«Just received an update from our China contacts...Zhenhai district has been locked down due to three positive cases of COVID-19. The lockdown is for 14 days,» a source said. An importer based in the US confirmed the same information, adding that the company’s Shanghai office has been closed.

«We need to now ascertain the impact on port and terminal operations and how much trucking and depot operations will be affected,» a source based in Singapore said. However, this also means other regions could also soon see similar restrictions, the source said.

«The rising COVID infections may lead to shutdowns at Ningbo and some other ports in China, adding to congestion and cargo backlogs,» a source with a UK-based logistics company said. «this is only the beginning — the first quarter of 2022 is going to be a complete wreck.»

The increase in coronavirus infections may further disrupt the ocean freight industry by triggering higher demand for PPE kits and masks, in turn leading to higher freight rates.

«The traditional agricultural trade season also starts in January and a simultaneous rise in PPE shipments could choke the system further,» an exporter based in India said.

Some sources said that so far they have not faced any challenges from the shutdown.

«No effect currently...I don’t think the port will be impacted, but it will also depend on the development on the coronavirus situation» said Dave Li, branch manager, Chongqing City, T.H.I Group Limited.

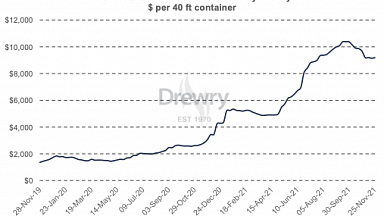

Container rates on major trade lanes have risen nearly three- to four-fold in the last 18 months amid coronavirus restrictions and subsequent supply chain blockages, as well as equipment shortages. Increased demand, with expenditure shifting from services to products, has further supported prices.

Platts Container Rate 5 — North Asia-to-East Coast North America — was assessed at $10,000/FEU on Dec. 6, against $4,800/FEU a year ago. The Platts container assessments denote the FAK (Freight All Kind) spot rates. The all-inclusive premium rates are currently at $16,000-$18,000/FEU on North Asia-to-East Coast North America route and $17,000-$19,000/FEU for Southeast Asia-to-East Coast North America.