Introduction

In May, Xi Jinping made his first post-pandemic visit to Europe, including France, Serbia, and Hungary. Earlier in the year, high-ranking EU officials, including German Chancellor Scholtz and European Commission President Von der Leyen, visited China to address issues such as the war in Ukraine, China’s manufacturing overcapacity, and the trade relationship between China and the EU.

Trade tensions with the US began under Trump, who imposed tariffs on Chinese goods in 2018. China retaliated with its own tariffs, leading to a trade war that was somewhat mitigated by the Phase One agreement in January 2020. Despite this agreement, tariffs on a significant portion of trade remain in place.

The EU has traditionally taken a different stance, focusing on fair competition and reciprocity rather than engaging in a full-scale trade war. However, its approach is becoming less accommodating, with increasing concerns about trade imbalances.

Historical Trade Tensions

In 2016, Trump’s campaign accused China of unfair trade practices and currency manipulation. This led to tariffs imposed in July 2018 and a retaliatory trade war. The Phase One agreement in January 2020 adjusted some tariffs but left many high. As of now, about 58% of US exports to China and 66% of Chinese exports are still subject to tariffs.

The EU, meanwhile, has expressed concerns about fair competition and overcapacity but has been more divided in its policy approach due to differing member state interests. The trade deficit with China, which peaked in 2022, has recently increased again.

Recent Developments

Under the Biden administration, most of Trump’s trade measures remain in place with some modifications. Biden has allowed certain tariffs to expire but introduced new ones, leading to increased tax revenue. China has responded cautiously, but tensions persist, especially regarding US actions related to Taiwan and technology restrictions.

The EU’s trade with China has shown volatility, with a significant drop in imports from China since August 2022, though there was a recent uptick in April 2024. The EU is also considering new tariffs on Chinese electric vehicles (EVs) due to concerns about state subsidies. These tariffs, effective from July 4, 2024, might still face opposition from member states like Germany.

China’s Trade Strategy

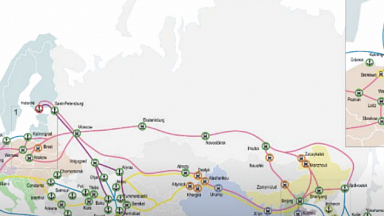

Since joining the WTO in 2001, China’s trade has expanded significantly. It has developed its own industries and now produces high-value goods like smartphones and semiconductors. China’s strategy involves reducing trade barriers, negotiating Free Trade Agreements (FTAs), and expanding the Belt and Road Initiative (BOR) to secure new markets and raw materials.

Broader Implications

The broader West, including the US and Europe, is concerned about vulnerabilities in supply chains and geopolitical tensions, especially related to Taiwan and the South China Sea. China’s relationship with Russia also raises concerns, although China has avoided providing lethal aid to Russia so far.

Conclusion

Trade tensions between China and the West are expected to continue escalating. The US is likely to maintain a confrontational stance, while the EU is becoming more assertive. Both are targeting high-value sectors such as EVs and semiconductors. China will attempt to manage these tensions while strengthening trade ties with emerging markets and pursuing FTAs and the BOR to stabilize its trade relationships and ensure a steady supply of raw materials.

Mevissen, Teeuwe. 2024. «China’s Trade Challenges — Rabobank.» Rabobank. 2024. https://www.rabobank.com/knowledge/d011438834-chinas-trade-challenges.