IATA Cargo Chartbook Q2 2021 states the upward trend in air cargo traffic and outlines drivers and limitations for the market.

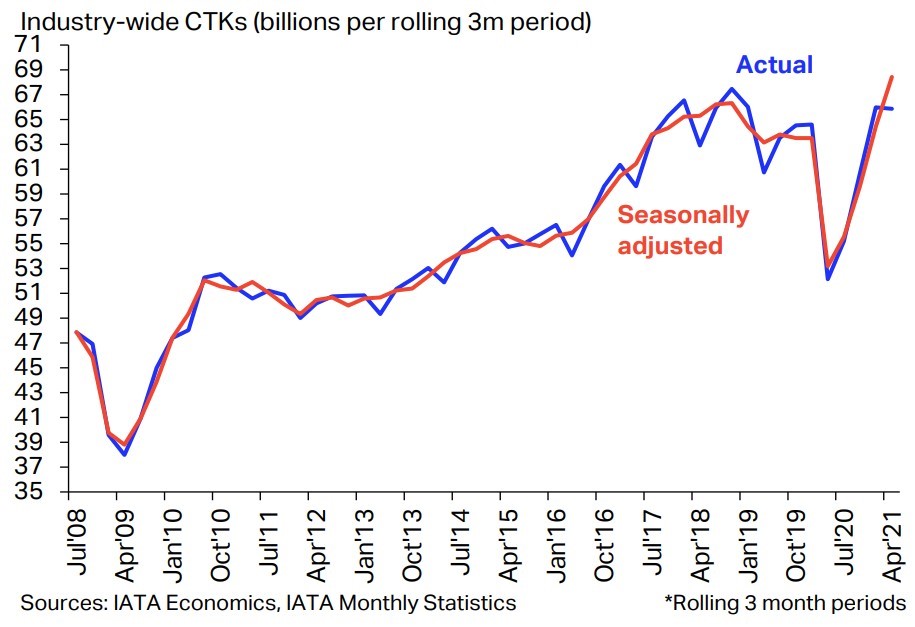

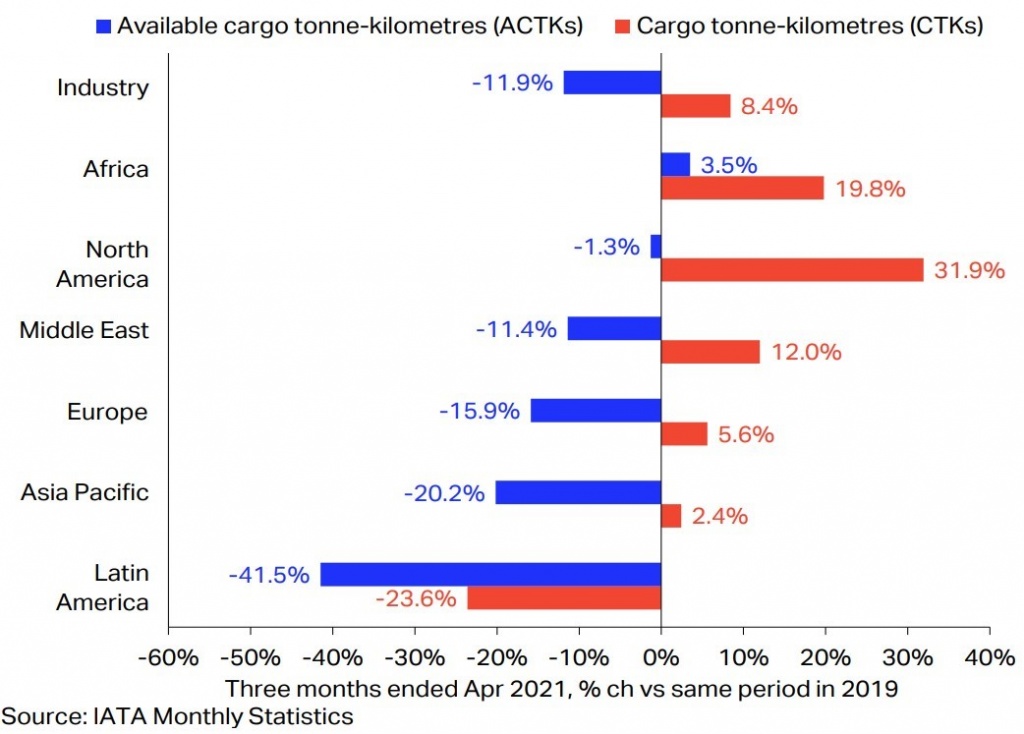

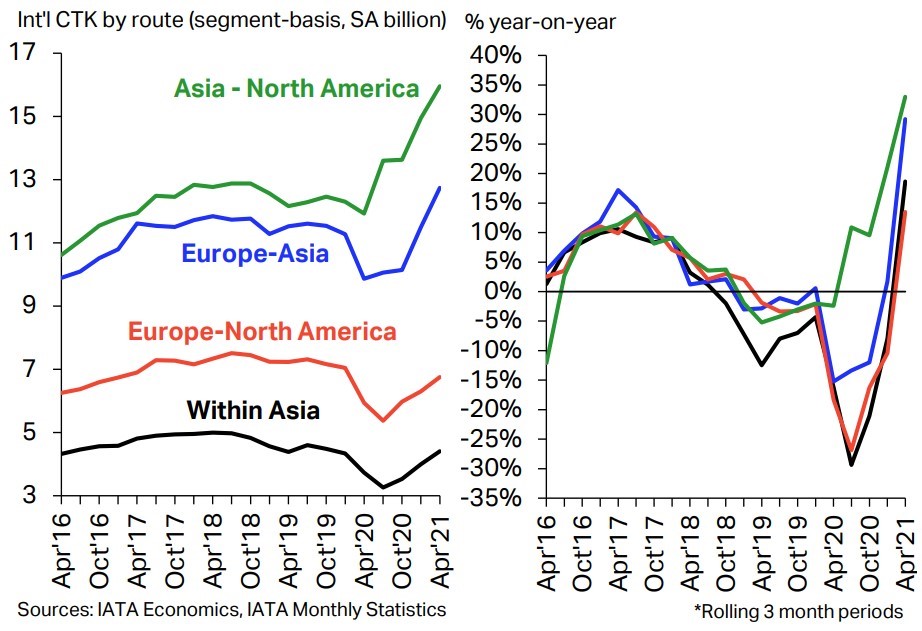

In the three months to April 2021, industry-wide cargo tonne-kilometres (CTKs) grew by 8.4% compared to pre-crisis levels in 2019. Unlike a few months ago, the strong performance is now visible in most of the main regions and trade lanes.

Air cargo has overperformed global goods trade in the three months to April. This is partly explained by the very low inventoryto-sales ratio, which is leading to an inventory restocking cycle, a common pattern at the start of an economic upturn. Moreover, other drivers of air cargo demand are also supportive.

Capacity continues to improve at a slow pace — industry-wide available cargo tonne-kilometres (ACTKs) fell by 11.9% versus the three months to April 2019. Air cargo fares, revenues and load factors continued to trend at elevated levels.

Economic conditions are supportive of air cargo in advanced and emerging markets. Industrial production was 1.6% above precrisis levels in Q1 2021, while world trade rose by 3.1% in the same interval, despite significant congestion in supply chains.

The full version of the article is available here.