According to Vecci, speed is the main feature that fashion supply chains focus on. «Luckily supply chains today are faster than ever», he added. This constitutes one of the main reasons why rail and the New Silk Road are gaining so much attention lately in the fashion industry. With rail being the fastest transport mode, apart from aeroplanes, the reliability of its services is crucial since a small delay can have an impact on the whole distribution scheme, and even on the opportunities at the sales market.

A fashion brand’s experience with rail

Hugo Boss’ experience with rail freight transportation, to and from Asia, started back in 2015. The beginning saw a considerable number of containers being transported, while in five years, until 2020, the company observed a solid growth of the transported volumes.

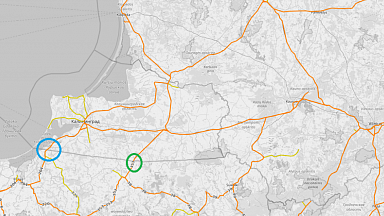

Primarily, the brand focused only on the transportation of a specific product group because they needed to test the reliability of the service. Specifically, since fashion customers are susceptible to the quality of the delivered products, certain factors had to be taken into consideration. For instance, transporting products through Russia and Kazakhstan, during winter, could be a challenge due to the extremely low temperatures. As a result, they even experimented with reefer containers to transport their goods.

Time and several tests proved that rail was way more reliable than expected. Additionally, other potential issues, such as train wobbling and rocking, were resolved by improving the product packaging. The specific initiative demonstrates that to have supply chains running smoothly; each side needs to take its responsibilities. Rail could be capable of reaching the standards of the fashion industry, but without the cooperation and adaptability of the shipper, this might not be feasible.

Limitations

Apart from the positive aspects of using rail and the New Silk Road, Vecci also referred to some limitations that shippers frequently face. The impossibility to book single twenty-foot containers on a train, for example, is indeed problematic since it restricts shippers from using rail more. At the moment, shippers have to book double twenty-foot containers even though they do not need them. Consequently, the expenses get considerably increased.

Another critical issue that could also impact the cost of rail freight, according to Vecci, is that of the reduction or cut of Chinese government subsidies. Relying on subsidies cannot be avoided, and, understandably, their shortage could pose a threat to the Eurasian rail transportation overall. Nevertheless, this issue constitutes a good chance for the countries that participate in the New Silk Road to review some of their policies and adopt standard measures in such topics.

Did you miss it?

Did you miss the European Silk Road Summit 2020? It is possible to watch the replay of the conference. You can buy a replay ticket here.