When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

-

According to estimates by RatingDog and S&P Global, China’s manufacturing business activity saw a marginal contraction in November 2025. The main factor was stagnation in orders and production. However, a noticeable divergence between domestic and external demand dynamics was observed. For instance, new export orders showed the strongest growth in the past 8 months. In December, the state may intensify support measures to achieve the annual GDP growth target. Business expectations are on the rise.

-

The Eurozone manufacturing sector slipped back into contraction in November. The HCOB Manufacturing PMI index declined to 49.6 [S&P Global]. A key negative factor was another decline in external demand—new export orders decreased for the 5th consecutive month. Surveyed companies noted shortages of certain materials and difficulties in procurement from foreign markets.

-

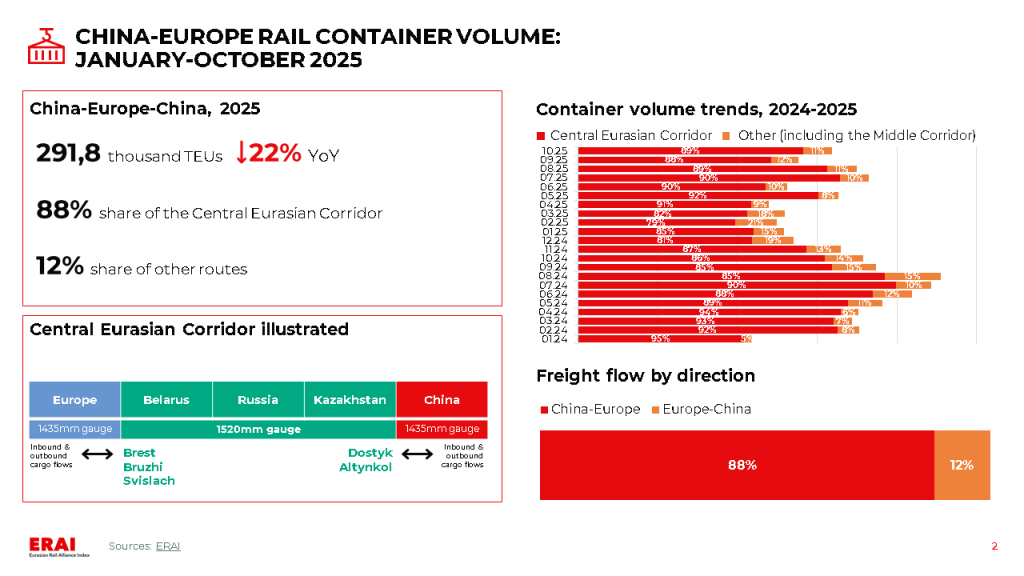

In January-October, the volume of China-Europe-China rail container transportation decreased by 21% YoY. In October, the total shipment volume across all routes fell by 11% YoY but also increased by 11% MoM. Volume growth in October compared to September was recorded on both the Central Eurasian Corridor and the Middle corridor. Seasonal delays are observed on the Middle corridor in the Caspian Sea due to adverse weather conditions.

-

Demand for Asia-Europe sea freight remains stable. According to Flexport, this may be linked to ongoing shifts in China’s export trade — some cargo flows have switched to the EU route. The abolition of the duty-free threshold for low-value goods in the EU from 2026 could create an additional incentive for imports.

Freight rate trends

-

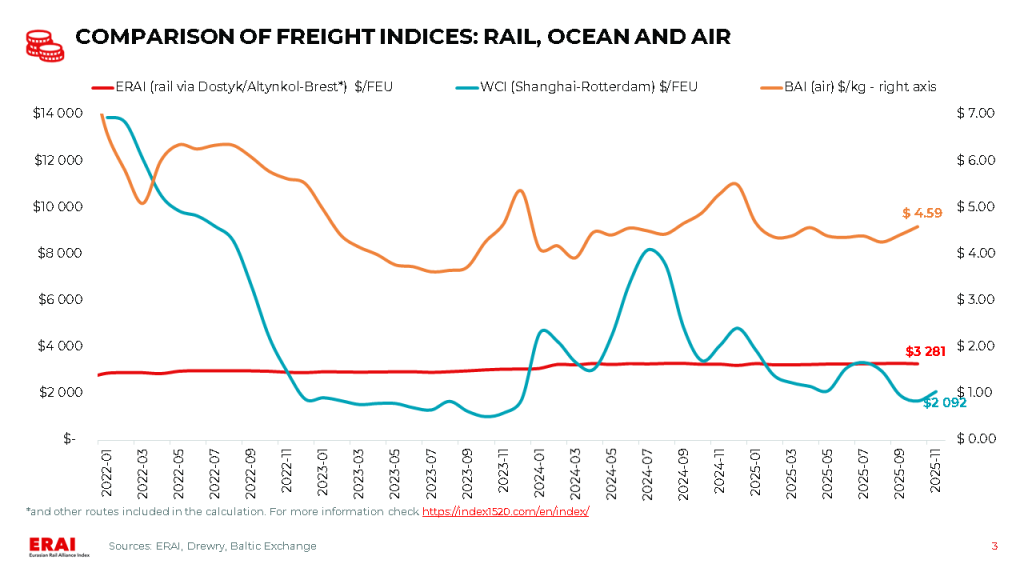

The Shanghai-Rotterdam WCI fell by 1% last week to $2 165/FEU (21% MoM, −46% YoY) [Drewry].

UPDATE: As of the evening of December 4, 2025, the latest WCI Shanghai-Rotterdam reading has risen by 4% WoW — up to $2 241/FEU.

According to Drewry, carriers have implemented FAK rate increases effective December 1, targeting a range of $3 100-4 000/FEU in an effort to gain leverage ahead of the 2026 contract season. GeekYum, data shows the average spot rate from major carriers for the first half of December is $2 300-2 700/FEU, reaching approximately $2 700-2 800 in the second half of the month. The rate increases are supported by stable demand and terminal congestion in Europe and Asia. -

Futures point to a stabilization of ocean freight rates until the end of 2025. Traders also expect rates to remain in the $1 500-2 000/FEU corridor for most of 2026.

Other trends

-

On November 18, an agreement was signed for China Railways (via CRCT) to join Middle Corridor Multimodal Ltd. [Railfreight].

-

China has presented the «Plan to Promote the Openness and Interconnectivity of Logistics Data and Reduce Overall Logistics Costs». The plan envisages the integration of data from various modes of transport, customs, and key industries. The main objective is integrated management of different transport modes and comprehensive data exchange between agencies, including for the implementation of a «single document» for multimodal transportation. The state will support the creation of regional logistics hubs and digital platforms that consolidate company data. Part of the aggregated information will be publicly available: data on vehicles, routes, cargo, licenses, port throughput capacity, and customs clearance statuses.

Ocean freight: short-term market improvement amid persistent medium- and long-term risks

Current Situation and Near-Term Outlook: the recovery trend continues.

-

Demand for Asia-Europe sea freight remains stable. According to Flexport, his may be linked to ongoing shifts in China’s export trade — some cargo flows have switched to the EU route. The abolition of the duty-free threshold for low-value goods in the EU from 2026 could create an additional incentive for imports.

-

Operations in Northern European ports are normalizing, but disruptions persist at major hubs. n Belgium, a 3-day strike is disrupting port activities. In Asia, terminal congestion increased significantly towards the end of November. As of 30.11.2025, port delays amounted to: 438 thousand TEU in Northern Europe (-20% MoM) and 1.3 million TEU in North Asia (-9% MoM) [Linerlytica].

-

The Shanghai-Rotterdam WCI fell by 1% last week to $2 165/FEU (21% MoM, −46% YoY) [Drewry]. According to Drewry, carriers have implemented FAK rate increases effective December 1, targeting a range of $3 100-4 000/FEU in an effort to gain leverage ahead of the 2026 contract season. GeekYum, data shows the average spot rate from major carriers for the first half of December is $2 300-2 700/FEU, reaching approximately $2 700-2 800 in the second half of the month.

-

The rate increases are supported by stable demand and terminal congestion in Europe and Asia. Should demand weaken, carriers may partially scale back their rate increase plans.

-

According to Drewry’s forecast, carriers’ operating profit in 2025 will be around $20 billion, with losses exceeding $10 billion expected in 2026 [JOC]. For reference, estimates of rate levels at which carriers break even on service provision are:

Asia-Northern Europe: ~$1 800/FEU for major carriers [JOC]

General average: ~$1 100/FEU [ShippingWatch]

Medium- and Long-Term Outlook: The overall trend continues to point towards a growing supply-demand imbalance and intensifying competition.

- Carriers are considering a gradual resumption of Suez Canal transits in 2026 [JOC, JOC]. Currently, only CMA CGM has scheduled voyages for late December and January. Other players are considering the period after the Chinese New Year.

China-EAEU logistics market

Import and export trends

-

On December 2, the Bank of Russia lowered the US dollar exchange rate by 0,53 rubles, to 77.7 rubles. The US dollar fell below the 78-ruble mark for the first time since July 17. On December 2, the euro exchange rate decreased by 0,48 rubles to 90.34 rubles, and the Chinese yuan by 0,06 rubles to 10.96 rubles. Provided the geopolitical situation remains stable, representatives of Russia’s largest banks expect the dollar to strengthen in the first half of 2026. The forecast range is 90-105 rubles, which is seen as favorable for balanced foreign trade. An increase in the dollar’s exchange rate would help offset the decline in export profitability caused by an excessively strong ruble and support the competitiveness of domestic goods in foreign markets.

-

The law raising the VAT rate from 20% to 22% was signed by Vladimir Putin on November 28 [Kommersant]. Most small business representatives plan to adapt to the VAT increase rather than cease operations. The main adaptation strategies include raising prices for consumers (61%) and optimizing costs (21%). A moderate profit decline of 10-20% is expected for one-third of market participants. According to expert estimates, adaptation will occur through business model adjustments with a temporary surge in optimization schemes [Kommersant].

-

High wage growth rates continue in Belarus. Real wages increased by 7% YoY in October 2025, following an 8,6% YoY increase in September. The public sector continues to show faster growth: 9,8% YoY in October after 10,8% YoY in September, supported by an increase in the base wage rate. The ongoing wage growth will continue to support domestic demand [BELTA]. This factor lays the groundwork for potential growth in import transportation.

-

The Ministry of Transport proposes introducing a voluntary «take-or-pay» principle into railway transportation through amendments to the Railway Transport Charter. According to this principle, shippers under long-term contracts with Russian Railways will be required to pay for the full agreed volume of transportation, even if the actual volume is lower, which is intended to improve planning reliability for the carrier [RZD-Partner].

-

Analysts forecast that coal’s share in the railway freight structure will decrease by 5 percentage points to 24% by 2030, mainly due to the global energy transition. Its place will be taken by containers, industrial raw materials, and petroleum products, allowing for continued growth in total loading volume amid changing demand structure [Kommersant].

-

Import rates in the China-Moscow multimodal corridor began an active surge ahead of the New Year holidays and the increased cost of the railway component. The average transportation cost via Far Eastern ports has increased by $1 200/FEU over the past month and now stands at ~$5 500/FEU (SOC). Rates for direct rail transportation are also showing growth, albeit at a less active pace, with a change of $250/FEU MoM, and are at the level of ~$5 150/FEU (COC).

-

KTZ has imposed a ban on the dispatch of container trains with grain cargoes from all railway stations in Kazakhstan to China via the international border crossing point «Altynkol — Khorgos». [LogiStan]. Restrictions on the movement of container trains will be in effect from December 2 to 10, 2025, inclusive. The basis for the restrictions was the accumulation of 175 container trains heading towards Altynkol station, as well as 23 trains delayed from their schedule.