Next week could see a return to double-digit gains however, as a 1 July implementation of new price levels is expected.

For example, MSC has announced FAK rates on Asia-North Europe of $9,800 per 40ft high-cube and $9,000 to West Mediterranean destinations, for Monday.

According to Andy Cliff, director at Straightforward Consultancy, UK shippers and their forwarders are being quoted FAK rates of $9,000-$9,800 per 40ft across all three carrier alliances until the middle of July.

He added that if the peak season continued into its traditional August/September period, 40ft spot rates could reach $14,00-$15,000.

And further surcharges are set to hit trades associated with Asia-North Europe — also on 1 July. CMA CGM is set to implement a $1,500 peak season surcharge (PSS) on Oceania-North Europe shipments, as well as an emergency space surcharge of $500 per box on India-North Europe.

Hapag-Lloyd will implement a $1,000 per 40ft PSS on the Far East-India trade.

This week, however, Drewry’s World Container Index (WCI) composite index grew 4%, with its Shanghai-Rotterdam leg showing the steepest growth, at 7% week on week, to end at $7,322 per 40ft.

This was broadly in line with Xeneta’s XSI and Freightos’ FBX indices, which recorded rates of $6,909 and $7,001 per 40ft, respectively.

The FBX recorded a 4% increase on Asia-Mediterranean, to $7,169, while the WCI’s Shanghai-Genoa leg grew 1% week on week, to end at $7,102 per 40ft.

Spot rate growth on the Asia-North America routes was also modest this week: the WCI’s Shanghai-Los Angeles and Shanghai-New York legs were both up 4%, to $6,673 and $7,827 per 40ft respectively; while the XSI’s transpacific route grew 3%, to $6,975 per 40ft.

However, spot rate shippers on the transpacific could see a double-digit jump next week, with CMA CGM set to implement a $2,400 per 40ft PSS on all ex-Asia shipments to the US from Monday.

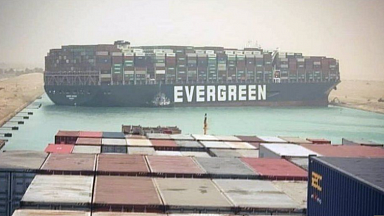

Aside from the well-understood reasons for the spot rate surges since May — vessel diversions around the Cape of Good Hope and bursts of port congestion in several regions — an associated problem for carriers’ customers has been access to equipment, and new data from box trading and leasing platform Container xChange shows the inflationary pressure this has put on the price of new containers and one-way lease rates.

«Average container prices in China have reached their highest in two years, at $3,600 this week for 40ft high-cube containers in China. These prices were somewhere around $1,700 in March-April — a 112% increase in a span of two months,» it said.

Meanwhile, leasing rates on China-Europe routes have risen by three times; Container xChange recording an average pickup charge ex-Shanghai to Rotterdam growing from around $500 in November to around $1,700 today.

However, founder and CEO Christian Roeloffs said the situation could reverse soon: «While prices and rates are significantly up, trading volumes have decreased as buyers are becoming more cautious.

«This trend indicates a potential reversal of prices in the near future, as the market adjusts to the current disruptions and the high levels of volatility,» he explained.