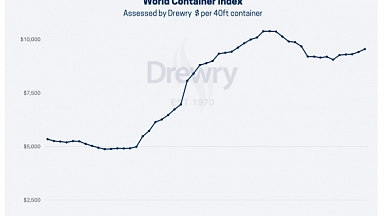

Ocean freight spot rates rose further again this week from their already record-high levels, driven in particular by increases on Asia-Europe trades.

According to Drewry’s World Container Index, spot prices to ship a 40ft container from Shanghai to Rotterdam surged another 7% or $605 this week to $8,976 — more than six times their level last year, and those on Shanghai-Genoa rose $411 to $8,943 for a 40ft box, more than five times their level in the same period of 2020.

Prices on the transpacific saw more-modest gains, with a rise of just 1% to $5255 per feu, three times their level in the same period last year, while rates from Shanghai to New York inched up $78 to come in at $7,085 for a 40ft container.

Prices on the transatlantic remained relatively stable come up with the head haul westbound leg rising just 1% to an average of US$3,550 per feu on Rotterdam-New York.

Outbound from the US, rates on Los Angeles-Shanghai grew $121 to stand at $710, while prices on Rotterdam-Shanghai increased $127 to $1,521 per feu.

Drewry’s composite World Container Index, an average freight rate assessments on eight major East-West trades, increased 4.7% or $255 to $5,726.99 per 40ft container.

For the year-to-date, the average composite index of the WCI, assessed by Drewry, is $5,143 per 40ft container, which is $3,287 higher than the five-year average of $1,856 per 40ft container.

Drewry expects the index to remain stable next week.