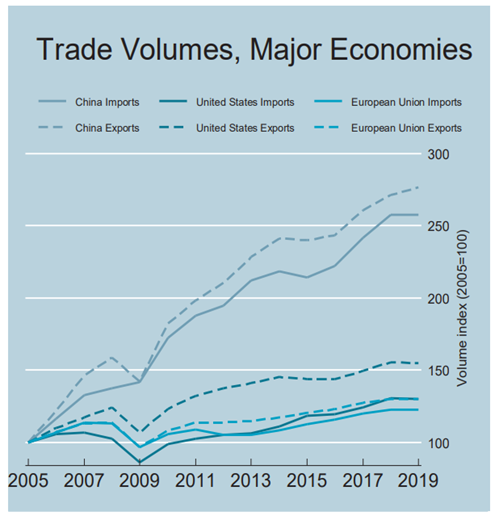

After a recovery in international trade in 2017, economic conditions started deteriorating in the second half of 2018 and further in 2019, due to trade tensions between the United States of America and China, fears of a disorderly Brexit in Europe and a negative global output outlook more generally.

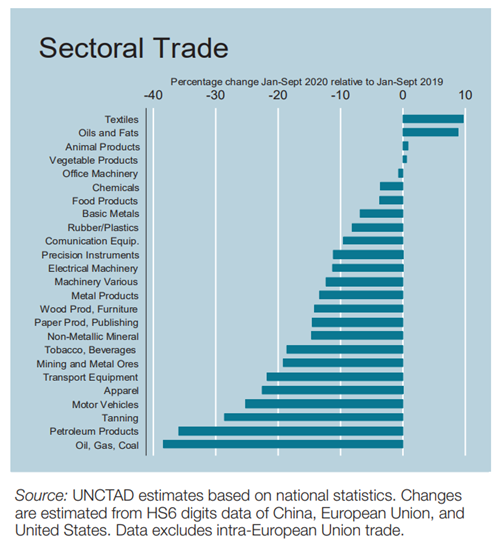

The trade downturn of 2019 has been widespread across all geographic regions. Merchandise trade has shown largest drops while services trade kept increasing in 2019, although at a slower pace. Trade in natural resources showed the strongest drops in 2019 because of lower prices, while manufactured goods trade decline was modest. Agricultural trade kept increasing in 2019.

In addition, available data for 2020 indicate a sharp decline in trade growth (about 8 per cent), largely due to the COVID-19 pandemic. The sharpest drop in international trade occurred in the second quarter of 2020, with global merchandise trade falling by more than 20 per cent relative to the same quarter of 2019. Trade trends for the second half, although still negative on a year-over-year basis, are better than during the first half. Notably, the relative recovery in the second half of 2020 was largely driven by China.

This report is structured into two parts. The first part presents a short-term overview of the status of international trade using preliminary statistics on merchandise trade up to the third quarter of 2020. The second part provides illustrative statistics on international trade in goods and services covering the medium term. The second part is divided into two sections. Section 1 provides trade statistics at various levels of aggregation illustrating the evolution of trade across economic sectors and geographic regions. Section 2 presents some of the most used trade indicators at the country level, to illustrate trade performance across countries.

The full version is attached to this article.