The air cargo charter market is finishing the year very strongly amid supply chain disruptions and limited capacity options and demand for flights is set to remain at a high level in 2022, according to a leading broker.

«We’ve been very busy throughout 2021 and had to deal with a constant shortage of capacity. A resurgence in Covid-19-related PPE shipments has made the situation even more critical during the current Q4 pre-Christmas peak,» Chapman Freeborn Group’s cargo and OBC sales director, Reto Hunziker, told Lloyd’s Loading List in an interview.

«We have done and are still doing a lot ex-Asia flights mainly from China and Hong Kong into Europe, the Middle East and the US. Besides PPE, there is a lot of demand for the uplift of e-commerce cargo. As for transatlantic routes, demand is at a high and steady level.»

He continued: «The challenge the market is facing now not only concerns a lack of air capacity but also inefficiencies surrounding ground handling infrastructure with congestion at airports, while there is also a shortage of road feeder services (RFS) capacity.»

‘Preighters’ set to stay

Asked whether there had been a reduction in the number of ‘preighters’ operating in the air cargo charter market since airlines began resuming their passenger service schedules, Hunziker replied: «As far as we are concerned, there continues to be strong, ongoing demand for preighters and what’s more we do not expect that passenger capacity will get back to the market that quickly. There are still too many local, regional and global Covid-related restrictions in place, which makes it very difficult for people to travel. We see preighters continuing to play an important role in the supply chain in 2022.»

Commenting further on the outlook for the market next year, Hunziker noted: «There might be a little slowdown between Christmas and Chinese New Year — not that we are seeing anything at the moment that points to this. We expect that demand in 2022 will remain on a high level with capacity staying tight.»

He added: «Yes, there will be more passenger aircraft in service but still a good deal fewer than pre-pandemic. Also, not that much additional or new ‘pure’ freighter capacity is scheduled to enter the market next year, so ‘supply’ is likely to more or less remain where it is now.

E-commerce factors

«E-commerce will further drive and push ad-hoc and programme charters throughout the year. On top of this, we all know that Covid will continue to have some influence on the demand side for charters.»

These observations are consistent with those of other brokers and air freight professionals.

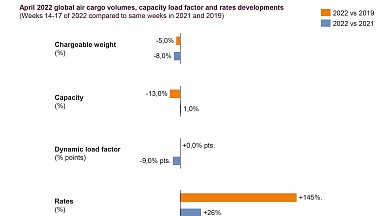

As reported last week in Lloyd’s Loading List, ex-Asia air freight rates have soared to new record highs on several lanes in the last few weeks, notably for China-US traffic but also to Europe.

Stifel’s senior analyst for Global Logistics Bruce Chan, noted that as the year and its normal fourth-quarter (Q4) peak season have progressed in the last few weeks, capacity seems to be getting tighter, rather than looser. One factor is that «labour remains a major constraint» — not just causing congestion in ports, but also on airport cargo ramps. «Which brings us to the elephant in the room, as far as air cargo capacity is concerned: Covid,» Chan noted.

Omicron impact on capacity

With the new omicron variant apparently exceptionally transmissible and more resistant to existing vaccines, Chan highlighted, noted: "Whatever the epidemiological impact, the rise of this new variant, in our view, will keep capacity tighter for longer, and thus keep rates higher for longer.

«First, this and potential future variants will likely continue to restrict network throughput due to safety protocols, episodic infections, and variations in national and municipal responses. Second, this and other new variants are likely going to delay a return to pre-pandemic international business travel (or international travel in general), which means that the complete return of belly capacity on those core lanes will also get pushed out. And there’s at least some risk that belly capacity may never fully recover if we see more permanent cultural adaptation to a hybrid in-person/virtual business environment.

«Finally, with renewed lockdowns in some countries and geographies, and with continued and not unreasonable public concern about viral spread, we believe the eventual transition of discretionary dollar spend away from goods and back to services may be elongated as well. These factors should support persistently elevated air freight rates, in our view, and any shippers that were looking for relief in the seasonal first quarter freight lull may not find it — at least to the extent that they expect.»