China’s automakers are readying a new crop of hybrid and all-electric vehicles (EVs) for Europe, using next week’s Munich auto show to kick off the next phase of their expansion in the region, Bloomberg reported on Monday. It is hardly surprising that, with only a week left before the event, public attention has already begun to focus on the presence of Chinese cars, especially considering their outstanding performance two years ago.

Two years ago, some media outlets were eager to highlight the Munich auto show as a platform for showcasing Chinese competition in EVs. In 2023, Reuters reported that about 41 percent of exhibitors are based in Asia, with double the number of Chinese companies attending, including BYD, Xpeng and battery maker CATL.

This year’s auto show, officially known as IAA Mobility 2025, will begin on September 9 in Munich, Germany. As the 2025 event in Germany approaches, Chinese automakers are expected to once again capture media attention.

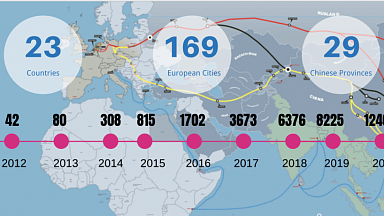

Regardless of how individual companies perform at the event, one key development is clear: behind this influx of Chinese EVs into Munich lies a much more mature and integrated automotive collaboration between China and Europe. This collaboration has rapidly grown and evolved over the past two years, forming a complex and mutually beneficial supply chain.

First, Chinese carmakers are increasing their investments in Europe and accelerating the localization of their manufacturing efforts. According to a report by the Financial Times in May, Chinese investment in Europe rose for the first time in seven years in 2024, driven by «a surge in EV and battery projects in Hungary.»

Second, these investments and industrial collaborations are boosting the European economy. In Hungary, for example, China has become an important source of foreign investment in recent years. According to the Xinhua News Agency, Hungarian Prime Minister Viktor Orban said in May that Chinese investments have become an «indispensable engine» of Hungary’s economic growth.

Third, Chinese carmakers are making strides in building comprehensive service networks to better cater to local consumer needs. Some Chinese companies have set up regional operations centers in Europe, working closely with local dealers and logistics providers to develop integrated networks for storage, after-sales services, and insurance. These interconnected services form a robust, one-stop solution that links European automotive service businesses with Chinese brands.

The automotive industry is one of the most globally integrated sectors, encompassing a wide range of activities from components to finished vehicles, and an extensive network of supporting services. The deepening of China-Europe vehicle coordination is a testament to the increasing interdependence of the supply chain, one that spans both Europe and China. Notably, cooperation between Chinese and European carmakers has been more established in China, where it began earlier and is more deeply rooted.

As the Munich auto show approaches, we can expect to see a significant presence of Chinese automakers once again. While some foreign media outlets may seize the opportunity to highlight the «competition» posed by China, it is important to recognize that, beyond the competition, the collaboration between Chinese and European carmakers has led to a deeper, more intertwined automotive ecosystem.

There are, of course, challenges to advancing this cooperation, particularly in light of the EU’s protectionist trade policies that have affected the development of the EV industry. For the China-Europe EV supply chain to integrate more effectively, both sides, and especially the EU, will need to consider a range of factors — policy, technology, and talent — and offer more support. This includes addressing issues as minor as the compatibility of charging plugs, as well as broader challenges like easing market access, both of which will require additional effort.

At the upcoming Munich auto show, it will be clear that behind Chinese vehicles is a growing and evolving supply chain built on China-Europe cooperation. While competition is certainly part of the equation, it’s just as important to recognize the mutual benefits and synergies that emerge from this competition.

The best way forward is to foster both competition and collaboration. This balanced approach will not only benefit automakers but will also contribute to the broader economic growth of both China and Europe.