When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

- In September, Chinese manufacturing enterprises significantly increased their procurement of raw materials and components [S&P Global]. This trend may signal an acceleration in industrial production and a strengthening of the country’s export potential. Key regions driving demand growth include South America, Southeast Asia, and Africa (including potential re-exports to the US). Meanwhile, no significant demand fluctuations have been recorded from Europe.

- In September, export conditions for German industry improved again, with the HCOB Export Conditions Index reaching 51.3 [S&P Global]. New export order volumes stabilized, supported by demand from Asia and North America. The strongest performance remains in the mechanical engineering and consumer goods sectors, while the chemical and automotive industries continue to contract.

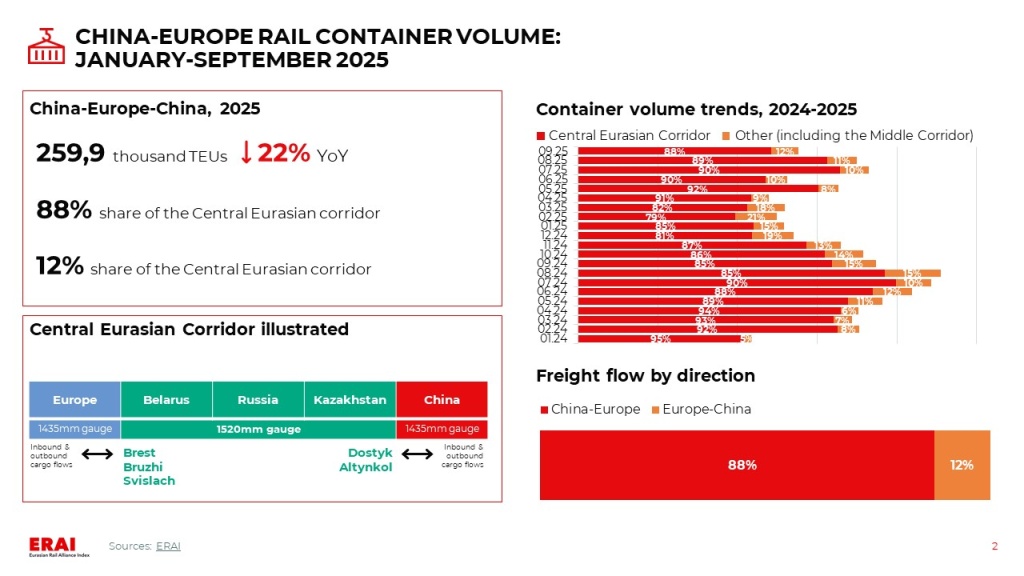

- For January—September, China—Europe—China rail container volumes fell by 22% YoY. In September, total volume across all competitive routes declined by 23% YoY and 18% MoM. This sequential decrease was primarily driven by a contraction in the central Eurasian corridor. The Middle Corridor also registered a volume decrease of approximately 8% MoM.

- Contrary to earlier forecasts, demand for Asia-Europe sea freight began to rebound after the Golden Week holiday, although the pace of recovery remains subdued.

Freight rate trends

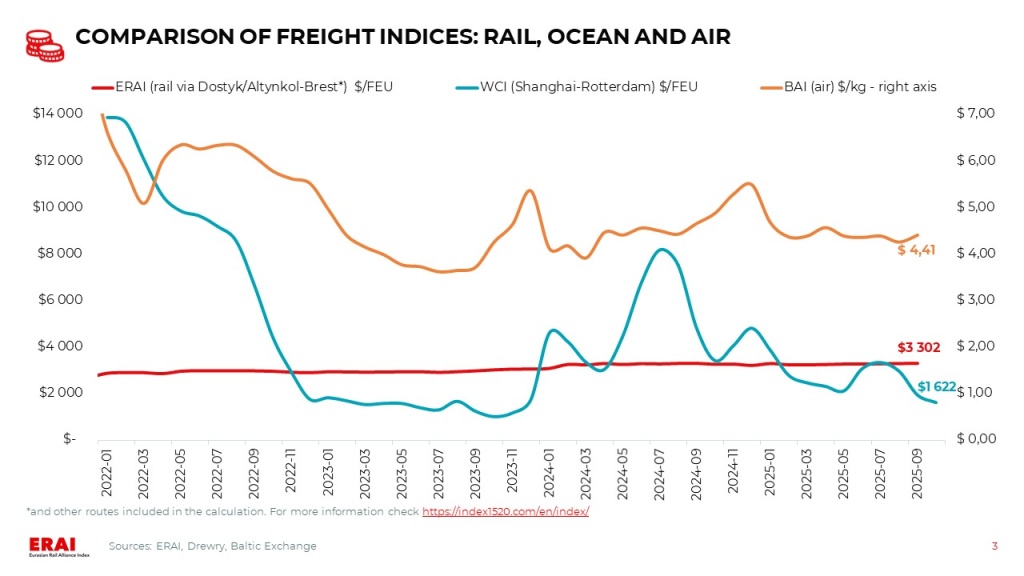

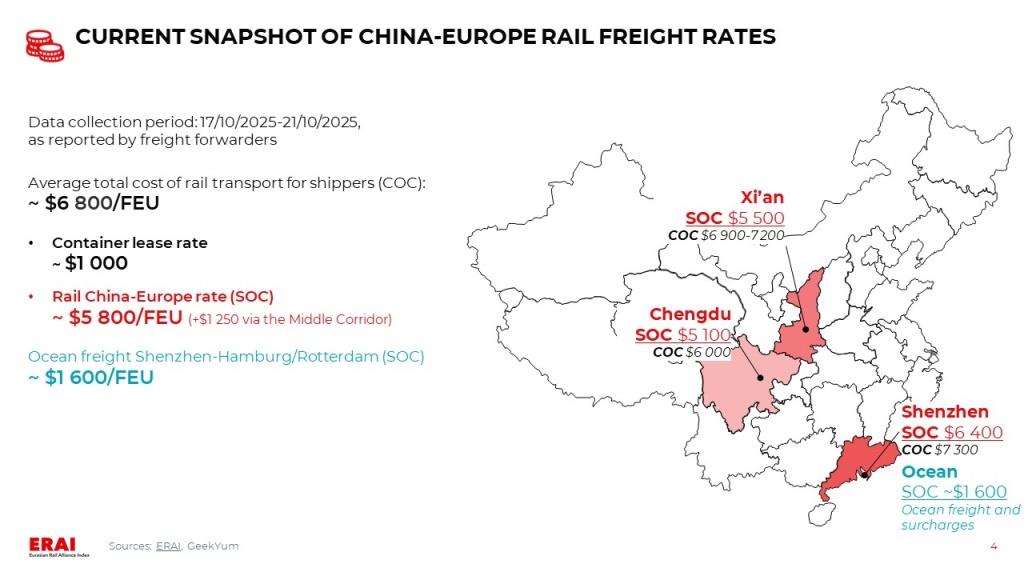

- The average China—Europe rail shipping rate for late October shipments is approximately $5 800 per FEU (SOC). Rates vary by origin, ranging from ~$5 100/FEU (Chengdu) to ~$6 400/FEU (Shenzhen). Container lease rates range from $800 to $1 100.

- The WCI Shanghai—Rotterdam increased by 6% over the past week to $1 669/FEU (-13% MoM, −51% YoY) [Drewry]. This marks the first time the index has halted its decline since late July. Carriers have raised FAK rates for the second half of October and have officially announced a General Rate Increase (GRI) for November [Flexport]. Port congestion, potential blank sailings, and the risk of equipment shortages in early November increase the likelihood of these measures holding. According to GeekYum, the average rate from major carriers is ~$1 900/FEU for the remainder of October and ~$2 600/FEU for the first ten days of November.

- Futures pricing points to a moderate increase in ocean freight rates through the end of 2025. Specifically, Asia—Europe rates are projected to gradually rise to approximately $2 300 per FEU by the end of this year.

UPDATE: As of the evening of October 23, 2025, the latest WCI Shanghai-Rotterdam reading has risen by 4% WoW — up to $1 736/FEU.

Other trends

- Following a successful pilot voyage along the Northern Sea Route (NSR), operator Sea Legend Shipping has announced plans to launch a regular service starting in the summer of 2026 (1-2 sailings per week) [Global Times]. During the non-navigable season, the company plans to implement a multimodal solution: sea delivery via the Suez Canal, followed by a rail leg to terminals in Europe (total transit time is approximately 25 days). This service will serve as an alternative to the China-Europe Railway Express. In the future, the company aims to transition to year-round navigation via the NSR.

- On October 15, 2025, a new China-Europe Railway Express route was launched on the Wuhan—Northern Europe corridor [HUBEI.GOV; Fuootech]. Upon arrival in Hamburg, a portion of the cargo will be redirected via three multimodal routes to the ports of Esbjerg (Denmark), Gothenburg (Sweden), and major Norwegian ports. The transit time will be approximately 22 days.

|

|

|

Ocean freight: short-term market uplift post-holiday, amplified by European port disruptions

Current Situation and Near-Term Outlook: a modest demand uptick and European logistical disruptions are laying the groundwork for a reversal in freight pricing.

- Contrary to earlier forecasts, demand for Asia-Europe sea freight began to rebound after the Golden Week holiday, although the pace of recovery remains subdued.

- While conditions at Asian ports have stabilised, significant operational disruptions persist in Northern Europe. Strikes in Benelux ports have caused terminal congestion, and despite the rather quick end of the protests, it will take several weeks to clear the backlog. With ongoing sysyemic container pick-up restrictions, these disruptions are further destabilising European supply chains. As of 19 October 2025, port delays amounted to 504 thousand TEUs in Northern Europe (up 106% MoM) and 738 thousand TEUs in Northern Asia (down 54% MoM) [Linerlytica].

- The WCI Shanghai—Rotterdam increased by 6% over the past week to $1 669/FEU (-13% MoM, −51% YoY) [Drewry]. This marks the first time the index has halted its decline since late July. Carriers have raised FAK rates for the second half of October and have officially announced a General Rate Increase (GRI) for November [Flexport]. Port congestion, potential blank sailings, and the risk of equipment shortages in early November increase the likelihood of these measures holding. According to GeekYum, the average rate from major carriers is ~$1 900/FEU for the remainder of October and ~$2 600/FEU for the first ten days of November.

- Despite a declared ceasefire in Gaza and initial announcements about service resumption, most carriers are maintaining a wait-and-see approach. A full resumption of Suez Canal transit is considered contingent on several months of sustained regional stability, according to HSBC estimates [JOC].

UPDATE: As of the evening of October 23, 2025, the latest WCI Shanghai-Rotterdam reading has risen by 4% WoW — up to $1 736/FEU.