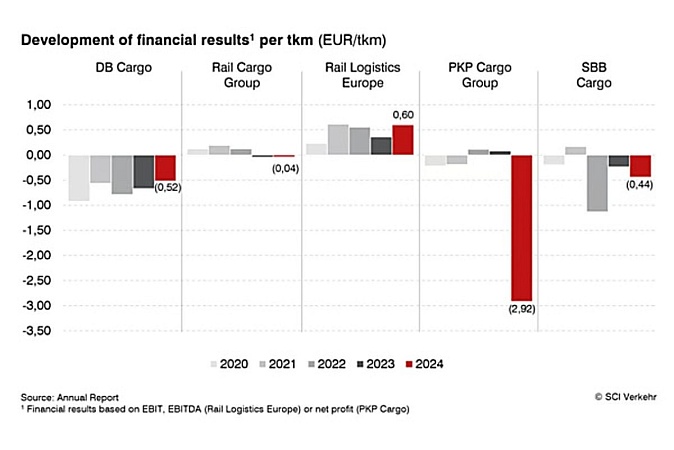

European rail freight transport is in the midst of a profound crisis. Disruptions in U.S. foreign policy and shifts in global trade are compounding the challenges faced by an industry already grappling with structural weaknesses. Key causes include declining demand for traditional goods such as coal, steel and chemicals, insufficient digitisation of infrastructure and increasing pressure to transform due to EU competition policy. Profitable companies remain the exception, and rail continues to lose market share to road transport.

Loss of market share despite growing overall traffic

Despite growing transport volumes, rail freight transport has lost almost 2.5 percentage points of market share in recent years. The modal split in 2023 was just 16.4%. Even under favourable economic conditions, such as the successful stabilisation of the global economy, SCI Verkehr forecasts an average annual growth of only 1.3% until 2030. The freight divisions of former European state railways are under pressure too: they operate on chronically underfunded tracks while having to meet demanding EU competition requirements. Furthermore, the necessary infrastructure expansion and renewal measures initially burden freight transport, particularly in Germany. Construction sites and the costly detours they cause weaken rail’s competitiveness compared to road transport, which is more flexible.

Intermodal transport emerges as a stabilising factor

A more detailed picture emerges in combined transport. SCI Verkehr expects a recovery of 4.7% in 2024, following a decline of 7.3% the previous year. This recovery is mainly driven by container traffic from Eastern Europe and an increasing number of military transports. While these factors stabilise the overall market, they do not reach the growth rates of around 2% per year that were common before 2023.

New players are changing demand

Industries such as steel, chemicals and automotive are undergoing significant transformation and facing considerable pressure from energy costs. At the same time, the operator landscape is changing: as intermodal transport recovers, shipping companies and retail corporations are increasingly organising rail transport independently to make their supply chains more resilient.

Digitalisation offers short-term potential

While long-term mega-projects such as the Digital Automatic Coupling (DAC) or ERTMS/ETCS currently require significant investment, short-term digital solutions such as terminal automation or personnel scheduling offer tangible efficiency gains. SCI Verkehr analysis concludes that these technologies can increase capacity, conserve resources, and improve rail’s competitiveness.

Source: https://railmarket.com/