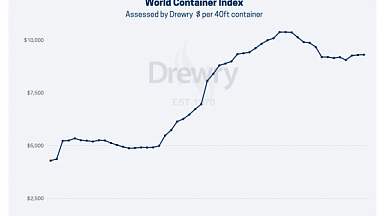

Despite and because of a further worsening in container shipping vessel reliability, ocean freight spot rates rose again this week for the 19th consecutive week, according to the latest World Container index assessed by Drewry, as continuing global container shipping disruptions continue to drive up prices.

And Drewry expects rates to increase further in the coming week.

The composite index across eight major East-West trades increased 2.1% or $204 this week, to reach $9,817 per 40ft container, although various freight sources report that the real price paid by shippers is far higher currently. Nevertheless, the trend remains clear; and Drewry highlighted that this is the 19th consecutive week of increases, taking the overall average price to more than four and a half times (+351%) its level a year ago.

The average composite index of the WCI, assessed by Drewry for year-to-date, is $6,498 per 40ft container, which is $4,238 higher than the five-year average of $2,260 per 40ft container.

Freight rates on Eastbound Transpacific lanes surged 4% or $393 to $11,362 from Shanghai to Los Angeles and 5% or $631 to $14,136 from Shanghai to New York per 40ft container. Spot rates on Shanghai to Genoa gained $203 to reach $13,464 for a 40ft box, a change of 594% Y-o-Y. Similarly, rates on Los Angeles to Shanghai grew 3% or $40 to $1,398 per feu. Freight rates on Shanghai to Rotterdam gained $89 to reach $13,787 for a 40ft box.

However, rates from New York to Rotterdam dropped 1% or $12 to reach $1,142 per feu. Freight rates on Rotterdam to New York and Rotterdam to Shanghai remain stable at previous weeks level.

The latest analysis by Freightos this week of prices on its digital rates platform indicates average spot prices on Asia-US West Coast services remained relatively unchanged this week at $18,425/FEU — 462% higher than the same time last year. Average Asia-US East Coast prices increased 1% to $20,057/FEU, and are 442% higher than rates for this week last year.