Figures for week 20 (15 to 21 May) show a decrease of −4% in tonnages and stable in average global air cargo prices, week on week, after tonnages recovered in the second week of May from the −10% drop in the first week — based on the more than 400,000 weekly transactions covered by WorldACD’s data.

Comparing weeks 19 and 20 with the preceding two weeks (2Wo2W), overall tonnages increased by +2% versus their combined total in weeks 17 and 18, while capacity remained stable and average worldwide rates decreased by −1%.

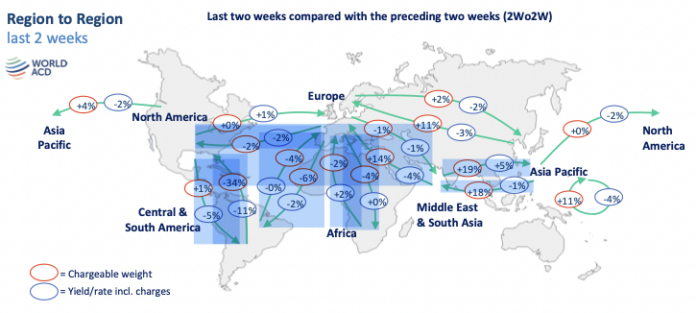

At a regional level, most origin regions showed an upward trend in tonnages on a 2Wo2W basis, following the drop at the start of May, except for a small (-1%) drop ex-Europe and a (-24%) correction ex-Central & South America following the surge of flower exports in late April and early May related to Mother’s Day.

Notable increases can be observed between Middle East & South Asia and Asia Pacific (eastbound +19%, westbound +18%), ex-Middle East & South Asia to Europe (+14%), ex-Asia Pacific to Europe (+11%), and intra-Asia Pacific (+11%).

Meanwhile, average pricing decreased slightly, on a 2Wo2W basis, from all of the main origin regions, with rates between Central & South America and North America among the most notable changes (northbound −11%, southbound −5%), along with a +5% jump in the rates outbound Middle East & South Asia to Asia Pacific.

Year-on-Year perspective

Comparing the overall global market with this time last year, chargeable weight in weeks 19 and 20 was down −7% compared with the equivalent period last year. The most notable changes include double-digit percent decreases in year-on-year (YoY) tonnages ex-North America (-16%) and ex-Europe (-15%), while traffic ex-Middle East & South Asia is up +9%, YoY.

Overall capacity has increased by +13% compared with the previous year, with double-digit percentage increases from all regions except North America (+8%) and Central & South America (-9%). The most-notable increase was ex-Asia Pacific (+43%).

Worldwide average rates are currently −37% below their levels this time last year, at an average of US$2.49 per kilo in week 20, despite the effects of higher fuel surcharges, although they remain significantly above pre-Covid levels.