Aside from another «jump» in Asia-North Europe ocean rates, which spiked 15% and US$500 past the US$10,000/FEU mark this week, prices stayed level on most major lanes, according to the latest international freight update published by digital rates specialist Freightos, which incorporates the Freightos Baltic Index (FBX).

However, shippers are bracing for early-month General Rate Increases (GRIs), and demand and capacity constraints have added transatlantic shippers to the list of those often adding hefty premiums on top of elevated rates to secure space, it noted.

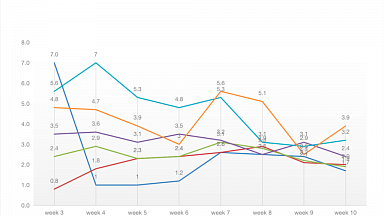

Asia-US West Coast prices increased 2% to $5,494/FEU and are 236% higher than the same time last year.

Asia-US East Coast prices also climbed 2% to $7,479/FEU, and are 190% higher than rates for this week last year.

«Rates keep climbing not only because demand and volumes have continued to stay at peak levels, but also because of the delays that those volumes have caused, which in turn reduce capacity by tying up ships and containers,» commented Freightos’ Research Lead, Judah Levine.

He highlighted a recent analysis which showed that so far this year carriers have cancelled the same percentage of Asia-US West Coast sailings due to delays as they did last year because of plummeting demand during the first months of the pandemic.

«As some carriers skip port calls at certain Chinese ports to catch up with schedules or avoid congestion at Hamburg, demand and COVID are combining to cause new delays: the Port of Yantian near Shenzhen stopped accepting containers for export for part of last week due to an outbreak among port workers, leading some carriers to skip port calls there, which could also add pressure on nearby ports.»

Levine added; "And though air cargo rates remain extremely elevated, the addition of capacity in the form of China Airlines and Cathay Pacific flights returning after quarantine restrictions, may have contributed to Asia-US and Europe prices declining by 10% or more on some lanes since mid-May.