When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

-

July data signals a slowdown in China’s economic activity. Industrial production growth fell to 5.7% YoY (the lowest since November 2024), while retail sales grew by only 3.7%, missing expectations of 4.6% [CNBC]. The momentum from earlier export orders and seasonal activity is fading, and domestic demand remains subdued. In the absence of new stimulus, production and export shipment growth rates may continue to decline. In response, authorities are accelerating fiscal stimulus for the economy [Bloomberg].

-

August PMI data reflects an improvement in business activity in the Eurozone: the composite index rose to 51.1—a 15-month high—with the manufacturing PMI reaching 50.5 (a 38-month high), and industrial output recording its fastest growth since April 2021. However, export orders continue to decline. The downturn has persisted since March 2022, with the rate of contraction in August being the sharpest in five months [S&P Global]. Business expectations have declined for the second consecutive month amid persistent external uncertainties and pressure on export demand.

-

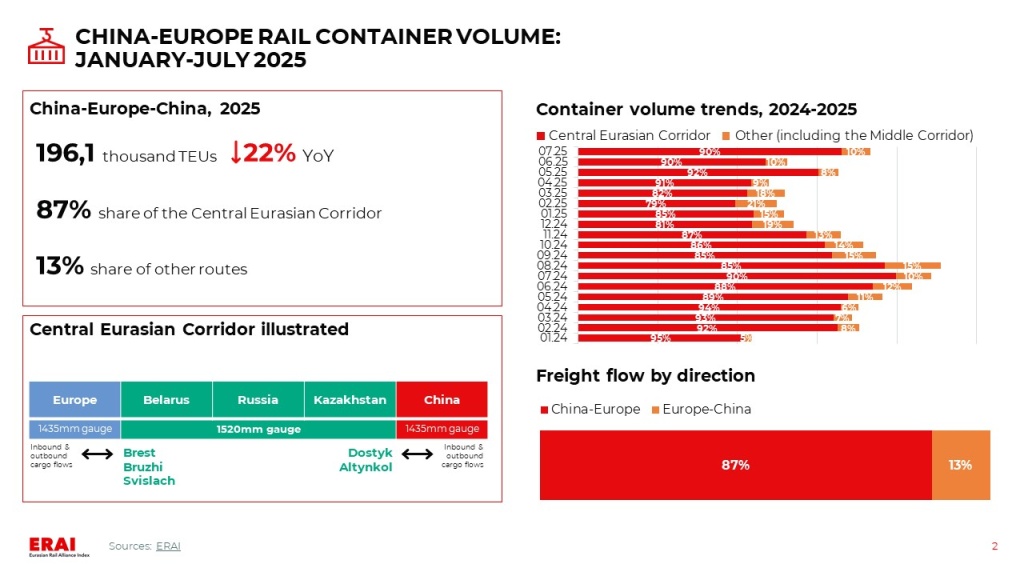

In the January-July period, the volume of China-Europe-China rail container transportation decreased by 22% YoY. In July alone, the total volume of shipments across all competitive routes fell by 18% YoY but increased by 39% MoM. The month-over-month growth in July was primarily driven by increased activity along the central Eurasian corridor.

-

As the peak season concludes, a further weakening in demand for sea freight from Asia to Europe is being observed, along with improved availability of container equipment [Flexport]. However, the pace of the demand slowdown is not the only factor shaping market conditions.

Freight rate trends

-

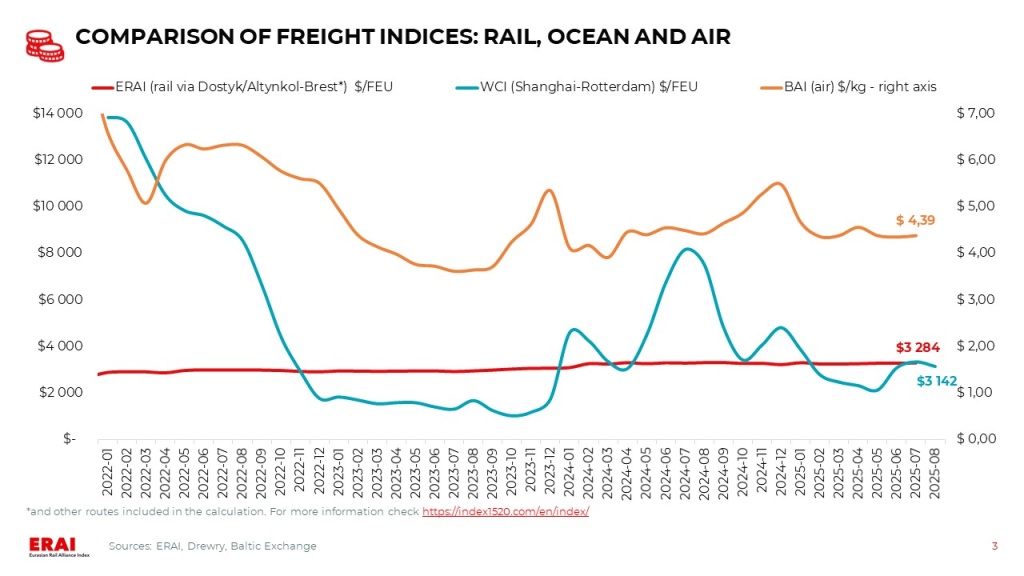

In recent months, average rates for China—Europe rail freight have remained relatively stable. Current rates are: $5 200–6 000/FEU (SOC) for central provinces (Chengdu to Xi’an) and ~$6 300/FEU (SOC) for coastal regions (Shenzhen). The average container leasing cost ranges between $800–900.

-

The Shanghai—Rotterdam WCI fell 6% last week to $2 973/FEU (—10% MoM, —60% YoY) [Drewry]. After a local peak in early July, rates continue to decline. According to the JOC, Asia—Northern Europe rates dropped to an average of ~$2 700/FEU last week. Data from GeekYum shows that as of early September, most carriers are quoting rates in the range of $2 200–2 400/FEU. For the second week of September, Maersk is offering a rate of $1 900/FEU [Linerlytica]. Carriers face significant challenges in maintaining prices amid market oversupply. However, a return to pre-pandemic rates (~$1 500/FEU) is unlikely: per-unit costs have risen significantly since 2019. For example, Hapag-Lloyd’s costs have increased by 30% [JOC].

UPDATE: As of the evening of August 28, 2025, the latest WCI Shanghai-Rotterdam reading has declined by 10% WoW — down to $2 661/FEU.

-

Futures quotes indicate a decline in freight rates throughout the second half of the year, with a pronounced drop in September—October. The forward curve suggests a decrease in Asia—Europe rates from current levels to around $1 700/FEU by the end of October, followed by a rebound to approximately $2 200/FEU by year-end.

Other trends

-

As of September 1, 2025, new EU regulations under the ICS2 (Import Control System 2) take effect, obliging shippers to include more comprehensive data in their stuffing lists and accompanying paperwork.

-

China’s Haijie Shipping Company will launch the first regular container line to Europe via the Northern Sea Route starting September 20 [High North News]. The route will include the ports of Qingdao, Shanghai, Ningbo, Felixstowe, Rotterdam, Hamburg, and Gdańsk. The transit time from Ningbo to the UK will be 18 days (for comparison: the transit time via the Ningbo—Wilhelmshaven line through the Suez Canal, opened earlier this year, is 26 days). The first voyage will utilize a vessel with a capacity of 4 890 TEU. The inaugural voyage has been fully booked.

-

A carbon-neutral container train service to Europe has been launched in Wuhan. On August 13, a train carrying auto parts and consumer goods departed from the CRIntermodal Wuhan terminal bound for Hamburg and Duisburg [SASAC]. The project is a collaboration between Wuhan Asia-Europe Logistics and DB Cargo Eurasia. The train exclusively uses green electricity on electrified sections of the route, and emissions from the remaining segments are offset through certified carbon credits (Gold Standard).