The EU is the largest chemicals supplier after China. The chemical industry is export-oriented. Primarily, the EU exports its products to such countries as the United States, Switzerland, China, Russia, Japan, Turkey, Canada, Brazil, the Republic of Korea, Australia, Mexico and India. Besides, the exporting countries are major manufacturers too.

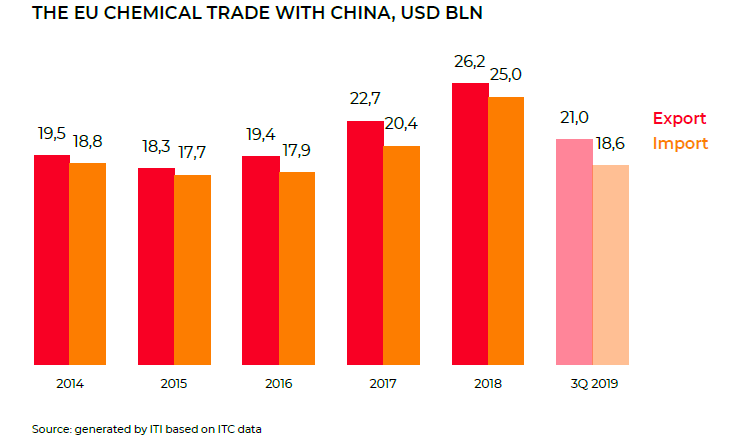

The EU-China chemical trade is developing steadily, with the EU’s surplus in trade with China. At large, the EU’s exports to China consist of medicines, immunological products, blood, blood fractions and cosmetics. Transportation of these goods is intermediated mainly by sea transport, with railway transport accounting for less than 1% of the total volume of the goods transported, which suggest the untapped potential of this means in the transportation of chemicals from Europe to China.

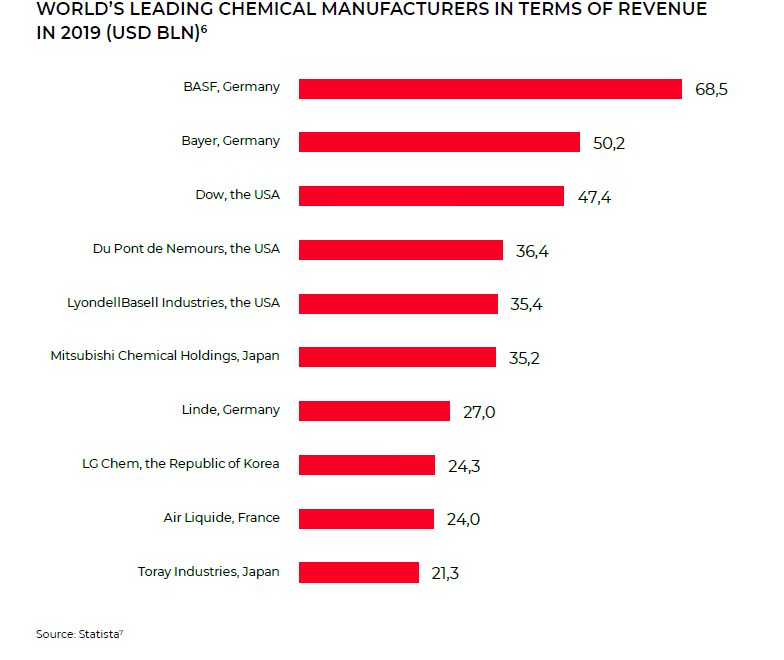

According to the results of 2019, four major European manufacturers are among top 10 largest companies in the global chemical industry in terms of revenue. German manufacturers BASF and Bayer consistently rank among the leading companies. BASF specializes in the production of chemicals, plastics, agricultural products, as well as oil and natural gas. Bayer, a company with multiple headquarters around the world, used to be known for marketing heroin and branding aspirin.

Chemical products bear specific features defining the rules and the means of their transportation. At present, all companies with manufacturing production in the EU transport their products by road. This indicated that the demand for short-distance transportation exceeds the demand for long hauls: internal trade between EU member states; trade with other European partner countries outside the EU (located in geographical proximity to the producing countries); internal transport connection between chemical enterprises and their distributors. By now, European chemical manufacturers prefer sea transport when choosing a means of transport for exporting the goods to third countries. This is proven i. a. by the geographical location of their production capacities in the cities with direct access to sea or river transport. We should note the importance of manufacturing countries such as Germany and the Netherlands, which, in addition to an advanced production base, boast a convenient and developed transport infrastructure.

It is typical for EU chemical producers (and in other part of the world too, in general) to have «own» logistics operators under their control. But such operators mainly specialize in road transportation of cargo and they have their own fleet for this activity. International long-haul transportation is carried out by combining own logistics capabilities with third-party partners providing transport services.

There is a potential for the railway transport to grow in the volume of chemical products transported, since the bulk of such goods can be transported in containers. In addition, the railway transport is more favorable for the transportation of pharmaceuticals (the core product exported by the EU to China) compared to marine transport, since railway transport is several times faster.

Despite it that every major chemical colossus has established its manufacturing facilities in China, the domestic capacity is currently unable to fully satisfy the local demand. This particularly applies to such chemicals as biodegradable polymers, polyester fiber, ethylene and propylene.

Thus, there is a potential for the chemicals produced in the EU to be transported to China by rail, taking into account all the requirements for the transportation. On top of this, the current-day corporate environmental policy of all competitive chemical producers in the EU, as well as of consumers of such products in China, can facilitate transition to the stage when railway transport will become a key source of streamlining the transport costs, safety and speed.