When using, citing, or distributing the materials from this report, it is mandatory to reference the ERAI portal and include the webpage address https://index1520.com as the source of information.

China-Europe logistics market

Demand outlook

-

The ~9% depreciation of the yuan against the euro in 2025 has improved the price competitiveness of China’s exports [Bloomberg]. In August, Chinese shipments to the EU rose 10.4% YoY to $46.8 billion, while imports from the EU fell 0.6%. As a result, the trade imbalance is widening: in January—July, China’s surplus in trade with the EU exceeded $168 billion, nearing a record high. This underscores the strengthening position of Chinese manufacturers in the European market — including autos, where Chinese brands’ share exceeded 5% for the first time in 1H 2025 — while EU export opportunities remain constrained.

-

Final PMI data for August show improving business activity in the eurozone: the composite index rose to 51.0 — a 12-month high — with manufacturing PMI at 50.7 (a 38-month high), and industrial output posting the fastest growth in nearly 3.5 years [S&P Global]. However, export orders continue to contract. The decline, ongoing since March 2022, accelerated in August to the sharpest pace in five months. Business expectations fell for the second consecutive month, reflecting persistent external uncertainty and pressure on export demand.

-

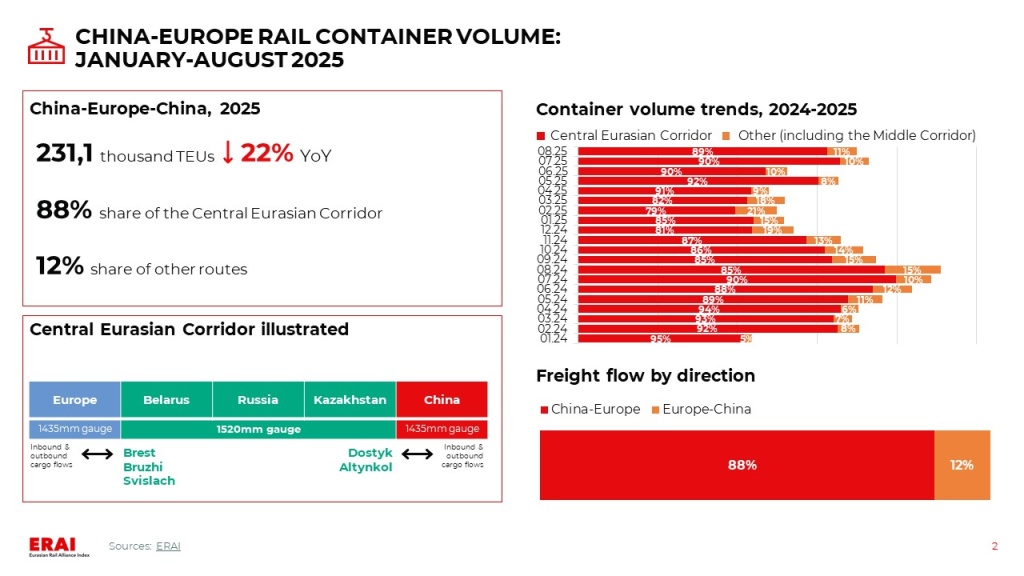

Preliminary results for January—August indicate China—Europe—China rail container volumes dropped 22% YoY. In August, total volumes across all routes fell 23% YoY and 4% MoM. The monthly decline was driven by weaker flows on the central Eurasian corridor, while the Middle corridor volumes edged up.

-

Demand for ocean freight from Asia to Europe continues to weaken [Flexport]. Ahead of China’s «Golden Week» holiday (1–8 October), no significant changes are expected.

Freight rate trends

-

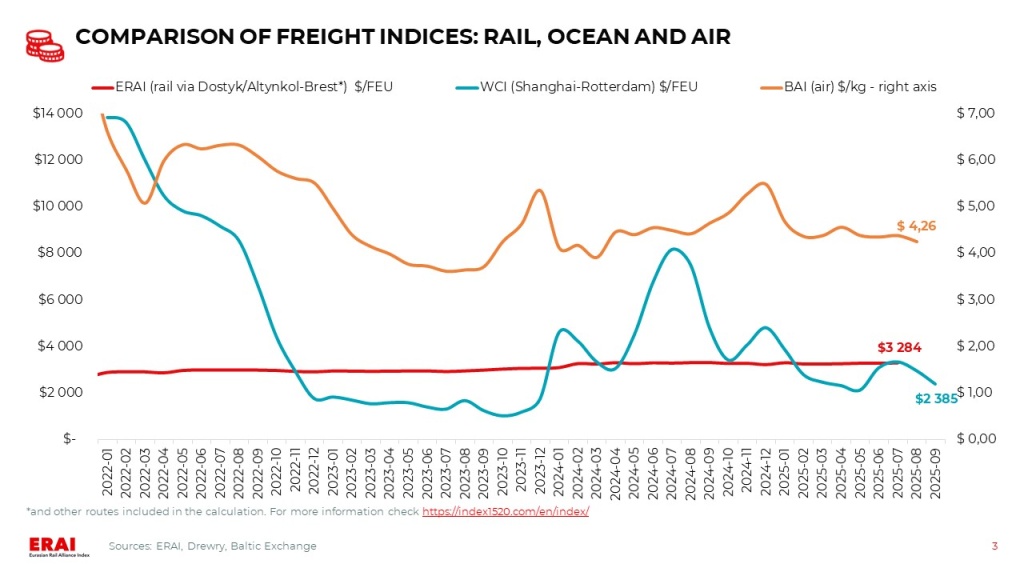

Rates on the central Eurasian corridor are around $6 000/FEU SOC. The lowest quotes are for routes from Chengdu and Chongqing to Duisburg — about $5 300/FEU SOC. Average container lease cost is around $800.

-

In August, rates on the Middle corridor slightly declined: Zhengzhou—Baku (Absheron) fell to $5 500–6 950/FEU, and Hefei—Baku to $5 650–7 100/FEU, while Xi’an—Baku held steady at $5 600–5 700/FEU [Argus].

-

The WCI Shanghai—Rotterdam index decreased by 10% last week — to $2 385/FEU (-27% MoM, −62% YoY) [Drewry]. Rates are approaching the lowest levels of 2025, with a risk of further decline. According to GeekYum, for the rest of September most carriers quote $1 700–2 100/FEU. The Gemini Cooperation’s price cuts set the general trend in the market — rate reductions and competition for cargo. The upcoming Maersk rate announcement for the end of September will determine further dynamics.

UPDATE: As of the evening of September 11, 2025, the latest WCI Shanghai-Rotterdam reading has declined by 10% WoW — down to $2 143/FEU.

-

Futures quotations, based on contracts published by the Shanghai Futures Exchange, indicate a further decline in freight rates, with a pronounced trough in September—October. The curve points to a decrease on the Asia—Northern Europe route from current levels to about $1 700/FEU by end-October, with growth to about $2 200/FEU by year-end.

Other trends

-

In September, PKP Cargo Connect sent the first train from Warsaw to China carrying products from Poland, Germany, the Czech Republic, Lithuania, and Latvia (furniture, sporting goods, footwear, etc.) [RAIL MARKET]. Two more departures are expected in the coming weeks, with frequency depending on demand. The service is organized jointly with Zhengzhou International Hub Development and Construction Co., Ltd. (ZIH) and its parent company Henan Zhongyu International Port Group.

-

The number of routes via the Middle Corridor continues to increase. In September, a service was launched from Guangzhou to Europe through Turkey and Romania [China Daily], and in August, trains from Chongqing and Chengdu departed via Istanbul to Łódź and Budapest. According to reports, transit time on the Middle Corridor to Turkey was reduced from 20 to 15 days [China Daily]. Earlier this year, China State Railway Group and Turkish operator Pasifik Eurasia signed an agreement on the joint organization of regular container services: at the first stage, 10 pilot departures are planned, with a subsequent ramp-up to a target of 1 000 trains per year.

China-EAEU logistics market

Import and export trends

-

Bank of Russia has published the draft «Main Directions of the Unified State Monetary Policy for 2026–2028». Key points include: a key rate cut will only be considered after inflation sustainably reaches 4%, no earlier than 2029; despite slowing price growth, core inflation remains above target, requiring caution; the baseline scenario assumes sanctions will persist and possibly tighten; further economic slowdown is expected in 3Q2025. Current monetary policy tightness is deemed sufficient to return inflation to target by end-2026. All decisions follow a conservative scenario, ruling out premature easing.

-

Additionally, the regulator published alternative forecast scenarios indicating a key rate range of 11–15% for next year. The Central Bank will continue to exercise caution and reduce rates slowly. Maintaining tight monetary policy and declining consumer activity in Russia will continue to keep import volumes low. As a result, competition on the China-Russia route will intensify.

-

On the other hand, given gradual recovery in the Russian car sales market, a resurgence in imports of Chinese automobiles and components is expected following a significant supply downturn earlier this year. In August, 122.2 thousand new passenger cars were sold in Russia, marking the highest monthly figure this year. However, YoY decline reached 17.6%. Over the first eight months of 2025, sales totaled 773.3 thousand units (-23% YoY) [Autostat].

-

Import rates in multimodal transport have resumed their decline after a brief stabilization at the end of summer, down $200 MoM. The average cost of transportation via Far Eastern ports is ~$4 000/FEU (SOC). Meanwhile, rates for direct rail transport have continued steady growth for 2 months. The average rate level has increased by ~$600 MoM to ~$4 600/FEU (COC), though minimum offers remain at $3 650-$3 800 (COC).

-

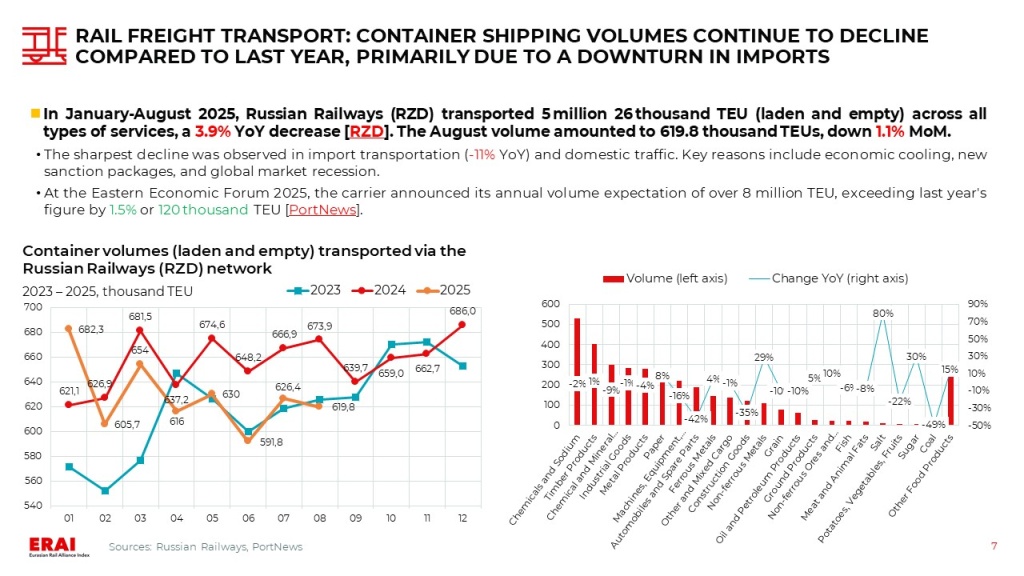

In January-August 2025, Russian Railways transported 5 million 26 thousand TEU (laden and empty) in all types of traffic, a decrease of 3.9% YoY [Russian Railways]. August volume amounted to 619.8 thousand TEU, down 1.1% MoM.

-

Russian Railways plans an additional increase in container transportation tariffs in 2026. In addition to general indexation, the company is considering a 5% surcharge and wants the ability to raise rates by another 15% on certain routes within a tariff corridor. At the Eastern Economic Forum 2025, market participants proposed freezing 2026 tariffs at current levels to prevent weakening of rail’s competitive position against growing containerized road transport [RZD Partner].