The largest networks are concentrated in countries with a developed industrial base and a high volume of domestic and international traffic. Germany leads the way with a network of 33,500 km, followed by France (27,700 km) and Poland (18,800 km). These countries form the key backbone of the European rail space, accounting for a significant share of freight and passenger traffic within the EU.

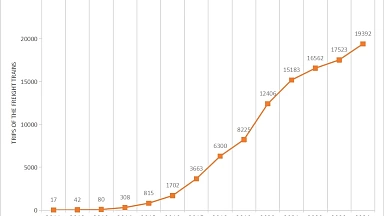

According to Eurostat, rail freight volumes in Europe have been declining by 4.7% annually from 2021 to 2024.

Rail freight volumes vary significantly between EU countries, creating a distinct hierarchy of transport hubs. The leaders in freight volumes are Germany (337.5 million metric tons) and Poland (217.3 million tons). These two countries play a key role in Eurasian transportation infrastructure and serve as key links on the China-Europe-China route. Their extensive terminal networks, high levels of intermodality, and modernized infrastructure enabled them to handle significant cargo volumes and secure a stable position in transit flows. According to the IRG-rail report, Germany has a record number of freight terminals—1,058—followed by Poland with 676.

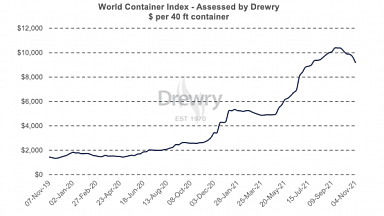

In 2024, container rail traffic volumes in Europe were heavily concentrated in a small number of countries. Germany remained the clear leader, with traffic volumes reaching 7.08 million TEU. This is more than twice the volume of its closest rival, Italy (3.35 million TEU), and reflects Germany’s role as the continent’s central logistics hub and the main distribution hub for container flows. The group of countries with high volumes also includes Poland (2.47 million TEU), the Czech Republic (1.80 million TEU), France (1.80 million TEU), and the Netherlands (1.75 million TEU). Poland and the Czech Republic play a key role on land routes between Eastern and Western Europe, including routes linked to China-Europe-China connections. Countries in the Balkan region demonstrate significantly lower traffic volumes. Thus, in Romania, container rail traffic amounted to 258,000 TEUs, in Croatia — 188,000 TEUs, and in Bulgaria — 109,000 TEUs. A similar situation is typical for the Baltic and Northern European countries, where volumes do not exceed 100,000 TEUs per year.

According to the IRG-rail report, the TAC rate for the minimum access package, which carriers paid to infrastructure owners from 2019 to 2023, has been declining.

The average TAC in Europe in 2023 was approximately €2.83 per train-km. However, this figure should not be directly compared with the market price of rail container train transport, which, according to European operators, ranges from €40—55 per train-km.