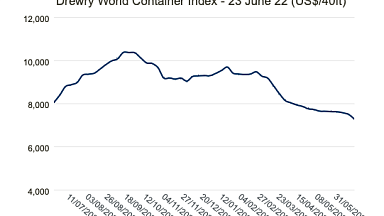

Contract containerised freight rates have witnessed an «astronomical» hike in the first six months of this year and are expected to remain elevated for at least the medium term.

The latest Xeneta Shipping Index shows contract rates rose 39.2% year on year, following a 2.3% increase in June. While the comparable period last year was affected by the onset of the pandemic, the index has risen 37.7% since the end of 2020.

«It can almost be difficult to keep a sense of perspective here,» said Xeneta chief executive Patrik Berglund. «Seen in the context of 2021, a 2.3% gain appears only moderate, but in any other month, in any other year, this is a very strong performance for the carriers.»

Strong demand in the US continued to be the main driver of rates performance.

The index for US imports rose 9.3% last month, the third-largest increase on record, and resulted in the benchmark being 36.9% higher than in June 2020. The index has risen 36% since the end of 2020.

In Europe, however, imports on the XSI declined for the first time in seven months in June after the benchmark fell by 4.2%.

Despite the month-on-month decline, the index is still up 48.1% compared with the same period a year earlier and has risen by 47.1% since last December.

«While imports on the benchmark declined in June, rates in the spot market continue to rise. Port congestion and equipment shortages remain a contributing factor,» Xeneta said.

Mr Berglund warned there was little relief in sight, as carrier efforts to increase their fleets would not bear fruit until 2023-2024.

«Ports in the US are facing new levels of congestion, causing huge delays in shipments and inventory shortages for retailers,» he said.

Shippers were left with the «unpalatable and unsustainable» option combination of deteriorating reliability and climbing spot and contract rates.

«It is exceptionally tough for shippers to navigate the market right now, as the delta between short-term and contract rates continues to grow,» Xeneta said. «Carriers unquestionably have the upper hand and are in a strong position to exploit the budgets of big volume shippers.»

That would be reflected in carriers’ results, Mr Bergund said. «We should all brace ourselves for the carriers’ and forwarders’ second quarter of the year financials. It will be a joyful moment for the sellers, but painful for the rest of the market.»