Airfreight capacity looks set to tighten further in the coming weeks as demand continues its upward trend for the looming peak season.

Niall van de Wouw, managing director at air cargo industry analysts, CLIVE Data Services, said: “It might get pretty messy soon if this climbing load factor continues for the next few weeks. At the moment we see no reason why it would not, and things tend to get a bit stronger towards the end of the year. We still see very little relief from a capacity point of view.”

CLIVE uses the dynamic load factor which takes both the weight and volume utilisation of air cargo shipments into account, to provide a more realistic and valuable picture of how efficient airlines are using their air cargo capacity.

De Wouw said that during pre-Covid peak times the air cargo dynamic load factor could reach a global level of around 67%, but when the Covid crisis started “we saw the load factor go through the roof, above 68% or 70%, and in the peak season last year we went up to 72%”.

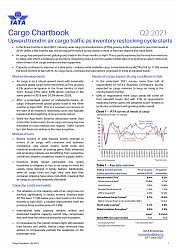

After the “crazy times” in March this year there was a gradual decline in the dynamic load factor which reached a bottom end of 64% but in September there was a one percentage point a week increase which has been climbing steadily to 68%.

CLIVE sources directly from most of the world’s airlines who provide load factor data on widebody passenger flights and all freighter flights.

“Chock-a-block full”

In the latter part of September, the 12 major airports in Asia Pacific had an average westbound load factor to Europe and the Middle East of 92%, “in other words chock-a-block full”.

De Wouw said that there was “very little room to manoeuvre” but noted that Shanghai was now at around 91%, compared with just 76% three weeks earlier due the impact of Covid-related airfreight ground handling issues. At that time, the major Chinese air cargo hub saw some flights leave half or completely empty.

De Wouw observed that in tight markets such as now, rates could “increase quite rapidly” as shippers and major freight forwarders got “jumpy” and began buying airfreight space to secure their supply chains ahead of the peak season.

As previously reported, average rates in September were more than double those in 2019.

Spot rates heating up

In terms of air cargo spot rates, the market appears to be heating up from Asia to Europe. Spot rates on that trade lane are now at around $6.50 per kilo compared with just over $5 five weeks ago, increasing by 30%, “which is quite dramatic in a short space of time”.

The average global load factor, according to CLIVE data, has already gone up from 64% five weeks ago to around 68% last week: “There are all kinds of indicators showing that the markets are heating up further and that is mainly driven by the shortage in supply. It is not the demand that is going through the roof, but it is fact the capacity is still in short supply.”

De Wouw observed that shippers in certain areas are getting nervous and want to make sure they get their products in front of the consumers for the seasonal period: “That is also pushing the rates up even further.”

Asked whether the very high load factors would see fourth quarter airfreight rates continuing to rise, De Wouw said: “That would also be my expectation, yes.”