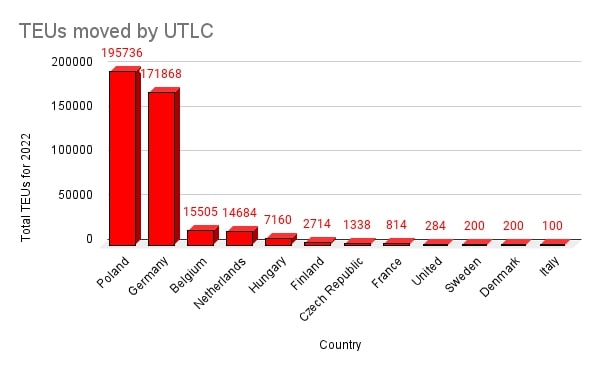

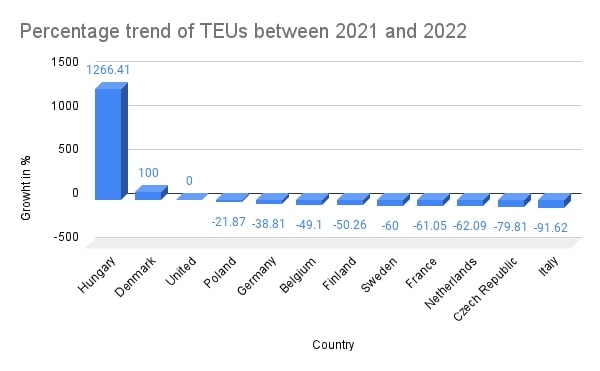

According to UTLC data, Italy’s transportation volume fell by 91,62 per cent year-on-year, which can be described as total destruction. Poland, considered an industry leader, was not spared, with a year-on-year drop of 21,87 per cent. The only positive from the data is Hungary, which was not a significant player in this railway transportation circle before. Hungary made a splash and has emerged as a new force, topping the potential list with a freight volume increase of 1,266 per cent.

Poland still on top

In terms of volume, Poland still ranks first with a total volume of 195,736 TEUs, with westbound trains exceeding eastbound ones by more than ten times. The eastbound export on the German line (107,382 TEUs) is almost twice the amount of westbound volumes (64,486 TEUs). When it comes to the Netherlands, eastbound trains were roughly the same as westbound ones. On the other hand, Belgium had almost no eastbound trains departing, with the entire flow being contributed by the westbound trains. For Hungary, the overall volume is relatively small, with westbound trains being six times more than eastbound ones.

What caused the China-Europe railway freight to be almost completely wiped out in some countries and increase in others? What do the total volume and year-on-year growth data reflect, and what signals can it bring to the future? Poland, Germany, the Netherlands, Belgium, and Hungary were the first five countries in terms of volumes exchanged with China in 2022, according to UTLC data. Let’s take a closer look at what happened there.

Poland is still the main force

From the perspective of overall traffic, Poland is still the main destination of China Railway Express. The overall traffic decreased by 21,87 per cent year-on-year, and the rate of decline was the lowest among EU member states. Compared with the 61,19 per cent decline in eastbound trains, the 13,41 per cent decline in westbound ones can be described as gentle. According to Liu Lijun, general manager of Toprail, the western route can maintain a relatively low rate of decline. This is because of the conflict in Ukraine and the COVID-19 epidemic, which is inseparable from the influx of e-commerce goods.

German exports are going strong

Germany is the only country among the five countries in this analysis whose exports are far greater than its imports. Last year, Germany’s westbound trains to China fell by 55,10 per cent, while trains going east decreased by 21,76 per cent. As Germany’s largest trading partner, its exports to China include complete vehicles and auto parts, mechanical equipment, and optical products.

The perfect stations and infrastructure facilities in Germany also provide infrastructure for international logistics. There is the port of Hamburg, Europe’s third largest port in the north, and Duisport, the world’s largest inland port in the west. Railway and inland river transportation can also provide a better logistics infrastructure for the Western European market.

When German Chancellor Scholz visited China in November last year, he reached a number of large trade orders between China and Germany. The prospect of Sino-German trade seems to be bright. Recently, the «New China Strategy» that has been heard in the German media has also overshadowed the growth of trade. However, the rhetoric of «getting rid of China’s cheap supply chain» advocated by the «New China Strategy» may have a certain impact on westbound imports, while eastbound exports will continue.

Belgium and Netherlands: moral boycott and the COVID-19

As for the decline in traffic in the Netherlands and Belgium, it may be related to the moral boycott of Russia by Western European countries. In the Netherlands last year, the westbound trains fell by 70,88 per cent, and eastbound ones dropped by 41,54 per cent. In Belgium, no volumes were shipped toward China, while the number of trains coming in decreased by 22,77 per cent.

As a large trading country, the Netherlands has the largest seaport in Europe, the Port of Rotterdam. After the Ukrainian conflict, as the price of sea freight dropped, more and more cargo owners returned to sea freight. At the same time, more and more Dutch companies were interested in the northern line of the China Railway Express that passes through Russia out of compliance considerations.

The Port of Antwerp in Belgium is the second largest port in Europe. The disappearance of eastbound cargo flow may also return to shipping. However, e-commerce also supports westbound cargo flow. Cainiao’s overseas warehouse in Liege is a good example. At the same time, China imports dairy products and alcoholic products from the Netherlands and Belgium all year round. China’s strict epidemic prevention and border inspection measures may have led to a reduction in the transportation of such products.

Hungary’s sudden rise

It is especially worth mentioning the UTLC data concerning Hungary. Last year, the overall cargo volume increased by 1,266 per cent. The westbound traffic increased by nearly 3000 per cent. Compared with the volume of other countries, the volume of Hungary can be described as relatively little. (7,160 TEUs). Nevertheless, this upward trend also indicates a developing market.

The railway network is sound and the facilities are convenient. The new station at Fenyestlitke, the East-West Gate, provides the conditions for cultivating the maturity of the Hungarian market. It’s just that the right time, people, and place have not yet arrived. However, if there is a new turning point in the conflict in Ukraine in the future and the situation improves, the railway transportation market may become more accepting of Hungary.

As Andy Luo, general manager of China-Philippines Bank Xi’an, previously pointed out, «Hungary is a member state of the European Union and one of China’s largest investment partners in Central and Eastern Europe. It represents policy dividends and stability, and these are particularly important and valued for our logistics service practitioners, especially in the current situation full of uncertainties.»