High demand will continue to buoy air cargo charter activity over the next few months, consolidating the strong start to 2021, although prices may cool somewhat from their current high levels, according to a leading air freight broker.

Dan Morgan-Evans, group cargo director of Air Charter Service (ACS), told Lloyd’s Loading List last week that the strong demand of the first weeks of 2021 had continued in February and March and seemed set to continue until this summer.

The company saw growth of around 200% in terms of cargo flight volumes in January compared to the same month last year, with a similar pattern in February — attributed to issues including ocean freight supply chain difficulties, a resurgence in volumes of COVID-19-related personal protective equipment (PPE) from China to Europe and the US, along with some post-Brexit-related uncertainty.

And in a market update last week, he told Lloyd’s Loading List: «February compared extremely well with what was an excellent January. March looks to be continuing in the same vein, and I don’t envisage any let-up in demand until the summer — if indeed it comes.

«Capacity is still tight but has been eased due to the fact that we are not in a peak period at the moment. The extensive use of ‘preighters’ has also now become the ‘new normal’ for cargo charters.»

Charter rates remain high

Morgan-Evans added: «The market is buoyant and full charter rates remain high — southeast Asia probably being the ‘hottest’ region right now. But there has been some decline in scheduled air cargo rates from China and we envisage that this will trickle down to charter rates as we head into the middle of the year.»

He continued: «However, there continue to be factors in play that could keep prices where they are at present», highlighting «port congestion due to the cargo backlogs, exacerbated by coronavirus-related dock labour shortages, upsurges in PPE and test kit charters, while vaccine distribution may also have an impact as supplies increase.

«Nevertheless, the general consensus is that charter rates will remain higher than average for the rest of 2021.»

Morgan-Evans also highlighted that in the current market, prices can fluctuate significantly from week to week and from operator to operator. «It really is a case of finding the right aircraft for the job at the time, and rates can vary accordingly,» he noted.

«Although the preighters are relieving the capacity issues, freighters are still our ‘go to’ and are still the dominant force. But at the end of the day, we offer whatever solution is going to work best for the customer.»

Similar reflections

His comments broadly reflect those of fellow leading air freight broker Chapman Freeborn, which said earlier this month that it expected constrained capacity, a surge in the roll-out of vaccine shipments worldwide, and already buoyant demand in the air cargo sector for other commodities to keep air freight rates at their current buoyant levels for some time to come.

Chapman Freeborn’s head of cargo, Pierre Van der Stichele, told Lloyd’s Loading List that prices for full freighter charters had been very high until the start of Chinese New Year (CNY), with examples of near to $1million per flight for a B747F or equivalent from Asia to Central Europe. Since CNY, those prices had slipped by early March to $500,000-600,000, albeit with a fair bit of fluctuation, although he expected prices to rise again, «because if you’re trying to find a 100-tonne capacity pure freighter, it’s still hard.»

He said capacity was stretched on most of the major routes for air cargo Asia-Europe, Asia-USA, Asia-LATAM, Europe- USA, Europe-LATAM, and Asia/Europe-Africa, noting: «Demand is very strong and there are no signs of a swift recovery in capacity and the core fleet of freighters is fully committed until at least December 2021.»

Forwarders also believe air freight rates are likely to stay strong for several more months and potentially several years, with modal shift from a disrupted ocean freight market also set to buoy air freight until at least this summer. But high levels of uncertainty and volatility are set to persist that make long-term capacity and pricing agreements risky for freight forwarders and their customers.

Kuehne + Nagel (KN) CEO Detlef Trefzger this month said he believed there was little or no sign of a collapse or significant dip in air freight yields on the horizon as the main factors determining their current buoyant levels — the air capacity squeeze due to the loss of passenger belly-hold space, and disruption in sea freight flows due to problems in the supply of empty containers and port congestion — are likely to remain unchanged in the foreseeable future.

«The market at the moment is driven by a significant lack of ‘belly’ capacity,» said Trefzger. «We are around 90% down on the normal ‘belly’ capacity that we have seen in the networks globally in 2019. And while it’s anybody’s guess, we do not expect this capacity to come back and be available before 2024, 2025.

«We might see a slight decline in (air freight) yields in 2022, but that’s speculation. It really depends on alternative capacity, which is belly capacity.»

Ongoing ocean issues

Trefzger highlighted that ongoing ocean freight issues were also playing a significant part in keeping air freight yields bullish. «There is additional demand coming into the networks from, say, time-critical shippers who cannot rely on sea logistics anymore,» he noted.

Mads Ravn, executive vice president for air freight procurement at freight forwarder DSV, told Lloyd’s Loading List earlier this month that even if the ocean supply situation does ease, the pressure from modal shift to air freight will continue for some time.

«If you think about the hundreds of thousands of containers that are sitting off the west coast, that gives you an idea that it’s not going away any time soon,» he explained. «Here we’re talking about months of delays in inventories. So, we do expect that this will continue for quite a while, even though things have eased a little bit out of China in terms of getting capacity. We do expect that this will continue for months to come; the ocean situation, will not correct itself until this summer at the very earliest.»

Analysis by WorldACD

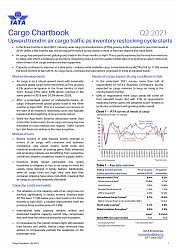

Analysis by WorldACD indicates that the global air freight market has seen a mixed start to 2021, with a slight year-on-year increase in volumes and far higher average prices compared to the first two months of last year. But the analysis shows huge differences from region to region, with volumes from China and northeast Asia up sharply in the first two months, compared to previous years, but most other origin regions reporting year-on-year declines.

Globally, February showed a worldwide year-on-year (YoY) weight increase of 1.1%, accompanied by a yield/rate increase in US$ of 84%. After a strong volume drop in the middle of the month, around Chinese New Year, the end of the month showed a strong recovery, WorldACD noted.

Due to the annually changing dates of Chinese New Year (CNY), WorldACD said it traditionally looks at January and February together. Though counting one day less in 2021 than in the leap year 2020, the YoY figures for these two months are + 0.9% in weight and +79% in yield/rate (in US$). Within the two-month period, average prices increased by 4%, month on month (MoM), and average load factors went up by 3.2 percentage points, MoM.

But breaking down these worldwide averages, it found that Asia Pacific — one of the six main regions charted by WorldACD — was «in a class of its own, emphasising the increasing importance of the region in world trade».

Except from the sub-region Australasia & the Pacific, which saw volumes down by 26%, YoY, air cargo exports from Asia kept growing strongly in the first two months of 2021. That growth was particularly strong from the sub-regions China and North East Asia, which showed YoY growth figures of 46% and 24%, respectively, compared with January-February 2020, while the entire region’s air cargo output this year grew by 19%, YoY.

Given that 2020 saw a troubled start for China and northeast Asia, WorldACD also compared this year’s performance with 2019 and 2018. The entire Asia Pacific region’s air cargo output this year was up by 14% vs 2019, and by 6% vs the bumper year 2018. In imports, Asia Pacific was 7% above 2020, 2% above 2019, but 4% below 2018, with WorldACD noting that the intra-Asia Pacific business was growing much less than exports to other regions.

Drastically different for other sub-regions

But for the other 19 «sub-regions» around the world, «the picture is drastically different», WorldACD highlighted. Apart from three small sub-regions — Central Africa, Mexico and Central Asia — all sub-regions showed a decrease in outgoing business in 2021 compared to each of the three foregoing years. Hardest hit are South Asia, with a decrease of around 24% vs each of the three earlier years, North Africa (-23% YoY), Southern Africa (-20% YoY), the Gulf Area (-17% YoY) and Canada (-16% YoY).

Looking at yields or prices for the various air freight product types, WorldACD found that all six origin regions — Africa, Asia Pacific, Central & South America, Europe, MESA and North America — had «behaved in the same way when it comes to increases in yields/rates: in all regions, the yield/rate growth YoY continues to be stronger in general cargo than in special cargo.»

But that was not the case when it comes to volumes: with a YoY growth of 29% YoY, Vulnerable Cargo & High Tech «very clearly outpace not only the market as a whole, but also score much better than all other large special cargo categories, including Pharma/Temp, which were all negative YoY», WorldACD noted.

However, from Asia Pacific, the ‘High Tech’ segment increased by more 25% YoY in each regional direction, fuelled by the worldwide demand for work-from-home devices.

WorldACD noted that the highest rates in air cargo at the moment are paid for business originating in South Korea, both eastbound and westbound, highlighting that «demand for COVID-19 diagnostic kits and a sea/air transfer play an important role here».

Looking at how things are shaping up in March, WorldACD noted that worldwide volumes at the beginning of the month were slightly higher than at the end of February. While that may be an early sign that the month will be positive, it noted that «many individual markets will no doubt experience a different reality once again».

Signs of strength

In an update last week, Flexport noted that the export market from China continued to show signs of strength heading into the end-of-the-quarter peak period. It said rates have jumped between China and US Midwest and East Coast destinations, although rates to the US West Coast were lower.

And it said Asia-Europe capacity «remains tight and rates are holding», adding: «SE Asian and transpacific eastbound markets continue to be very tight with rates inching higher as demand grows.»

European export spike

It noted that European export demand «continues to show a lot of strength to the Americas and Asia. Rates are spiking and show levels which are 2x from prior months. Carriers are reporting booking backlogs of up to 10 days before cargo moves out on planes, unless express-level rates are paid to expedite cargo. This capacity-demand imbalance will likely test shippers’ patience going into April.

Meanwhile, it said the US export market «remains strong to Europe, LATAM and Asia», adding: «Demand outpaces capacity in all markets but booking-backlogs of 7-10 days are reported to Asia and Europe. With the continued lack of belly capacity likely to remain, we expect to see these conditions into April.»

And on the ground, Flexport said airport cargo handling «in several US cities continues to face severe backlogs. The worst situation is in ORD where ground handlers have yet to recover from recent snowstorms and an ongoing deluge of import freight.»