Worldwide, the kilograms transported in the period 1-15 November (H-1 Nov) stood at 48% of the total for the whole of October (from Asia Pacific 51%, Europe and North America 47%, Central and South America 46%, Middle East & South Asia (MESA) 44%, and Africa 42%), it noted.

«In other words, any month-over-month (MoM) growth in November will have to come from the second half of the month. Weekly volumes in H-1 Nov were more or less the same as in the last week of October.»

While worldwide yields/rates (per kg) continued their upward movement, here too there was a slowdown in growth — the average going from US$3.13 in the last week of October to US$3.25 in the first week of November, an increase of 3.9% week-on-week (WoW) to US$3.28 in the second week of November (+0.9% WoW).

«For the first time in many weeks, yields/rates from China dropped. Whilst they were up by 3.8% WoW in the first week of November, in the second week they were down by 2.5% WoW,» WorldACD revealed.

On the China-Asia Pacific trade lane they decreased by 9.5% (to US$ 2.20/kilo), fell by 0.9% from China to Europe (to US$ 5.08/kilo) and shed 6% on China-North America routes (to US$ 5.93/kilo).

«Incoming business into Asia Pacific saw a downward trend: yields/rates dropped by 0.8% WoW on average, whilst this figure was slightly up for all other destination regions.

The average load factors were slightly lower in H-1 Nov than in October. We did not see a WoW change in last week’s (seccond week of November) data, except for the load factors ex-Europe which went up by more than 1.5 percentage points.

As for the key takeaways from the market last month, volumes were «only» 11% below October 2019, but 8% above September 2020.

«Worldwide air cargo contracted by one-third year-over-year (YoY) in April 2020. Since that very steep decline, the sector has bounced back steadily,» WorldACD underlined..

«Airline revenues from air cargo (in October) kept rising: +48% YoY, thanks to a still very high price per/kg, which has hovered between 60% and 67% above last year (in US$) for the past four months, culminating in an October increase of 66% YoY and 4.3% MoM.

«All this happened with freighter capacity increasing by 5% MoM, whilst cargo capacity on passenger aircraft grew by 11% MoM. The load factors for the two aircraft types increased by a modest 2% and 1% respectively over the month of September.»

WorldACD reported that among the three largest regions, the origin Asia Pacific did best again in volume in October, falling 7% YoY, but recording the second-highest YoY increase of price/kg (+82.4%). The origin area Middle East & South Asia (MESA) almost doubled its prices for the month of October YoY. The MoM price increase ex-Asia Pacific was 9.4% against a worldwide average of 4%: in 2019 the MoM increase ex-Asia Pacific was 5.5%.

«For the first 10 months of the year, Asia Pacific was the only region keeping its YoY volume loss in single figures (-9.8%), coupled with a record YoY revenue increase of 59%, more than double the worldwide average of 29%. Most striking is the fact that the share in worldwide air cargo revenues, generated from business originating in the Asia Pacific countries, has gone up from 41% in 2019 to 50% in 2020.»

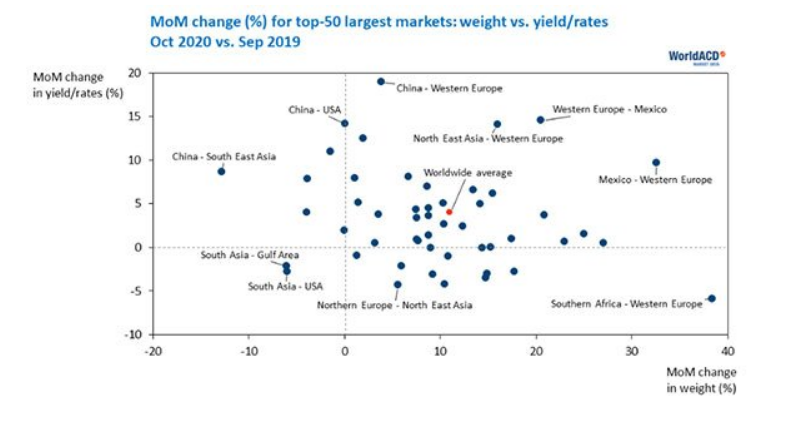

The chart below shows how the world’s top-50 air cargo markets performed (MoM) (yield/rates in US$/kg). The markets between Western Europe and Mexico stand out, WorldACD observed.