Some of the reasons for the recent price spike in air cargo rates tie into increasing signs of geographical lane imbalance in market demand and capacity availability, according to analysis based on data from the Baltic Air Freight Index (BAI).

«That imbalance is manifesting via pricing and has significant implications for global supply chains as the market continues to recover from the pandemic. Shippers, 3PLs, and other stakeholders may struggle to right-size their transportation networks in the wake, in our view,» noted Bruce Chan, vice president and senior research analyst, Global Logistics and Future Mobility, at US-based investment bank and financial services company, Stifel.

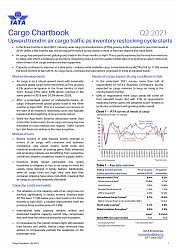

Comparing BAI’s pricing data or two large baskets: Shanghai (PVG)/Hong Kong to Europe and Shanghai/Hong Kong to North America, shows that the Europe-bound lanes grew average prices by approximately 7% and 14% from March to April, respectively.

«That increase is nothing to sneeze at and directionally consistent with normal seasonal trends, in our view. But compare that to North America-bound lanes, with PVG and Hong Kong origins rising 39% and 32% in April 2021 over March 2021, respectively. That sequential ramp is far larger than the low-to-mid-single-digit increases seen in 2019, the increases seen in 2018, and within earshot of last year’s 62% and 41% monthly sequential increases from Shanghai and Hong Kong, respectively. Recall that those numbers came during an unprecedented globally coordinated lockdown and as worldwide capacity halved almost overnight.»

Exploring some of the potential drivers of this «bifurcation» in results, Chan underlined that they all have a foundation in end-market demand.

«By the close of March, US personal income was up around 30% year over year. Government transfer payments accounted for more than the entirety of the gain, thanks to a significant third round of stimulus, as well as unemployment benefits (to a much smaller but still-material extent),» he commented.

«The growth in personal income levels have been fueling significant demand for retail goods — on top of already historically-low inventory levels — particularly among air freight-heavy categories like e-commerce fulfillment, luxury goods, and high tech, in our view. Moreover, differences in vaccination rates and the pace of economic reopening has caused a perceptible divide in brick-and-mortar activity, as well as services and experiential spending, in our view. From a product category standpoint, we believe the implications are for perishables, fresh produce, flowers, and live animals, among others.»

Highlighting the knock on effects of the ’demand dichotomy’ for supply chain planners, Chan said:

«If they persist, and if we see a sustained rift in Europe-bound versus North-America-bound pricing, we might expect capacity providers to naturally allocate more lift to the North American demand market. Follow the money, as they say.»

Chan added: «We might expect already-challenging asset balance and lane balance issues to be exacerbated. And we might expect an uptick in cargo-only flying of passenger aircraft as average prices spike. In conclusion, among the other challenges posed by severe supply chain disruption and scarce air cargo supply, geographic variance in the pace and magnitude of recovery and reopening may create additional layers of complexity and cost for shippers and other purchasers of lift. We continue to look toward the BAI data to see whether last month’s results develop into a bona fide pattern, or whether they represent a shorter term blip.»

Last week, the BAI showed that prices from Shanghai to a basket of European airports had risen a further 7% on the previous week to $5.11 per kilo and that average spot prices from Shanghai and Hong Kong to the US rose to more than $9.20 per kilo — rises of 8% and 7%, respectively.