Further to the snapshot below, you may be interested in an annual subscription to our Cancelled Sailing Weekly Insight which provides detailed assessments and analysis by main trade and alliance. Weekly reports include port waiting time events for Los Angeles and Long Beach, and year-on-year comparison.

Weekly analysis: 12 November 2021

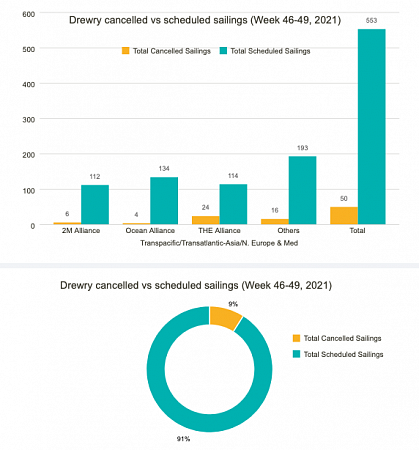

Across the major trades: Transpacific, Transatlantic and Asia-North Europe & Med, 50 cancelled sailings have been announced between weeks 46 and 49, out of a total of 549 scheduled sailings, representing 9% cancellation rate. During this period 76% of the blank sailings will occur in the Transpacific Eastbound trade. Over the next 4 weeks, The Alliance has announced 24 cancellations, followed by 2M and Ocean Alliance with 6 and 4 cancellations, respectively. The good news is that spot rates generally have peaked with East-West rates expected to stabilise over coming weeks. However, it is abundantly clear that the global supply chain crisis will not resolve itself anytime soon. Port congestion is a global phenomenon, causing huge delays to ship schedules and forcing carriers to skip ports, particularly in Europe, while imports from Asia are expected to stay strong until Jan-22.