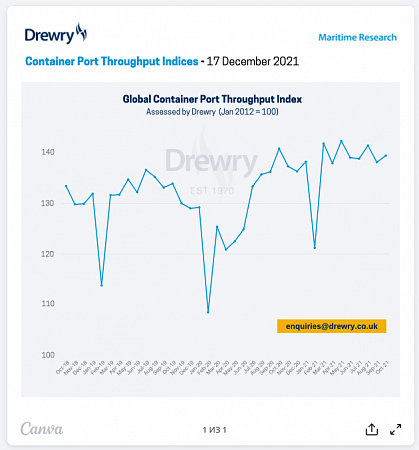

Drewry’s latest assessment — December 2021

- After decreasing more than 3 points in September 2021, the Drewry port throughput index improved slightly by 1% (1.4 points) MoM in October 2021. However it was 1% below October 2020, but 4.1% above the level recorded in October 2019. Volume growth is expected to remain under pressure for the remainder of the year due to ongoing congestion across the major markets — China, North America, Europe.

- Oceania was the weakest performer, with the index declining by 11 points (7.7%) YoY and 2.5 points (1.8%) MoM in October 2021. The score of 133.7 points is 5.4% lower than the level reported in October 2019. However, as the smallest of the world regions this did not have a material impact on the performance of the global index.

- Latin America posted a strong YoY increase with a gain of 16 points (12.7%), and MoM increase of 4 points( 3.2%) to reach its all-time high of 141.5 points in October 2021. The index is 14.3% higher than the pre-pandemic October 2019 value of 124 points. The North American index witnessed 4.5% MoM growth, and despite being 1% lower than October 2020, the score of 162.6 points was 10.5% higher than the October 2019 level.