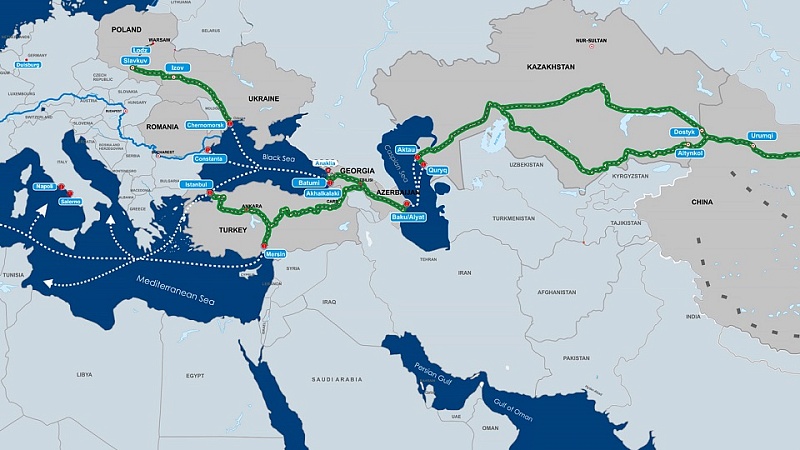

The Middle Corridor is currently the focus of the market, as it is the most feasible alternative to the main route on the New Silk Road, running through Russia and Belarus. This route is currently abandoned by a large number of companies. These companies are now searching for alternatives to keep running cargo by train.

The Middle Corridor allows for this, albeit with limitations. Cargo inevitably needs to cross the Caspian Sea, which greatly limits the capacity of the corridor. The short-haul sea leg across the Caspian Sea is considered a major bottleneck for the route, with only three vessels currently operating between Baku and Aktau.

Capacity calculation

Leila Batyrbekova, an expert on the Middle Corridor and participant at the summit, made a simple calculation of the capacity increase resulting from the three additional vessels. Currently, there are three feeder vessels operating regularly in the Caspian section, with a capacity of 350 TEUs, 125 TEUs and 125 TEUs, totaling 600 TEUs.

Considering a transit time of three to four days per roundtrip, the three vessels together are able to provide five departures per week. This translates to a maximum total capacity of 3,000 TEUs per week, which is equivalent to 30-40 trains. With the addition of three new ships in September, this capacity would double to 60-80 trains per week.

Is this enough?

In 2021, the total shipment volume of the China Railway Express on the main route reached 1.46 million TEUs, or about 2.75 TEUs per week. Obviously, the capacity of the Middle Corridor is too limited to absorb all cargo on this route.

Cankat Yildiz from Middle Corridor Logistics emphasised: «When talking about capacity, people in the industry tend to compare the Middle Corridor with the main line, but this is a mistake. We cannot absorb all these volumes, but that does not mean we cannot grow», he commented during the panel discussion in Brussels.

Piece of a puzzle

«Using this corridor is like a puzzle, you need to adapt and synchronise all the different modes of transport», contributed Alexander Hau from Maersk, which has explicitly said farewell to the route through Russia. In this puzzle, the trans-Caspian segment is not the only bottleneck in the corridor. The Black Sea is also a problem. Currently, Romania’s commercial port of Constanza on the Black Sea coast is facing congestion. In addition, insurance companies are generally reluctant to provide insurance services for trans-Black Sea shipments due to war risk assessments.

In addition, the European part of the Middle Corridor is also in need of improvement. Yildiz noted that the transportation in the section from Azerbaijan to Europe also has capacity constraints, and it is urgent to develop a more efficient multimodal transportation solution.

A participant at the summit commented it would take about fourteen days to reach European destinations from the Georgian port of Poti, regardless of the mode of transport used. The railway network between Romania and other European cities is up for development. Further on, construction works in Slovenia have hindered freight traffic, and large-volume shipments are currently not allowed.

Room for optimism

Although the Middle Corridor may seem challenging, perhaps the industry should not be too pessimistic about it. Hau said: «The China Railway Express is an alternative to shipping, and the Middle Corridor is an alternative to the main line, that is, an alternative to the alternative. It takes time to develop a corridor, and there should be no excessive pressure from the outside world.»

Port of Trieste speaker Francesco Parisi added: «The most flexible solution is to develop a variety of alternative routes, rather than sticking to one or two lines. These alternative routes do not necessarily have to handle all freight volumes, but are free for customers and companies to choose and use.»