In Malaysia, a prolonged nationwide lockdown has disrupted sectors, including automotive, semiconductors and medical equipment, according to a new report by Everstream Analytics.

The supply chain visibility firm says production is most affected in Selangor and Kuala Lumpur — the industrial corridor leading into Port Klang — with factories forced to reduce or shut operations to comply with new measures.

For example, the report says, the Ministry of International Trade and Industry has placed limits on workforce capacity, depending on the industry: out of 18 sector categories, 13 are permitted to operate with 60% of the workforce, but five can only operate at 10%.

This is expected to put significant strain on semiconductor production, serious given the global supply shortage. According to the Malaysia Semiconductor Industry Association, the Covid restrictions are likely to reduce output by 15%, to 40%.

Everstream added: «Regional and global supply chains relying on manufacturers and suppliers located in Selangor and Kuala Lumpur are expected to face significant impacts on supply capacity and delivery times as the country struggles to contain the pandemic, and the backlog of orders may not be quickly cleared in the coming months.»

There’s a similar situation unfolding in neighbouring Thailand. According to the Thai National Shippers’ Council (TNSC), exports were on track for 10% growth this year, but the group has concerns production will be disrupted during the summer if vaccine distribution doesn’t pick up pace.

TNSC president Chaichan Chareonsuk told the Bangkok Post: «Although domestic outbreaks remain severe, leading some factories to temporarily halt their production and postpone the delivery of goods to destination countries, we expect total exports will not be affected much in the short term.»

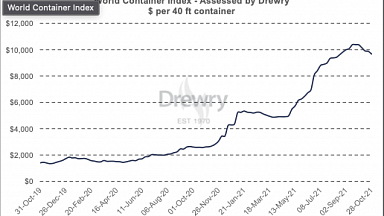

However, he added, container shortages and high freight costs still posed a risk to exporters.

Meanwhile, in Vietnam, new rules for factories are placing mopre strain on supply chains in and around commercial capital Ho Chi Minh City (HCMC).

For example, on Wednesday businesses in HCMC were told they would have to close unless they could provide accommodation and food for employees on their premises — a practice some factories have already implemented this month. As a result, one Taiwanese footwear maker with 56,000 staff has reportedly suspended operations for 10 days.

Separately, in adjacent Dong Nai province, a South Korean shoemaker, a Nike supplier, has shut three factories due to a Covid outbreak, according to Reuters.

Julien Brun, managing partner at supply chain consultancy CEL, said most factories were running anywhere from 5% to 70% below standard capacity, depending on the industry and location.

He told The Loadstar: «Export demand from the west and APAC shows signs of increasing, and there are business opportunities to fulfil, but the main concern remains on the supply side — how to maintain as much capacity possible to absorb the resurgence of export demand.»