming that “Xeneta has just provided an interesting additional piece on information on the XSI data”, he added: “This is an important additional piece of information – not because of the magnitude, but because of the extreme spread seen in the premium pricing. This exemplifies why the competitive situation between the shippers themselves is changing, as they are clearly not all equally disadvantaged in terms of freight costs.”

Untangling surcharge premiums

Another senior maritime and trade analyst, Neil Dekker, also welcomed the additional information, congratulating Xeneta “to be the first to untangle what might be deemed as an average quay rate and the additional premiums – which of course in due time – will diminish. It is clear for some time that individual lines have different surcharges at different times and hence, any visibility into the real rate has been rather clouded. On this basis, premiums for the transpac are incredibly high and in fact more than the basic freight.”

He said what Xeneta is doing with its “massive range of rates per port pairing”, gives “huge visibility to the market”, adding: “Since March 2020, the market has changed beyond recognition and we are unlikely to see rates of US$1,500 per FEU from South China to the USWC for a long time to come.”

He noted that the disparity Xeneta points out “between load ports also shows that the market is multi-tiered and this is even more important given the increase in shipments out of SE Asia. The rates excluding surcharges also give some visibility in terms of where spot rates may be when congestion ends and an idea for shippers entering into new contracts in 2022; where the new rates may settle is what everyone wants to see.”

Unprecedented rates spread

Patrik Berglund, CEO of Xeneta, welcomed the feedback, noting: “Providing visibility in this market is challenging and the spread between low to high and from short-term to long-term contract rates has never been bigger. It makes it harder than before for shippers and forwarders to understand the market, the movements, and where they should or can be positioned. They should be equipped with solid data to navigate this rapidly changing environment.”

He also highlighted some more relevant information on this that Xeneta had shared in August, in which Erik Devetak, chief product and data officer at Xeneta, noted: “The fluctuation and large container rate deltas we are currently experiencing are due to a severe fragmentation of the ocean container market, in particular on the transpacific. Over the past four years, one could safely assume a relatively homogeneous spot price regardless of the origin, destination, time of booking, or space guarantee. This is no longer the case. Therefore, all indices will report different levels. It’s not black or white.”

Devetak continued: “Pricing now depends on various factors. It all depends on what kind of shipper or freight forwarder you are.”

Key determining factors

Devetak said the price a customer can achieve will, therefore, depend on how they answer the following questions: Do you need it tomorrow? Did you book in advance? Does your cargo need to travel through a congested origin/destination port? Are you procuring carrier-direct or via a freight forwarder? How good are your carrier relationships?

For example, as of last month on the transpacific, shipping a container from China can be as much as US$2,500 cheaper than shipping a container from Japan and US$3,000 cheaper than shipping a container from Singapore, he noted.

“Therefore, a shipping index which includes only Chinese Exports, like the Shanghai Container Freight Index (SCFI), is naturally lower than one that includes all Far East exports, like our Xeneta Shipping Index (XSI), which is still naturally cheaper than one that also includes Southeast Asian export, like the Freightos Baltic Index (FBX). These considerations alone can result in price differentials of thousands of dollars.”

Shipping guarantee values ‘ballooned’

Devetak continued: “Similarly, the value of a shipping guarantee has ballooned from a few hundred dollars to an average price of US$2500, with some carriers charging substantially more than that. This explains the price differentials between indices that include such surcharges (FBX, Drewry) and others that do not (SCFI, Platts).

“If, additionally, the booking is not performed with significant lead time, then the scramble for capacity can drive prices to astronomical levels, US$18,000-20,000.

“Interestingly, we also observe that not all market players necessarily see all the different market levels. Some smaller or less attractive customers are defaulted to the more costly premium options.

“Because of these considerations, shipping a container across the transpacific, particularly, can be as cheap as US$5,500 or as high as US$20,000. Therefore, when using a shipping index or performing a benchmarking exercise, it is crucial to fully understand what you are benchmarking against and what you are trying to achieve.”

He explained that “at Xeneta, we collect and aggregate thousands of rate sheets from global shippers and freight forwarders. Therefore, we have the privilege to see first-hand and analyse all these various price levels and market factors that are driving the current volatility. This enables us to give an accurate-as-possible view on rates.”