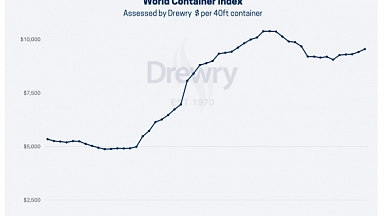

- The composite index increased 1.7% or $170 this week, and also, remains 344% higher than a year ago.

- The average composite index of the WCI, assessed by Drewry for year-to-date, is $6,598 per 40ft container, which is $4,304 higher than the five-year average of $2,294 per 40ft container.

- Drewry’s composite World Container index increased by 1.7% or $170 to reach $9,987.27 per 40ft container, 344% higher than the same week in 2020.

- This is the 20th consecutive week of increases. Freight rates on Shanghai to New York surged 6% or $899 to reach $15,035 per 40ft container.

- Spot rates from Los Angeles to Shanghai gained $35 to $1,433 per feu. Similarly, rates on Shanghai to Rotterdam and New York to Rotterdam grew 2% each to reach $14,074 and $1,168 per 40ft box respectively.

- However, rates from Rotterdam to New York dropped 11% or $685 to $5,776 per feu. Freight rates on Shanghai to Genoa and Rotterdam to Shanghai remain stable at previous weeks level.

- Drewry expects rates to increase further in the coming week.