Following yesterday’s Loadstar Premium’s exclusive news break of senior management quitting DSV, rivals are hoping to pick up both customers and staff from the merger.

In fact, many already have.

At least one large DB Schenker customer is known to have ‘moved on’, while other forwarders are also reporting new business wins.

«We see a large number of customers not willing to have all their eggs in one basket,» said Burkhard Eling, CEO of Dachser. «Maybe one of the two [forwarders merging] were blacklisted, so the other one is blacklisted as well.

«So we see a lot of new revenue coming. Good.»

Others, including DHL and Geodis, said they were still awaiting the impact.

«I think we’ve come to a certain level of consolidation where our customers are looking for back-ups, because you need to have choice to maintain the supply chain,» said Henri Le Gouis, head of global forwarding at Geodis.

«I don’t believe that creating monopolies will favourably impact global supply chain management. I think it’s important, especially to the big customers, to have a few preferred partners.»

He added: «We’ll see if there are any opportunities to get new customers. I can tell you in a few months, because we are just starting. The closing was only a few days before, so it’s too early to say. But we see that Geodis definitely has some room to grow within this market and, we believe, has its role to play.»

Even DSV admitted that it would lose some customers. In an earnings call last month, CEO Jens Lund acknowledged: «If we look at organic growth in an integration period, it’s typically a little bit lower than you would normally achieve. When we buy a company, we typically factor-in that we will lose a little bit of revenue as well.»

However, he said: «We should be able to do a little bit better when it comes to growing our existing business, and then we should also hopefully manage the integration in such a way that we lose less volume than we have done before.»

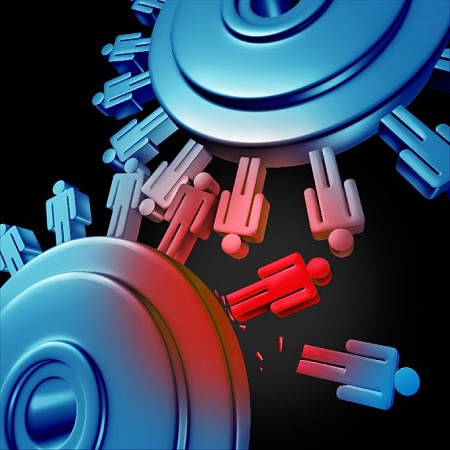

Not only are customers expected to walk away, but staff too.

«Geodis, still part of the top 10 in terms of worldwide forerunners, has a chance to play in this game,» Mr Le Gouis told The Loadstar. «It will benefit from talent leaving this company, because of potential synergies, or drastic management decisions — and also customers looking for alternative options.»

And Geodis also faces competition from the ever-burgeoning compatriot CMA CGM Group. But Mr Le Gouis denied there was a challenge from the expanding Marseille group, which includes Ceva.

«CMA is one of our preferred carriers, and we are very happy to deal with CMA. And Ceva is a competitor,» he said simply.

And he denied that Geodis would face the same prospect as DB Schenker, despite also being owned by a national rail company.

«So far, SNCF has always said that Geodis was part of the group, and part of its strategic mission. So this is its mission.»

Mr Le Gouis added that SNCF was also supportive of Geodis’ own M&A plans. He said: «When acquisitions make sense to help and fuel our strategy, we use them. And with the support of our shareholders.

«We’ve always got the support of our shareholders when it comes to acquisitions we estimate to be profitable and strategic.»

But few companies are able to bite off as big a mouthful as DSV — and nor do they want to.

«Quite honestly, of course, [DSV is] a huge player in the market,» said Mr Eling. «But we never were the one going for size. We always go for quality. We always go for good integrated networks. This is how we support our customers best. And this will not change.»

With a number of digital forwarders said to be holding up ‘for sale’ signs, is this an avenue in which Flexport can grow inorganically? It has already taken on Convoy’s technology and Shopify’s logistics arm, but cashflow could be a problem.