The Review of Maritime Transport 2020 provides an update on the latest trends in maritime trade, supply, markets, key performance indicators, and legal and regulatory developments. It also includes a special chapter with testimonials from maritime stakeholders and their experiences in coping with the COVID-19 pandemic.

The COVID-19 pandemic has underscored the global interdependency of nations and set in motion new trends that will reshape the maritime transport landscape. The sector is at a pivotal moment facing not only immediate concerns resulting from the pandemic but also longer-term considerations, ranging from shifts in supply-chain design and globalization patterns to changes in consumption and spending habits, a growing focus on risk assessment and resilience-building, as well as a heightened global sustainability and low-carbon agenda. The sector is also dealing with the knock-on effects of growing trade protectionism and inward-looking policies.

The pandemic has brought to the fore the importance of maritime transport as an essential sector for the continued delivery of critical supplies and global trade in time of crisis, during the recovery stage and when resuming normality. Many organizations, including UNCTAD and other international bodies, issued recommendations and guidance emphasizing the need to ensure business continuity in the sector, while protecting port workers and seafarers from the pandemic. They underscored the need for ships to meet international requirements, including sanitary restrictions, and for ports to remain open for shipping and intermodal transport operations.

International maritime trade under severe pressure

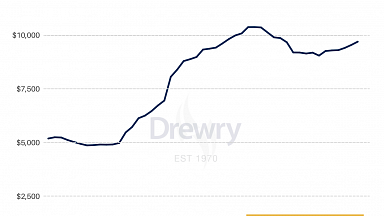

The global health and economic crisis triggered by the pandemic has upended the landscape for maritime transport and trade and significantly affected growth prospects. UNCTAD projects the volume of international maritime trade to fall by 4.1% in 2020. Amid supply-chain disruptions, demand contractions and global economic uncertainty caused by the pandemic, the global economy was severely affected by a twin supply and demand shock. These trends unfolded against the backdrop of an already weaker 2019 that saw international maritime trade lose further momentum. Lingering trade tensions and high policy uncertainty undermined growth in global economic output and merchandise trade.

Volumes expanded by 0.5% in 2019, down from 2.8% in 2018, and reached 11.08 billion tons in 2019. In tandem, global container port traffic decelerated to 2% cent growth, down from 5.1% in 2018. Trade tensions caused trade patterns to shift, as the search for alternative markets and suppliers resulted in a redirection of flows away from China towards other markets, especially in southeast Asian countries. The United States increased its merchandise exports to the rest of the world, which helped to somewhat offset its reduced exports to China. New additional tariffs are estimated to have cut maritime trade by 0.5% in 2019, with the overall impact being mitigated by increased trading opportunities in alternative markets.

The full version is attached to the article.