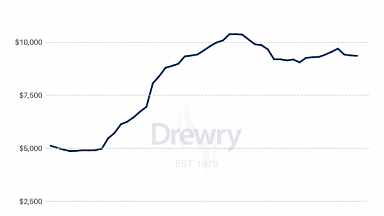

Bottlenecks in the containerised freight supply chain could mean that surges in spot freight rates on some trade lanes have further to run.

«Vessels, equipment, berthing space, yard space, chassis, and trucks are becoming a scarce commodity in an increasing number of locations,» said Sea-Intelligence chief executive Alan Murphy. «The effect of some of this scarcity has global ripple effects.

«When equipment becomes scarce, this means a carrier has to choose which customers to grant access to the equipment. At the end of the day, they would tend to favour those who are willing to pay more.»

While the situation was likely to resolve itself in the medium term, in the short term demand for equipment and slots would continue to put pressure on freight rates.

A «spill-over» effect was pushing high rates seen on the transpacific onto other trades. This has already been seen on the Asia-Europe trades, where spot rates jumped by a quarter last week alone.

«Under more normal conditions, the freight rate development tend to some degree to be isolated within each individual trade lane,» said Mr Murphy. «The spill-over effect between trades tends to pop up on rare occasions, where there is a shortage of vessel capacity, in which case carriers can choose to redeploy vessels from one trade to another.»

But the shortage of equipment was hitting all trades equally, hence rates would head up on all routes and geographies.

«As long as this effect is in play, it also means that trades that are paying less are more likely to see an upwards rate pressure, as shippers want to secure equipment for their goods.»

By analysing rates on a dollar per teu per mile basis, Sea-Intelligence found that some trades indicated potential for further rates growth.

On a teu per mile mile basis, rates to Europe were still lower than those to the US west coast.

«This means we might expect the rates to increase another 10%-15% from the current level,» the analyst said. «However, if the strength to US west coast continues unabated, we cannot rule out that it will be the other trades that will go further up towards that level. In that case, spot rates to northern Europe might increase another 50%.»

Despite increasing resistance from shippers, high demand levels meant that the situation was likely to remain the same for the immediate future.

«In the medium term, this problem will become resolved — and rate levels will not only abate, but also again start to decouple across diverse trade lanes. But in the very short term, the problem will not be fully resolved. As such, the upwards price pressure is likely to continue and we have not seen the upper levels yet.»

The problem was being compounded by a sharp decline in carrier on-time performance as they struggle to keep up with demand.

«This leads to a plethora of bottleneck problems, including port congestion,» Sea-Intelligence said.

«As ships are deployed that are larger than originally envisioned and ships generally are fuller than planned, this leads to more time spent in port. Ports are also not quite set up for such a surge, which creates congestion issues and can slow down vessel operations on average. On top of that, some vessels have incurred quarantine issues, when crew were found to be positive with coronavirus.»

But it was not carriers alone that are responsible for the increase in rates, Mr Murphy said.

«The physical reality on the ground is that there is a distinct shortage of capacity, and not just vessels, which cannot be fixed short-term,» he said. «This leads to shippers being active in securing space for their own individual companies — in turn also pushing prices upwards.»