At the end of October, on the 23rd, the Transport Complex Development Council held a meeting in subjects of the Russian Federation under the Federation Council (FC). The main topic of the event was the implementation of the development process of the North-South International Transport Corridor.

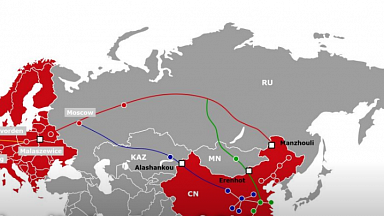

The North-South International Transport Corridor (ITC). This route, intersecting with most latitudinal transport corridors, provides a means of connecting Europe, the South Caucasus, Central Asia, and China. «It’s a key element of the Eurasian transport system,» Federation Council Economic Policy Committee Chairman Andrey Kutepov declared.

«The level of traffic in 2023 is growing and will continue to increase moving forward. For that reason, the transport corridor is in need of modernization,» he believes.

Currently, a great variety of products are shipped along the ITC, including grain, coal, and ferrous metals. The cargo flow volume transiting through the corridor is on an upward trend on all accounts regardless of the goods transportation method. According to the Ministry of Transport’s data, over 8 months, cargo transshipment at ports has increased by 70%, the uptick via railroad has increased by 30%, and auto transportation traffic volumes are on the rise as well.

Government agency work

In order to achieve these figures and maintain their further increase, the Ministry of Transport is conducting active cooperation with all involved and interested states.

According to Deputy Minister of Transport of Russia Valentin Ivanov, the current participants of the international North-South ITC development agreement include: Armenia, Azerbaijan, Belarus, Russia, Iran, India, Oman, Kazakhstan, Syria, Turkey, and Tajikistan. They are also working to add Turkmenistan and Uzbekistan to this agreement as well.

Furthermore, on Russia’s part, methodical work is being done on the development of all of the corridor’s routes and promoting them among the state authorities and cargo shippers of the Caspian Sea Basin, the Persian Gulf; Central, South, and Southeast Asia; as well as countries of the African continent. Interagency memoranda of mutual understanding in the transport and transit field have been signed with the Iranian, Turkmen, and Kazakh parties.

«The signing of similar soft documents is currently being discussed also with India, Oman, Qatar, Kenya, Bahrain, the UAE, and Saudi Arabia,» Valentin Ivanov said.

The sea component

The Russian ports of Olya and Astrakhan are actively involved in traffic along the North-South ITC (Trans-Caspian route).

For instance, a developed port infrastructure has been created in the Astrakhan Oblast, open year-round for Russian and foreign ships. The ports’ consolidated throughput capacity is as high as 16 million tons per year. Over the last two years, the throughput capacity of the Astrakhan sea port included in the VTS group, has doubled.

Deputy Chairman of the Astrakhan Oblast government Denis Afanasyev noted that there are currently 14 terminals in operation in the port zone.

«Most terminals are in the stage of modernizing and updating their technical base. Soon, new terminals are planned to be included within Astrakhan port’s boundaries. The relevant documents have already been submitted,» he noted.

The Pavlo-Astrakhan terminal is an example of positive cooperation between Russian and Iranian investors. In recent years, Iranian investors have invested about 700 million roubles in its modernization.

Denis Afanasyev commented that «Astrakhan Port,» PJSC, is modernizing its facilities and constructing new terminals for grain and vegetable oil transshipment. In the Limansky District, Olya commercial seaport increased its container platform and installed greater carrying capacity cranes.

Railroad routes

One may recall that the North-South ITC courses through two different land routes — the Eastern and the Western routes. All of them have a railroad. But whereas the Eastern route is fully connected to the railroad network, there is a missing track section in the Rasht-Astara part on the Western route, which takes a negative toll on traffic volume indicators. Transshipment is required there from the railroad to automobile transport, but the decision has already been made to construct it. In May, an intergovernmental Russian-Iranian agreement was signed for cooperation in financing this project.

However, it’s worth noting that on top of that, on the West route of Russian Railways, OJSC, several projects are being implemented to develop the border infrastructure, which should undoubtedly have a positive effect on boosting the cargo traffic indicator. Activities are underway to convert the Russian Derbent-Samur section up to the state border to an alternating current traction system and a Derbent railway checkpoint is being built.

«Creation of railroad traffic along this corridor by 2028 will provide a means to raise the competitiveness of the North-South ITC due to the much quicker delivery and shorter distance for transporting cargos,» Valentin Ivanov stated.

Note that it’s more convenient to deliver cargo from India and Iran to Kazakhstan, Uzbekistan, and Turkmenistan and back along the Eastern route due to the fact that they are connected by a railroad network. The Ministry of Transport is currently involved in the work to establish an end-to-end transportation service and reach agreements with Kazakhstan and Turkmenistan both unilateral and multilateral formats.

«Expansion» of the Eastern direction

Notably, one of the major players in the North-South ITC is Russian Railways Logistics, JSC.

According to Dmitry Murev, CEO of Russian Railways Logistics, JSC, the company works in two different routes (i.e., the East and the West routes).

The Western branch is seeing solitary shipments of containers due to the lack of a railroad infrastructure section, which necessitates the use of additional container transshipment to automobile transport. Meanwhile, for the Eastward direction, the subsidiary of Russian Railways holding company has organized a regular container service.

Since the service began operation, the company has sent 17 container trains for export, 13 of them this year.

According to Dmitry Murev, all participants in the transshipment process are interested and assisting in developing the corridor. This year, the issue was resolved of a unified through fare between all administrative shipping carriers involved in the route. Agreements were reached for through slots connecting the operation technology of 1,520 and 1,435 mm gauge lines.

«In total, the combined efforts by the railroad administrations, operators, and carriers operating on the route have paved the way for a 50% reduction in expenses on the Eastern branch,» Dmitry Murev said about the service.

«For instance, in terms of delivery, whereas the first system in October took 35–40 days from the Moscow and Northwestern regions to the Persian Gulf ports (Bander-Abbas), today it takes from 12–17 days, depending on the region they’re being sent from,» he explained.

The «prickly» route

Despite all the achievements in «rolling out» the ITC, the market’s participants still face the existing and emerging stumbling blocks which must be overcome to achieve the ITC’s full potential.

One of them is the cargo senders’ stereotypes. Clients that have tried the route already use this corridor on a constant basis. «Some cargo senders have been used to working with ports. In that respect, it’s very important to engage with them from a regional government perspective. And to communicate to them that the issues of insurance coverage risk, transparency, and cargo tracking have been resolved,» the head of Russian Railways Logistics believes.

Small logistics companies and carriers also encounter mutual settlement issues between parties. «Making payments, for instance, to Iran, Afghanistan, India, and China, must be done in converted currency. Whereas major companies can reach agreements on barter terms, small companies do not have bartering as an option,» President of the Russian Carriers and Logistics Organizations Olga Melnikova explained.

Yet another encumbrance is the price competitiveness of the corridor as such compared to alternative delivery routes — from the Baltic and Black Sea basins.

This issue has to do with the fact that the transit states whose territory the route passes through charge a high fee. «First and foremost, that’s Kazakhstan and Turkmenistan,» State Secretary and Deputy Minister of Industry and Trade of the Russian Federation Viktor Yevtukhov explained.

According to the Ministry of Industry and Trade, about 15,000 tons of industrial container cargos has been transported along the Eastern branch of the ITC this year.

For that reason, a plan is expected to be put in place to raise subsidies to accelerate traffic. «As a result of this measure, up to 660,000 thousand tons of industrial cargos a year may be attracted to the Eastern direction of the North-South ITC,» Viktor Yevtukhov commented.

Furthermore, a possible «potential» deficit of the Iranian party’s rolling stock must be taken into account for container traffic.

«They only have 1.5 thousand fitting platforms. As soon as volumes grow, there will be issues to handle on that side,» Dmitry Murev says.

The last issue, just as important, is the deficit of industry-specific professionals. «The recruiting process is very high in demand. Currently there are practically no professionals at all on the market capable of creating and selling transport products to work on the North-South corridor,» Olga Melnikova believes.

Andrey Kutepov, in turn, noted that today, state industry-specific agencies and educational institutions are conducting work in that area to train the required personnel.