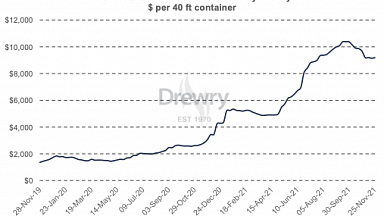

According to the latest Long-Term XSI Public Indices from Xeneta — which crowdsources real-time rates data from leading shippers — the global index recorded a «staggering» month-on-month (MoM) jump of 28.1% compared with June, «blowing the previous record (a 11.3% rise in May 2019) out the water».

The benchmark now stands 78.2% higher than in July 2020, and up 76.4% in 2021 alone.

An industry in overdrive

Patrik Berglund, CEO of Oslo-based Xeneta, described the latest increase as «a truly breath-taking development», adding: «We’ve seen a combination of high demand, undercapacity and supply chain disruption — in part down to COVID and port congestion — driving rates ever higher this year, but nobody could have anticipated a hike of this magnitude. The industry is in overdrive.

«Reports suggest that more than 300 vessels have already been ordered this year to try and redress the balance. However, these obviously won’t come on line for some time, so it’s difficult to see — unless something radical transpires — any relief on the immediate horizon for the shipper community. I’ve never seen anything like it.»

Record performance

The XSI, which is designed to help stakeholders understand the market and deliver market intelligence to inform contract negotiations, in July revealed «unprecedented shifts», with rates in Europe leading the way. The import benchmark for Europe «spiked by a massive 49.1% driving prices to an all-time high». Xeneta noted that the spot market had «set the course for the jump, with Freight All Kind, FAK, rates surpassing US$13,000 per FEU».

Average long-term contract freight rates for European imports «now stand a towering 120.3% up year-on-year». Exports also recorded their largest ever monthly increase, although by a more ‘modest’ 16% — up 39.8% since July 2020, Xeneta noted.

Xeneta said the Far East indices «followed suit, with a record-breaking 24.2% rise in exports» (prices) — 110.4% up, year-on-year — while imports edged up, relatively speaking, «by a still impressive 7.3% (43.2% higher than in July 2020).

In the US, the XSI revealed a 17.7% surge in imports — representing another all-time high — taking the benchmark to 61.2% above July last year. Exports also demonstrated strong gains, with an 11.1% climb — up 12% year-on-year, but up 18.4% since the start of 2021.

Knock-on effects

Despite what Berglund describes as «a crazy market», he noted that the majority of Xeneta users shipping large volumes report long-term contracts are mostly being honoured by carriers. This, he said, «is better than the beginning of the summer, when the fear of rolled cargoes and broken agreements was front of mind for a stressed shipper community».

He added: «However, bear in mind that volume flexibility is totally gone, with shippers committing to maximum quantities to secure positions onboard. Furthermore, all around the world, but especially in the US, shippers are playing safe and building buffer agreements to ensure they’re covered for the holiday season.

«As such, a ‘bullwhip effect’ is coming into play, as shippers order more to protect against delayed shipments and rollovers, further disrupting the supply chain. But, of course, who can blame them — they see it as the only way to stay ahead and make sure Christmas is saved.»

Newbuild orders

Xeneta points to «a glut of newbuild orders from key shipping lines scrambling to meet demand and secure market share — with, amongst others, COSCO believed to be have contracted 10 containerships, ranging from 14,092 TEU to 16,180 TEU, and Yang Ming understood to be mulling 24,000 TEU vessels».

Berglund stressed: «But shippers need short-term solutions, with greater reliability, easier negotiations and more sympathetic rates soon, rather than the promise of long-term relief. We’re already seeing some taking matters into their own hands, chartering vessels and joining with purchasing associations like XSTAFF, which supports CULines, in attempts to free themselves from the grip of traditional carriers. But that’s clearly not for everyone.»

Jostling for position

He continued: «It’ll be interesting to see how established players react to the red-hot market. Fortuitously, Evergreen ordered a dozen 24,000 TEU vessels back in 2019 and some will touch down this year, eventually boosting the firm’s capacity by 18%. There’s also word that Taiwanese carrier Wan Hai may re-enter European trades with its smaller vessels to take advantage of attractive rates. So, changes are on the horizon, but how significant will they will be in terms of the overall picture?»

He concluded: «For the time being, carriers have the fundamentals firmly in their favour and are enjoying time in the sun, as illustrated by recent earnings reports from major players such as from Maersk and Hapag Lloyd.»

Companies participating in Oslo-based Xeneta’s crowd-sourced ocean and air freight rate benchmarking and market analytics platform include major names such as ABB, Electrolux, Continental, Unilever, Nestle, L’Oréal, Thyssenkrupp, Volvo Group and John Deere.

Xeneta is a leading ocean and air freight rate benchmarking and market intelligence platform, reporting «live» on market average and low/high movements for both short and long-term contracts. Xeneta’s data is comprised of over 280 million contracted container and air freight rates and covers over 160,000 global trade routes.